Reset Form Schedule CR 5 MICHIGAN Schedule of Taxes and Allocation to Each Agreement Michigan Department of Treasury 3820 Rev

What is the Reset Form Schedule CR 5 MICHIGAN Schedule Of Taxes And Allocation To Each Agreement Michigan Department Of Treasury 3820 Rev

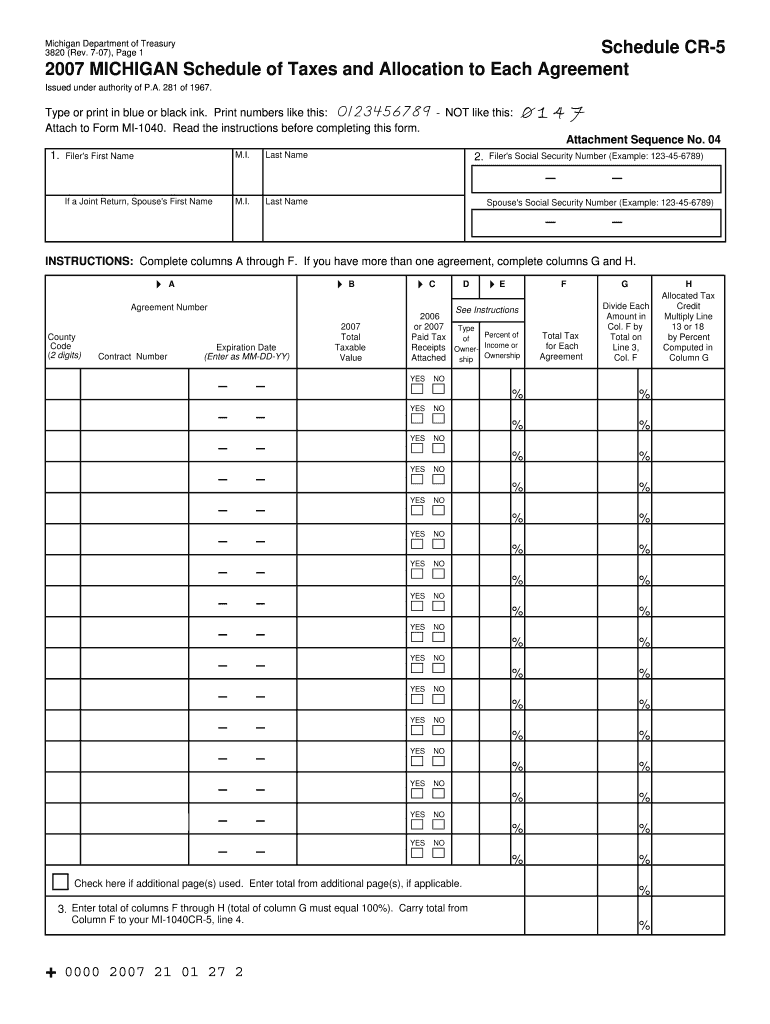

The Reset Form Schedule CR 5 is an official document provided by the Michigan Department of Treasury. This form is used to report and allocate taxes associated with various agreements within the state. It is crucial for businesses and individuals who need to comply with specific tax obligations in Michigan. The form outlines the necessary details for tax calculations, ensuring that all applicable taxes are accurately reported and allocated according to state regulations.

How to use the Reset Form Schedule CR 5 MICHIGAN Schedule Of Taxes And Allocation To Each Agreement Michigan Department Of Treasury 3820 Rev

Using the Reset Form Schedule CR 5 involves several steps to ensure proper completion. First, gather all relevant financial documents and agreements that pertain to the taxes being reported. Next, fill out the form with accurate information, ensuring that all fields are completed as required. After filling out the form, review it for accuracy, and then submit it according to the instructions provided by the Michigan Department of Treasury. This may include online submission, mailing, or in-person delivery.

Steps to complete the Reset Form Schedule CR 5 MICHIGAN Schedule Of Taxes And Allocation To Each Agreement Michigan Department Of Treasury 3820 Rev

Completing the Reset Form Schedule CR 5 requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from the Michigan Department of Treasury.

- Read the instructions carefully to understand the requirements.

- Gather all necessary documentation related to the agreements and taxes.

- Fill in each section of the form, ensuring accuracy in all figures.

- Double-check for any errors or omissions.

- Submit the completed form by the specified deadline.

Key elements of the Reset Form Schedule CR 5 MICHIGAN Schedule Of Taxes And Allocation To Each Agreement Michigan Department Of Treasury 3820 Rev

The Reset Form Schedule CR 5 includes several key elements that are essential for accurate tax reporting. These elements typically consist of:

- Taxpayer Information: Details about the individual or business submitting the form.

- Agreement Details: Information regarding the agreements that are subject to taxation.

- Tax Calculation Sections: Areas where specific tax amounts must be reported and calculated.

- Signature Line: A section for the taxpayer to sign and certify the accuracy of the information provided.

Legal use of the Reset Form Schedule CR 5 MICHIGAN Schedule Of Taxes And Allocation To Each Agreement Michigan Department Of Treasury 3820 Rev

The legal use of the Reset Form Schedule CR 5 is crucial for compliance with Michigan tax laws. This form must be used by taxpayers who are required to report taxes related to specific agreements. Failure to use this form correctly can result in penalties or legal complications. It is important to ensure that the form is completed accurately and submitted on time to avoid any issues with the Michigan Department of Treasury.

Filing Deadlines / Important Dates

Filing deadlines for the Reset Form Schedule CR 5 are established by the Michigan Department of Treasury. It is essential for taxpayers to be aware of these dates to ensure timely submission. Missing a deadline can lead to penalties or interest charges on unpaid taxes. Typically, deadlines may coincide with the end of the fiscal year or specific tax periods, so it is advisable to check the official guidelines for the most accurate information.

Quick guide on how to complete reset form schedule cr 5 michigan schedule of taxes and allocation to each agreement michigan department of treasury 3820 rev

Prepare [SKS] seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources you require to create, modify, and eSign your documents rapidly without holdups. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

How to update and eSign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Employ the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate the printing of new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your chosen device. Update and eSign [SKS] and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the reset form schedule cr 5 michigan schedule of taxes and allocation to each agreement michigan department of treasury 3820 rev

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Reset Form Schedule CR 5 MICHIGAN Schedule Of Taxes And Allocation To Each Agreement?

The Reset Form Schedule CR 5 MICHIGAN Schedule Of Taxes And Allocation To Each Agreement is a document required by the Michigan Department Of Treasury to report taxes and allocations for various agreements. It ensures compliance with state tax regulations and helps businesses accurately manage their tax obligations.

-

How can airSlate SignNow help with the Reset Form Schedule CR 5 MICHIGAN Schedule Of Taxes And Allocation To Each Agreement?

airSlate SignNow provides an easy-to-use platform for businesses to create, send, and eSign the Reset Form Schedule CR 5 MICHIGAN Schedule Of Taxes And Allocation To Each Agreement. Our solution streamlines the document management process, ensuring that all necessary forms are completed accurately and efficiently.

-

Is there a cost associated with using airSlate SignNow for the Reset Form Schedule CR 5 MICHIGAN Schedule Of Taxes And Allocation To Each Agreement?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to features that facilitate the completion of the Reset Form Schedule CR 5 MICHIGAN Schedule Of Taxes And Allocation To Each Agreement, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for managing the Reset Form Schedule CR 5 MICHIGAN Schedule Of Taxes And Allocation To Each Agreement?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which are essential for managing the Reset Form Schedule CR 5 MICHIGAN Schedule Of Taxes And Allocation To Each Agreement. These tools enhance efficiency and ensure compliance with state regulations.

-

Can I integrate airSlate SignNow with other software for the Reset Form Schedule CR 5 MICHIGAN Schedule Of Taxes And Allocation To Each Agreement?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage the Reset Form Schedule CR 5 MICHIGAN Schedule Of Taxes And Allocation To Each Agreement alongside your existing tools. This integration capability enhances workflow efficiency and data accuracy.

-

What are the benefits of using airSlate SignNow for the Reset Form Schedule CR 5 MICHIGAN Schedule Of Taxes And Allocation To Each Agreement?

Using airSlate SignNow for the Reset Form Schedule CR 5 MICHIGAN Schedule Of Taxes And Allocation To Each Agreement provides numerous benefits, including time savings, improved accuracy, and enhanced security. Our platform simplifies the eSigning process, making it easier for businesses to stay compliant with Michigan tax regulations.

-

How secure is airSlate SignNow when handling the Reset Form Schedule CR 5 MICHIGAN Schedule Of Taxes And Allocation To Each Agreement?

airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect your documents, including the Reset Form Schedule CR 5 MICHIGAN Schedule Of Taxes And Allocation To Each Agreement. You can trust that your sensitive information is safe while using our platform.

Get more for Reset Form Schedule CR 5 MICHIGAN Schedule Of Taxes And Allocation To Each Agreement Michigan Department Of Treasury 3820 Rev

- 1041a 2017 form

- Annex d checklist to submit to city of richmond form

- To be completed by vendor cont form

- Form 4 notice of change in representation ontario court services

- Mobile home utility complaint form rivcoagorg

- Ec screens iii 3 5 yrs pdf kidfriendly form

- Resale certificate request form kappes miller management

- Notice this is an application for the renewal of your thinkrisk coverging risk liability form

Find out other Reset Form Schedule CR 5 MICHIGAN Schedule Of Taxes And Allocation To Each Agreement Michigan Department Of Treasury 3820 Rev

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document