In Most Circumstances, Your Annual Election Amounts or Any Insurance Premiums You Are Having Payroll Deducted Pre Tax Cannot Be Form

Understanding the Annual Election Amounts and Insurance Premiums

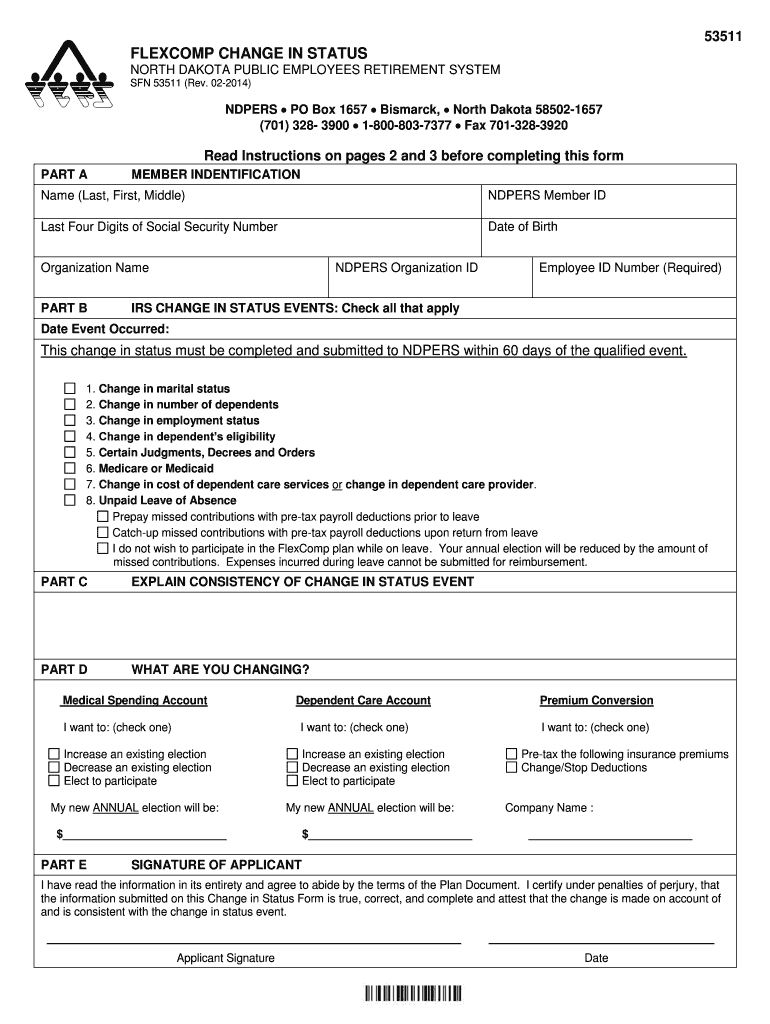

The phrase "In most circumstances, your annual election amounts or any insurance premiums you are having payroll deducted pre-tax cannot be changed" refers to the rules governing how employees can manage their benefits and deductions. Typically, once you elect your amounts for benefits like health insurance, these choices are fixed for the entire plan year unless specific qualifying events occur. These events might include marriage, divorce, or the birth of a child, which could allow for adjustments to your elections.

How to Use the Annual Election Amounts and Insurance Premiums

Utilizing your annual election amounts and insurance premiums effectively requires understanding your benefits package. Review your employer's benefits guide to see what options are available. When you initially enroll, you will select your coverage levels and any additional benefits. Remember that these selections play a crucial role in your financial planning, as they affect your take-home pay and overall health coverage.

Steps to Complete Your Annual Election Amounts

Completing your annual election amounts involves several key steps:

- Review your current benefits and any changes in your personal situation.

- Consult your employer's benefits materials for available options.

- Fill out the necessary forms during the open enrollment period.

- Submit your elections by the specified deadline to ensure processing.

Following these steps helps ensure that your benefits align with your needs for the upcoming year.

Key Elements of Annual Election Amounts and Insurance Premiums

Understanding the key elements of your annual election amounts is vital. These include:

- The types of benefits offered, such as health, dental, and vision insurance.

- The contribution amounts deducted from your paycheck.

- The duration of coverage, typically lasting for one year.

- Any limitations on changes outside of qualifying events.

Familiarizing yourself with these elements can help you make informed decisions about your benefits.

Legal Use of Annual Election Amounts and Insurance Premiums

Legally, your annual election amounts and insurance premiums are governed by federal regulations, including the Internal Revenue Code and the Employee Retirement Income Security Act (ERISA). These laws ensure that employees have clear guidelines on how benefits are administered, including the circumstances under which changes can be made. Employers must comply with these regulations while providing transparency about the benefits available to employees.

Examples of Annual Election Amounts in Practice

Examples of how annual election amounts work can clarify their application. For instance, if you elect to contribute a certain amount to a health savings account (HSA) or choose a specific health insurance plan, these amounts are locked in until the next enrollment period unless you experience a qualifying life event. Understanding these examples can help you navigate your benefits more effectively.

Quick guide on how to complete in most circumstances your annual election amounts or any insurance premiums you are having payroll deducted pre tax cannot be

Complete [SKS] with ease on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the suitable form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Handle [SKS] on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The easiest way to adjust and electronically sign [SKS] effortlessly

- Find [SKS] and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with features specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Decide how you wish to send your form, via email, text (SMS), or through an invite link, or download it to your computer.

Wave goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choice. Adjust and electronically sign [SKS] and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to In Most Circumstances, Your Annual Election Amounts Or Any Insurance Premiums You Are Having Payroll Deducted Pre tax Cannot Be

Create this form in 5 minutes!

How to create an eSignature for the in most circumstances your annual election amounts or any insurance premiums you are having payroll deducted pre tax cannot be

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does it mean when it says 'In Most Circumstances, Your Annual Election Amounts Or Any Insurance Premiums You Are Having Payroll Deducted Pre tax Cannot Be Changed'?

This statement indicates that once you select your annual election amounts or insurance premiums for payroll deductions, you typically cannot alter them until the next enrollment period. Understanding this can help you make informed decisions about your benefits and financial planning.

-

How does airSlate SignNow help with document management related to payroll deductions?

airSlate SignNow streamlines the process of managing documents associated with payroll deductions. By providing an easy-to-use platform for eSigning and sending documents, it ensures that all necessary paperwork is completed accurately and efficiently, which is crucial since 'In Most Circumstances, Your Annual Election Amounts Or Any Insurance Premiums You Are Having Payroll Deducted Pre tax Cannot Be Changed.'

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to essential features that enhance document management and eSigning capabilities, ensuring that you can effectively manage your payroll deductions, especially since 'In Most Circumstances, Your Annual Election Amounts Or Any Insurance Premiums You Are Having Payroll Deducted Pre tax Cannot Be Changed.'

-

Can airSlate SignNow integrate with other payroll systems?

Yes, airSlate SignNow can integrate seamlessly with various payroll systems, enhancing your workflow. This integration is beneficial for managing documents related to payroll deductions, as 'In Most Circumstances, Your Annual Election Amounts Or Any Insurance Premiums You Are Having Payroll Deducted Pre tax Cannot Be Changed.'

-

What features does airSlate SignNow offer to enhance user experience?

airSlate SignNow provides features such as customizable templates, real-time tracking, and secure cloud storage. These features simplify the document signing process and ensure compliance, especially when considering that 'In Most Circumstances, Your Annual Election Amounts Or Any Insurance Premiums You Are Having Payroll Deducted Pre tax Cannot Be Changed.'

-

How can airSlate SignNow benefit my business?

By using airSlate SignNow, your business can save time and reduce errors in document management. This efficiency is particularly important when dealing with payroll deductions, as 'In Most Circumstances, Your Annual Election Amounts Or Any Insurance Premiums You Are Having Payroll Deducted Pre tax Cannot Be Changed.'

-

Is airSlate SignNow secure for handling sensitive payroll documents?

Absolutely, airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. This ensures that all sensitive payroll documents are protected, which is crucial since 'In Most Circumstances, Your Annual Election Amounts Or Any Insurance Premiums You Are Having Payroll Deducted Pre tax Cannot Be Changed.'

Get more for In Most Circumstances, Your Annual Election Amounts Or Any Insurance Premiums You Are Having Payroll Deducted Pre tax Cannot Be

- Prospective visitor interview 2014 2019 form

- Ptax 230 2014 2019 form

- State form 45223 2008 2019

- Departmental action 2013 2019 form

- Prince georges county third party inspection program 2015 2018 form

- Msde state complaint special education 2012 2019 form

- Form tr 2013 2019

- Comprehensive plan amendment application city of form

Find out other In Most Circumstances, Your Annual Election Amounts Or Any Insurance Premiums You Are Having Payroll Deducted Pre tax Cannot Be

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure