265 25 Consolidated Monthly Cigarette Tax Report 25s Only Dor Mo Form

What is the 265 25 Consolidated Monthly Cigarette Tax Report 25s Only Dor Mo

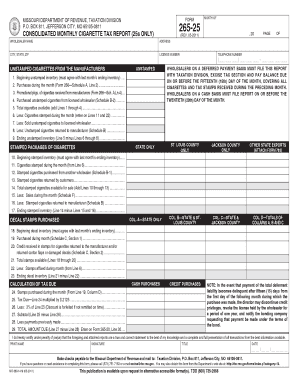

The 265 25 Consolidated Monthly Cigarette Tax Report 25s Only Dor Mo is a specific tax form used by businesses in the United States to report monthly cigarette sales and tax liabilities. This form is essential for ensuring compliance with state and federal tax regulations related to tobacco products. It provides a standardized method for businesses to report their sales data and calculate the appropriate taxes owed, specifically for 25s only, which refers to the packaging size of the cigarettes. Accurate completion of this form is crucial for maintaining good standing with tax authorities.

Steps to complete the 265 25 Consolidated Monthly Cigarette Tax Report 25s Only Dor Mo

Completing the 265 25 Consolidated Monthly Cigarette Tax Report involves several key steps:

- Gather sales data for the reporting month, focusing on the quantity of 25s sold.

- Calculate the total tax owed based on the applicable tax rates for cigarettes in your state.

- Fill out the form accurately, ensuring all required fields are completed, including your business information and sales figures.

- Review the completed form for accuracy to avoid potential penalties.

- Submit the form by the designated deadline, either electronically or via mail, depending on your state’s requirements.

How to obtain the 265 25 Consolidated Monthly Cigarette Tax Report 25s Only Dor Mo

The 265 25 Consolidated Monthly Cigarette Tax Report can typically be obtained from your state’s revenue department or taxation agency. Many states offer the form for download on their official websites. Additionally, businesses may contact their local tax office for assistance in acquiring the form. It is important to ensure that you are using the most current version of the form to comply with any updates in tax regulations.

Key elements of the 265 25 Consolidated Monthly Cigarette Tax Report 25s Only Dor Mo

Several key elements must be included when filling out the 265 25 Consolidated Monthly Cigarette Tax Report:

- Business Identification: Include your business name, address, and tax identification number.

- Sales Data: Report the total number of 25s sold during the month.

- Tax Calculation: Clearly outline the tax rate applied and the total tax owed.

- Signature: Ensure the form is signed by an authorized representative of the business.

Filing Deadlines / Important Dates

Filing deadlines for the 265 25 Consolidated Monthly Cigarette Tax Report vary by state but generally follow a monthly schedule. It is crucial to submit the form by the specified deadline to avoid penalties. Most states require submission by the end of the month following the reporting period. Keeping track of these deadlines can help prevent late fees and ensure compliance with tax regulations.

Penalties for Non-Compliance

Failure to file the 265 25 Consolidated Monthly Cigarette Tax Report on time or inaccuracies in the report can result in significant penalties. These may include monetary fines, interest on unpaid taxes, and potential legal action. It is essential for businesses to understand the importance of timely and accurate reporting to avoid these consequences. Regularly reviewing tax obligations and maintaining organized records can help mitigate risks associated with non-compliance.

Quick guide on how to complete 265 25 consolidated monthly cigarette tax report 25s only dor mo

Complete [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal sustainable substitute for conventional printed and signed documents, as you can obtain the necessary form and securely save it online. airSlate SignNow equips you with all the functionality required to create, edit, and electronically sign your documents swiftly without delays. Handle [SKS] on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to edit and electronically sign [SKS] effortlessly

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for this purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and then click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign [SKS] and ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 265 25 Consolidated Monthly Cigarette Tax Report 25s Only Dor Mo

Create this form in 5 minutes!

How to create an eSignature for the 265 25 consolidated monthly cigarette tax report 25s only dor mo

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 265 25 Consolidated Monthly Cigarette Tax Report 25s Only Dor Mo?

The 265 25 Consolidated Monthly Cigarette Tax Report 25s Only Dor Mo is a specialized document designed for businesses to report their monthly cigarette tax obligations. This report ensures compliance with state regulations and simplifies the tax filing process for cigarette distributors.

-

How can airSlate SignNow help with the 265 25 Consolidated Monthly Cigarette Tax Report 25s Only Dor Mo?

airSlate SignNow provides an easy-to-use platform for creating, sending, and eSigning the 265 25 Consolidated Monthly Cigarette Tax Report 25s Only Dor Mo. Our solution streamlines the document management process, allowing businesses to focus on compliance without the hassle of paperwork.

-

What are the pricing options for using airSlate SignNow for the 265 25 Consolidated Monthly Cigarette Tax Report 25s Only Dor Mo?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our cost-effective solutions ensure that you can efficiently manage the 265 25 Consolidated Monthly Cigarette Tax Report 25s Only Dor Mo without breaking the bank.

-

What features does airSlate SignNow offer for the 265 25 Consolidated Monthly Cigarette Tax Report 25s Only Dor Mo?

Our platform includes features such as customizable templates, secure eSigning, and real-time tracking for the 265 25 Consolidated Monthly Cigarette Tax Report 25s Only Dor Mo. These tools enhance efficiency and ensure that your documents are processed quickly and securely.

-

Are there any integrations available for managing the 265 25 Consolidated Monthly Cigarette Tax Report 25s Only Dor Mo?

Yes, airSlate SignNow integrates seamlessly with various business applications, allowing you to manage the 265 25 Consolidated Monthly Cigarette Tax Report 25s Only Dor Mo alongside your existing workflows. This integration capability enhances productivity and ensures a smooth document management experience.

-

What are the benefits of using airSlate SignNow for the 265 25 Consolidated Monthly Cigarette Tax Report 25s Only Dor Mo?

Using airSlate SignNow for the 265 25 Consolidated Monthly Cigarette Tax Report 25s Only Dor Mo offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. Our platform simplifies the entire process, allowing you to focus on your core business activities.

-

Is airSlate SignNow secure for handling the 265 25 Consolidated Monthly Cigarette Tax Report 25s Only Dor Mo?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your 265 25 Consolidated Monthly Cigarette Tax Report 25s Only Dor Mo is handled with the utmost care. Our platform employs advanced encryption and security protocols to protect your sensitive information.

Get more for 265 25 Consolidated Monthly Cigarette Tax Report 25s Only Dor Mo

- Rules and regulations civil usherbrooke form

- Transport accident regulations 2007 legislation legislation vic gov form

- Phyllis jean stone date of trial court judgment trial judge court from which appealed attorney for appellant attorney for form

- Overview of the probate and family mass legal services masslegalservices form

- Step by step instructions for filing a divorce my legal robot form

- Pforms macrospro se packetspro se packetsjacksonjackson seols

- Scholarship application flyer manly deeds scholarship form

- Hs soccer app 2 hs soccer application form

Find out other 265 25 Consolidated Monthly Cigarette Tax Report 25s Only Dor Mo

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself