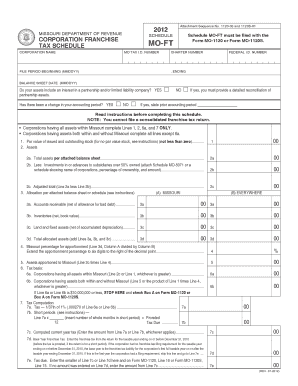

Reset Form SCHEDULE CORPORATION FRANCHISE TAX SCHEDULE CORPORATION NAME Attachment Sequence No

What is the Reset Form SCHEDULE CORPORATION FRANCHISE TAX SCHEDULE CORPORATION NAME Attachment Sequence No

The Reset Form SCHEDULE CORPORATION FRANCHISE TAX SCHEDULE CORPORATION NAME Attachment Sequence No is a specific tax form used by corporations in the United States to reset or amend their franchise tax schedules. This form is essential for ensuring that the corporation's tax obligations are accurately reported and updated. It helps maintain compliance with state tax regulations, allowing corporations to correct errors or update information related to their franchise tax filings.

How to use the Reset Form SCHEDULE CORPORATION FRANCHISE TAX SCHEDULE CORPORATION NAME Attachment Sequence No

To effectively use the Reset Form SCHEDULE CORPORATION FRANCHISE TAX SCHEDULE CORPORATION NAME Attachment Sequence No, corporations should first obtain the form from the relevant state tax authority. After acquiring the form, users should carefully fill in the required fields, ensuring all information is accurate and up to date. Once completed, the form can be submitted through the designated filing method, which may include online submission, mailing, or in-person delivery, depending on state guidelines.

Steps to complete the Reset Form SCHEDULE CORPORATION FRANCHISE TAX SCHEDULE CORPORATION NAME Attachment Sequence No

Completing the Reset Form involves several key steps:

- Gather necessary documents, including previous tax filings and any relevant financial statements.

- Fill in the corporation's name and identification details accurately.

- Provide updated information regarding the franchise tax obligations.

- Review the completed form for any errors or omissions.

- Submit the form through the appropriate channels as specified by the state tax authority.

Key elements of the Reset Form SCHEDULE CORPORATION FRANCHISE TAX SCHEDULE CORPORATION NAME Attachment Sequence No

The Reset Form includes several key elements that must be accurately completed:

- Corporation Name: The legal name of the corporation must be clearly stated.

- Attachment Sequence Number: This number helps identify the specific filing and its sequence.

- Tax Year: Indicate the tax year for which the reset is being filed.

- Updated Information: Any changes to the corporation's tax obligations or details should be included.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines when submitting the Reset Form. These deadlines can vary by state and are typically aligned with the annual tax filing dates. It is crucial for corporations to be aware of these dates to avoid penalties and ensure compliance with state tax laws. Checking with the state tax authority for the most accurate and up-to-date deadlines is recommended.

Penalties for Non-Compliance

Failure to submit the Reset Form SCHEDULE CORPORATION FRANCHISE TAX SCHEDULE CORPORATION NAME Attachment Sequence No by the designated deadline may result in penalties. These penalties can include fines, interest on unpaid taxes, and potential legal action. It is essential for corporations to stay compliant with tax regulations to avoid these consequences and maintain good standing with state authorities.

Quick guide on how to complete reset form schedule corporation franchise tax schedule corporation name attachment sequence no

Prepare [SKS] effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to easily locate the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents promptly without delays. Handle [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The easiest method to modify and eSign [SKS] seamlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact confidential information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate reprinting document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign [SKS] and ensure outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Reset Form SCHEDULE CORPORATION FRANCHISE TAX SCHEDULE CORPORATION NAME Attachment Sequence No

Create this form in 5 minutes!

How to create an eSignature for the reset form schedule corporation franchise tax schedule corporation name attachment sequence no

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Reset Form SCHEDULE CORPORATION FRANCHISE TAX SCHEDULE CORPORATION NAME Attachment Sequence No.?

The Reset Form SCHEDULE CORPORATION FRANCHISE TAX SCHEDULE CORPORATION NAME Attachment Sequence No. is a specific form used by corporations to reset their franchise tax obligations. This form helps ensure compliance with state tax regulations and allows businesses to maintain their good standing.

-

How can I access the Reset Form SCHEDULE CORPORATION FRANCHISE TAX SCHEDULE CORPORATION NAME Attachment Sequence No.?

You can easily access the Reset Form SCHEDULE CORPORATION FRANCHISE TAX SCHEDULE CORPORATION NAME Attachment Sequence No. through the airSlate SignNow platform. Simply log in to your account, navigate to the forms section, and search for the specific form you need.

-

Is there a cost associated with using the Reset Form SCHEDULE CORPORATION FRANCHISE TAX SCHEDULE CORPORATION NAME Attachment Sequence No.?

Using the Reset Form SCHEDULE CORPORATION FRANCHISE TAX SCHEDULE CORPORATION NAME Attachment Sequence No. is included in your airSlate SignNow subscription. Our pricing plans are designed to be cost-effective, providing you with access to all necessary forms and features.

-

What features does airSlate SignNow offer for the Reset Form SCHEDULE CORPORATION FRANCHISE TAX SCHEDULE CORPORATION NAME Attachment Sequence No.?

airSlate SignNow offers a range of features for the Reset Form SCHEDULE CORPORATION FRANCHISE TAX SCHEDULE CORPORATION NAME Attachment Sequence No., including eSigning, document tracking, and secure storage. These features streamline the process and enhance your document management experience.

-

Can I integrate airSlate SignNow with other software for the Reset Form SCHEDULE CORPORATION FRANCHISE TAX SCHEDULE CORPORATION NAME Attachment Sequence No.?

Yes, airSlate SignNow supports integrations with various software applications, allowing you to manage the Reset Form SCHEDULE CORPORATION FRANCHISE TAX SCHEDULE CORPORATION NAME Attachment Sequence No. seamlessly. Popular integrations include CRM systems, cloud storage services, and accounting software.

-

What are the benefits of using airSlate SignNow for the Reset Form SCHEDULE CORPORATION FRANCHISE TAX SCHEDULE CORPORATION NAME Attachment Sequence No.?

Using airSlate SignNow for the Reset Form SCHEDULE CORPORATION FRANCHISE TAX SCHEDULE CORPORATION NAME Attachment Sequence No. offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. Our platform simplifies the process, saving you time and resources.

-

How secure is the Reset Form SCHEDULE CORPORATION FRANCHISE TAX SCHEDULE CORPORATION NAME Attachment Sequence No. on airSlate SignNow?

Security is a top priority at airSlate SignNow. The Reset Form SCHEDULE CORPORATION FRANCHISE TAX SCHEDULE CORPORATION NAME Attachment Sequence No. is protected with advanced encryption and secure access controls, ensuring that your sensitive information remains safe and confidential.

Get more for Reset Form SCHEDULE CORPORATION FRANCHISE TAX SCHEDULE CORPORATION NAME Attachment Sequence No

- Sv 710 notice of hearing to renew restraining california courts courts ca form

- Sv 250 proof of service of response by mail judicial council forms courts ca

- Birch management inc lease agreement form

- Rebate form needymeds needymeds

- Download a print version colorado bar association cobar form

- Massachusetts state lottery commission license application booklet supporting the 351 cities and towns of massachusetts timothy form

- Fl 103 attorney or party without attorney name state bar number and address telephone no courts ca form

- Using clock jitter analysis to reduce ber in serial data applications this application note emphasizes on the emerging form

Find out other Reset Form SCHEDULE CORPORATION FRANCHISE TAX SCHEDULE CORPORATION NAME Attachment Sequence No

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy

- How Can I eSign Wisconsin Escrow Agreement

- How To eSign Nebraska Sales Invoice Template

- eSign Nebraska Sales Invoice Template Simple