Instructions for Forms 10 and 11, Form 10 July 11 Jud Ct

What is the Instructions For Forms 10 And 11, Form 10 July 11 Jud Ct

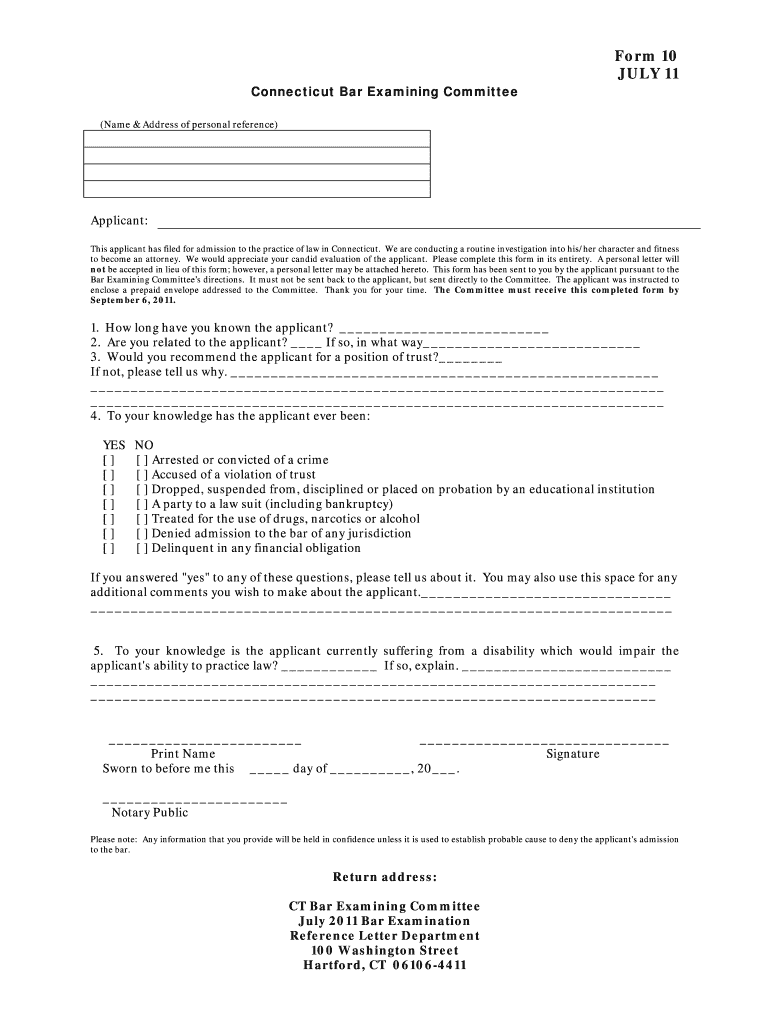

The Instructions For Forms 10 And 11, Form 10 July 11 Jud Ct provide essential guidelines for individuals navigating the legal process in Connecticut. These forms are typically used in judicial proceedings, including civil and family matters. Understanding the purpose and requirements of these forms is crucial for ensuring compliance with court procedures. The instructions detail how to accurately complete the forms, what information is necessary, and the legal implications of submitting these documents.

Steps to complete the Instructions For Forms 10 And 11, Form 10 July 11 Jud Ct

Completing the Instructions For Forms 10 And 11 requires careful attention to detail. Here are the steps to follow:

- Review the instructions thoroughly to understand the requirements.

- Gather all necessary personal information and documentation required to fill out the forms.

- Complete Form 10 by providing accurate details as specified in the instructions.

- Complete Form 11, ensuring that all sections are filled out correctly.

- Double-check all entries for accuracy and completeness.

- Sign and date the forms as required.

- Submit the completed forms to the appropriate court as outlined in the instructions.

Legal use of the Instructions For Forms 10 And 11, Form 10 July 11 Jud Ct

Understanding the legal use of the Instructions For Forms 10 And 11 is vital for ensuring that your submissions are valid. These forms must be filled out in accordance with the guidelines provided to be considered legally binding. The instructions specify the necessary signatures, dates, and any additional documentation that may be required. Failure to adhere to these legal standards can result in delays or rejection of the forms by the court.

Key elements of the Instructions For Forms 10 And 11, Form 10 July 11 Jud Ct

Several key elements are essential when working with the Instructions For Forms 10 And 11:

- Identification Information: Accurate personal details, including names and addresses.

- Case Information: Relevant details about the case, including case numbers and court locations.

- Signature Requirements: Specific instructions on who must sign the forms and where.

- Submission Guidelines: Instructions on how and where to submit the completed forms.

Filing Deadlines / Important Dates

Filing deadlines for the Instructions For Forms 10 And 11 are critical for ensuring timely processing. It is important to be aware of any specific dates mentioned in the instructions, including deadlines for submission and any required responses. Missing these deadlines can lead to complications in your case, so it is advisable to mark these dates clearly and plan accordingly.

Form Submission Methods (Online / Mail / In-Person)

The Instructions For Forms 10 And 11 outline various submission methods available for filing these forms. Depending on the court's requirements, you may have the option to submit your forms online, by mail, or in person. Each method has its own set of guidelines, including any necessary documentation that must accompany your submission. Understanding these methods can help streamline the filing process and ensure compliance with court protocols.

Quick guide on how to complete instructions for forms 10 and 11 form 10 july 11 jud ct

Accomplish [SKS] effortlessly on any gadget

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without any hold-ups. Handle [SKS] on any platform using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your paperwork.

- Emphasize relevant portions of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to apply your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] and ensure exceptional communication at every step of your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Can I fill out the form for the 2017 IISER with a rank of 11,003, given that only those with ranks below 10,000 are eligible?

If you're talking about JEE channel, then NO. You can't.If you belong to open category, then your CML rank should be below 10k.If you belong to any category, then your category rank should be below 10k

-

Where can I fill out the forms for the private exams for class 11 and 12?

Try thishttp://www.cbse.nic.in.

-

How do I fill out the P.11 form for UNDP?

How to Fill in Personal History Form

-

How do I fill out the form for PU class 11 in Jawahar Navodaya?

Visit your nearest navodaya and enquire about the available vacancies and apply there itself. Form isn't available online

-

What is the IRS form W-10 and how is it correctly filled out?

While you may have never heard of IRS Form W-10, you will if you’re currently paying or planning to pay someone to care for a child, dependent, or spouse? If you are, then you may qualify to claim what’s called the Child and Dependent Care credit on your federal income tax return. To claim this credit, your care provider must fill out a W-10. You may also need to fill out the form if you receive benefits from an employer sponsored dependent care plan.It’s certainly worth it to see if you qualify (and for this we recommend that you consult with a tax professional). The child and dependent care credit can be up to 35 percent of qualifying expenses, depending on adjusted gross income. For 2011, filers may use up to $3,000 of expenses paid in a year for one qualifying individual or $6,000 for two or more qualifying individuals. (When it comes time to figure your qualifying expenses, remember that they must be reduced by the amount of any dependent care benefits provided by your employer, if those benefits were deducted or excluded from your income.)Do You Qualify for the Credit?To see if you need to have your care provider fill out a W-10, first determine if you qualify for the credit for child and dependent care expenses. To qualify, the care must have been provided for one or more qualifying persons, generally a dependent child age 12 or younger when the care was provided. Certain other individuals, spouses and those who are incapable of self-care, may also be considered qualifying persons. (Note: each qualifying individual must be listed on your tax return.)Remember also that the amount you can claim as a credit is reduced as your income rises. According to the Tax Policy Center, “Families with income below $15,000 qualify for the 35 percent credit. That rate falls by 1 percentage point for each additional $2,000 of income (or part thereof) until it signNowes 20 percent for families with income of $43,000 or more.”Next, consider why the care was provided. To qualify, the person (or couple, if married and filing jointly) claiming the credit must have sought care so they could work or search for employment. Further, the individual or couple filing must be considered earned income earners. Wages, salaries, tips, other taxable employee compensation, and net earnings from self-employment all qualify individuals as having earned income. For married filers, one spouse may be considered as having earned income if they were a full-time student, or if they were unable to care for themselves.Who did you pay for care? Qualifying funds spent for care cannot be paid to a filer’s spouse, a dependent of the filer, or to the filer’s child, unless that child will signNow age 19 or older by the end of the year. (The rule for payments to the filer’s child does not change, even if the child is not the filer’s dependent.) Filers must identify care providers on their tax return.There are just a few more qualifying details. To qualify, filing status must be single, married filing jointly, head of household or qualifying widow(er) with a dependent child. The qualifying person must have lived with the person filing for over one half of the year. There are exceptions, for the birth or death of a qualifying person, and for children of divorced or separated parents.IRS Form W-10So, if you meet those criteria, then its time to make sure your care provider fills out a W-10. The form is simple to fill out, requiring only the provider’s name, address, signature and taxpayer identification number (usually their social security number). The form is only for your records; details about the provider will come when you fill out form 2441 for Child and Dependent Care Expenses.Source: The Child and Dependent Care Credit and IRS W-10 Form

Related searches to Instructions For Forms 10 And 11, Form 10 July 11 Jud Ct

Create this form in 5 minutes!

How to create an eSignature for the instructions for forms 10 and 11 form 10 july 11 jud ct

How to make an eSignature for the Instructions For Forms 10 And 11 Form 10 July 11 Jud Ct online

How to make an eSignature for the Instructions For Forms 10 And 11 Form 10 July 11 Jud Ct in Chrome

How to make an electronic signature for putting it on the Instructions For Forms 10 And 11 Form 10 July 11 Jud Ct in Gmail

How to make an electronic signature for the Instructions For Forms 10 And 11 Form 10 July 11 Jud Ct from your smartphone

How to create an eSignature for the Instructions For Forms 10 And 11 Form 10 July 11 Jud Ct on iOS

How to create an electronic signature for the Instructions For Forms 10 And 11 Form 10 July 11 Jud Ct on Android

People also ask

-

What are the Instructions For Forms 10 And 11, Form 10 July 11 Jud Ct.?

The Instructions For Forms 10 And 11, Form 10 July 11 Jud Ct. provide essential guidelines for filling out the specified legal documents. These instructions ensure compliance with court requirements and help users avoid common mistakes. Familiarizing yourself with these instructions is crucial for a smooth filing process.

-

How can airSlate SignNow assist with the Instructions For Forms 10 And 11, Form 10 July 11 Jud Ct.?

airSlate SignNow streamlines the process of completing the Instructions For Forms 10 And 11, Form 10 July 11 Jud Ct. by offering an intuitive platform for document creation and eSigning. Users can utilize templates and automated workflows to easily incorporate essential information. This simplified process saves time and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for Form 10 July 11 Jud Ct.?

Yes, airSlate SignNow offers a cost-effective pricing model tailored to your needs. There are various subscription levels available, allowing businesses to select a plan that fits their budget while still providing access to the necessary tools for handling Instructions For Forms 10 And 11, Form 10 July 11 Jud Ct. efficiently.

-

What features does airSlate SignNow offer related to Instructions For Forms 10 And 11?

airSlate SignNow provides features such as eSignature capabilities, document sharing, and real-time tracking to help you comply with Instructions For Forms 10 And 11, Form 10 July 11 Jud Ct. These tools facilitate collaboration among team members and clients, ensuring everyone is on the same page throughout the document process.

-

Can airSlate SignNow integrate with other applications for processing legal forms?

Absolutely! airSlate SignNow seamlessly integrates with various applications like Google Drive, Dropbox, and CRM systems. This integration allows users to easily manage their documents and adhere to the Instructions For Forms 10 And 11, Form 10 July 11 Jud Ct. without switching between different platforms.

-

What are the benefits of using airSlate SignNow for legal documentation?

Using airSlate SignNow for legal documentation offers signNow benefits, including enhanced productivity and reduced turnaround times. By following the Instructions For Forms 10 And 11, Form 10 July 11 Jud Ct. within the platform, users can ensure compliance while automating workflows, which leads to more efficient processing of legal forms.

-

How secure is airSlate SignNow when handling sensitive information related to legal forms?

airSlate SignNow prioritizes the security of your sensitive information by employing advanced encryption and security protocols. By following the Instructions For Forms 10 And 11, Form 10 July 11 Jud Ct., users can confidently manage their documents knowing that their data is protected against unauthorized access.

Get more for Instructions For Forms 10 And 11, Form 10 July 11 Jud Ct

Find out other Instructions For Forms 10 And 11, Form 10 July 11 Jud Ct

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order