Joint District Tax Levy Summary FP 8b FY2012 Joint District Tax Levy Summary FP 8b FY2012 Form

Understanding the Joint District Tax Levy Summary FP 8b FY2012

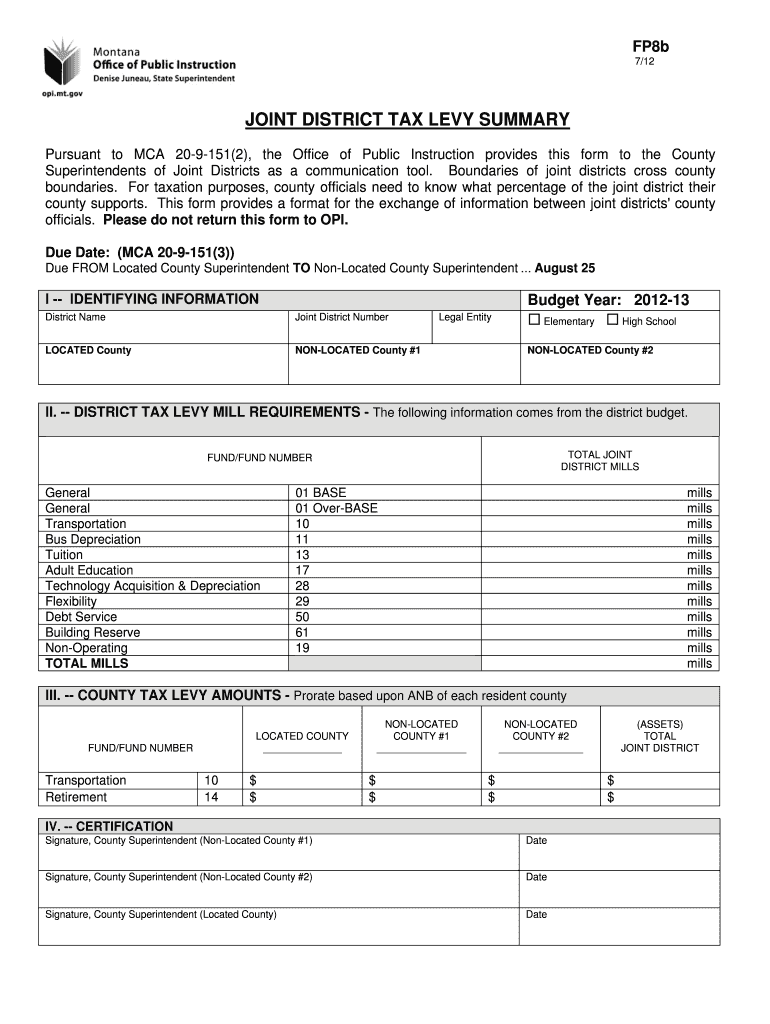

The Joint District Tax Levy Summary FP 8b FY2012 is a crucial document used by school districts in the United States to report tax levies. This form consolidates information regarding the tax amounts levied by various districts, providing transparency and accountability in the funding of educational services. It typically includes details such as the total amount of taxes levied, the purpose of the levies, and the distribution of funds across different programs. Understanding this form is essential for school administrators and financial officers to ensure compliance with state regulations and to facilitate effective budgeting.

Steps to Complete the Joint District Tax Levy Summary FP 8b FY2012

Completing the Joint District Tax Levy Summary FP 8b FY2012 involves several key steps:

- Gather necessary financial data, including previous tax levies and current budgetary needs.

- Consult with district stakeholders to determine the required levy amounts for various programs.

- Fill out the form accurately, ensuring all sections are completed, including the total tax levy and specific allocations.

- Review the completed form for accuracy and compliance with state guidelines.

- Submit the form to the appropriate state or local education authority by the specified deadline.

Key Elements of the Joint District Tax Levy Summary FP 8b FY2012

The Joint District Tax Levy Summary FP 8b FY2012 contains several key elements that are vital for its effectiveness:

- Tax Levy Amounts: Detailed breakdown of the total tax levies for the fiscal year.

- Purpose of Levies: Explanation of how the funds will be used, such as for operational costs or capital improvements.

- Distribution of Funds: Information on how the levies are allocated among different programs and services.

- Compliance Information: Sections that ensure the form meets state regulations and guidelines.

Legal Use of the Joint District Tax Levy Summary FP 8b FY2012

The legal use of the Joint District Tax Levy Summary FP 8b FY2012 is governed by state education laws and regulations. This form must be completed and submitted accurately to ensure that the district remains compliant with financial reporting requirements. Failure to submit the form or inaccuracies in reporting can lead to penalties, including potential audits or funding issues. It is essential for school districts to understand their legal obligations regarding tax levies to avoid any legal repercussions.

Obtaining the Joint District Tax Levy Summary FP 8b FY2012

To obtain the Joint District Tax Levy Summary FP 8b FY2012, school districts typically need to access the form through their state education department's website or directly from the local education authority. Many states provide downloadable versions of the form, along with guidance documents that outline the completion process. It is advisable for districts to check for any updates or changes to the form each fiscal year to ensure compliance with the latest regulations.

Examples of Using the Joint District Tax Levy Summary FP 8b FY2012

Examples of using the Joint District Tax Levy Summary FP 8b FY2012 can vary by district but generally include:

- Reporting tax levies for funding new educational programs or initiatives.

- Documenting changes in tax levies due to shifts in student enrollment or funding needs.

- Providing transparency to stakeholders about how tax revenues are utilized within the district.

Quick guide on how to complete joint district tax levy summary fp 8b fy2012 joint district tax levy summary fp 8b fy2012

Complete [SKS] effortlessly on any device

Digital document management has gained popularity among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources you require to create, edit, and eSign your documents promptly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

The most efficient way to modify and eSign [SKS] without effort

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and holds the same legal significance as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to deliver your form, via email, SMS, or an invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your requirements in document management with just a few clicks from any device you choose. Modify and eSign [SKS] and guarantee excellent communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Joint District Tax Levy Summary FP 8b FY2012 Joint District Tax Levy Summary FP 8b FY2012

Create this form in 5 minutes!

How to create an eSignature for the joint district tax levy summary fp 8b fy2012 joint district tax levy summary fp 8b fy2012

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Joint District Tax Levy Summary FP 8b FY2012?

The Joint District Tax Levy Summary FP 8b FY2012 is a detailed report that outlines the tax levies for joint districts for the fiscal year 2012. This summary provides essential insights into the financial obligations of the districts, helping stakeholders understand their tax responsibilities.

-

How can airSlate SignNow help with the Joint District Tax Levy Summary FP 8b FY2012?

airSlate SignNow streamlines the process of managing and signing documents related to the Joint District Tax Levy Summary FP 8b FY2012. With our platform, you can easily send, eSign, and store these important documents securely, ensuring compliance and efficiency.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents like the Joint District Tax Levy Summary FP 8b FY2012. These tools enhance collaboration and ensure that all parties are informed throughout the process.

-

Is airSlate SignNow cost-effective for small businesses handling the Joint District Tax Levy Summary FP 8b FY2012?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses managing the Joint District Tax Levy Summary FP 8b FY2012. Our pricing plans are flexible, allowing you to choose the best option that fits your budget while still accessing powerful features.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage the Joint District Tax Levy Summary FP 8b FY2012 alongside your existing tools. This seamless integration helps streamline your workflow and enhances productivity.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the Joint District Tax Levy Summary FP 8b FY2012, provides numerous benefits such as increased efficiency, reduced paper usage, and enhanced security. Our platform ensures that your documents are signed and stored securely, minimizing the risk of loss or unauthorized access.

-

How secure is airSlate SignNow for handling sensitive tax documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive documents like the Joint District Tax Levy Summary FP 8b FY2012. Our platform is designed to keep your information safe while allowing for easy access and collaboration.

Get more for Joint District Tax Levy Summary FP 8b FY2012 Joint District Tax Levy Summary FP 8b FY2012

Find out other Joint District Tax Levy Summary FP 8b FY2012 Joint District Tax Levy Summary FP 8b FY2012

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF