MO 1120X, Amended Corporation Income Tax Return for Tax Dor Mo Form

What is the MO 1120X, Amended Corporation Income Tax Return for Tax Year in Missouri?

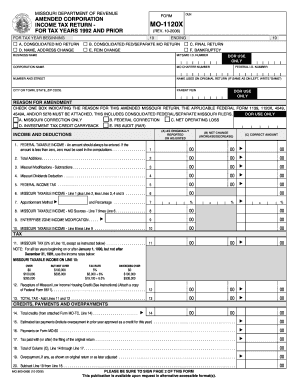

The MO 1120X is the official form used by corporations in Missouri to amend their previously filed corporation income tax returns. This form allows businesses to correct errors or make changes to their financial information, ensuring compliance with state tax regulations. It is essential for corporations that have discovered discrepancies in their original filings, such as incorrect income, deductions, or credits. By submitting the MO 1120X, corporations can adjust their tax liabilities and potentially receive refunds for overpaid taxes.

Steps to Complete the MO 1120X, Amended Corporation Income Tax Return

Completing the MO 1120X requires careful attention to detail. Here are the key steps to follow:

- Gather all necessary documentation, including the original tax return and any supporting documents that justify the amendments.

- Clearly indicate the tax year being amended at the top of the form.

- Fill out the form with accurate information, ensuring that all changes are clearly marked and explained in the designated sections.

- Provide a detailed explanation of the reasons for the amendments in the appropriate section of the form.

- Review the completed form for accuracy before submission to avoid delays or rejections.

How to Obtain the MO 1120X, Amended Corporation Income Tax Return

The MO 1120X can be obtained through the Missouri Department of Revenue's official website. It is available as a downloadable PDF file, which can be printed and filled out manually. Additionally, businesses can request a physical copy of the form by contacting the Department of Revenue directly. It is advisable to ensure that the most current version of the form is being used to avoid any compliance issues.

Filing Deadlines for the MO 1120X

Corporations must file the MO 1120X within a specific timeframe to ensure compliance with state tax laws. The amended return should be submitted within three years from the original filing date or within two years from the date the tax was paid, whichever is later. Adhering to these deadlines is crucial to avoid penalties and interest on any unpaid taxes.

Key Elements of the MO 1120X, Amended Corporation Income Tax Return

Several key elements must be included when completing the MO 1120X:

- Identification of the corporation, including name, address, and federal employer identification number (FEIN).

- Details of the original return, including the tax year and the amounts reported.

- Specific changes being made, including revised amounts and explanations for each adjustment.

- Signature of an authorized representative of the corporation, certifying the accuracy of the information provided.

Legal Use of the MO 1120X, Amended Corporation Income Tax Return

The MO 1120X serves a legal purpose by allowing corporations to correct previous tax filings in accordance with Missouri tax law. It is important for businesses to utilize this form properly to maintain compliance and avoid potential legal repercussions. Submitting an amended return can help rectify mistakes and ensure that the corporation is accurately reporting its financial status to the state.

Quick guide on how to complete mo 1120x amended corporation income tax return for tax dor mo

Complete [SKS] effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect environmentally-friendly substitute for traditional printed and signed papers, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to edit and eSign [SKS] without hassle

- Find [SKS] and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Select pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to share your form, by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mo 1120x amended corporation income tax return for tax dor mo

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MO 1120X, Amended Corporation Income Tax Return For Tax Dor Mo?

The MO 1120X, Amended Corporation Income Tax Return For Tax Dor Mo, is a form used by corporations in Missouri to amend their previously filed income tax returns. This form allows businesses to correct errors or make changes to their tax filings, ensuring compliance with state tax regulations.

-

How can airSlate SignNow help with filing the MO 1120X?

airSlate SignNow provides an easy-to-use platform for businesses to prepare and eSign the MO 1120X, Amended Corporation Income Tax Return For Tax Dor Mo. With our solution, you can streamline the document preparation process, ensuring accuracy and efficiency in your tax filings.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our cost-effective solution allows you to manage your MO 1120X, Amended Corporation Income Tax Return For Tax Dor Mo, along with other documents, without breaking the bank.

-

Are there any features specifically designed for tax document management?

Yes, airSlate SignNow includes features specifically designed for tax document management, such as templates for the MO 1120X, Amended Corporation Income Tax Return For Tax Dor Mo, secure eSigning, and document tracking. These features help ensure that your tax documents are handled efficiently and securely.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow offers integrations with various accounting software, allowing you to seamlessly manage your MO 1120X, Amended Corporation Income Tax Return For Tax Dor Mo, alongside your financial records. This integration enhances workflow efficiency and reduces the risk of errors.

-

What are the benefits of using airSlate SignNow for tax returns?

Using airSlate SignNow for your MO 1120X, Amended Corporation Income Tax Return For Tax Dor Mo provides numerous benefits, including time savings, improved accuracy, and enhanced security. Our platform simplifies the eSigning process, making it easier for businesses to comply with tax regulations.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your MO 1120X, Amended Corporation Income Tax Return For Tax Dor Mo and other sensitive documents are protected. We utilize advanced encryption and security protocols to safeguard your information.

Get more for MO 1120X, Amended Corporation Income Tax Return For Tax Dor Mo

- Form tpm 4 notice of appointment of registered agent and registered agent s statement notice of appointment of registered agent

- Instructions for forms 10 and 11 form 10 july 11 jud ct

- Ct 1041 1999 connecticut income tax return for trusts and estates form

- Form 207hcc ext application for extension of time to file health care center tax return application for extension of time to

- Ct 1127 2000 application for extension of time for payment of ct form

- Form 207 insurance premiums tax return domestic companies insurance premiums tax return domestic companies ct

- 1 grant application package 2 3 recovery delaware recovery delaware form

- Project launchenvironmental scan guidance january 2009 form

Find out other MO 1120X, Amended Corporation Income Tax Return For Tax Dor Mo

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document