Form 40 Schedules Nd

What is the Form 40 Schedules Nd

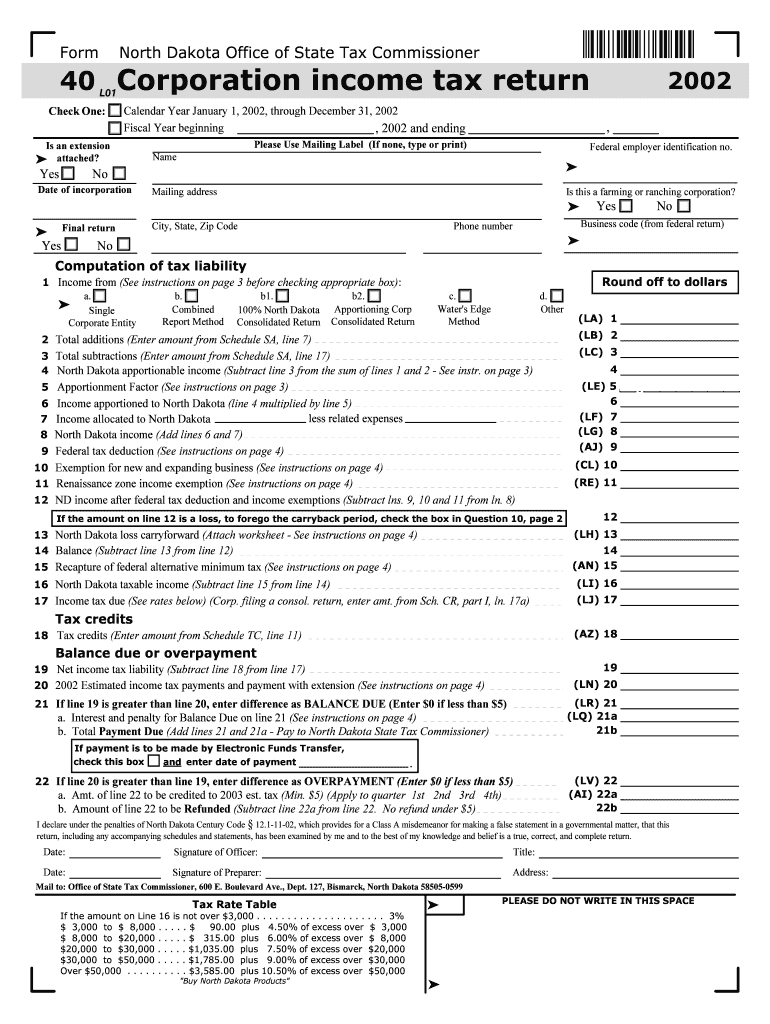

The Form 40 Schedules Nd is a specific tax form used in the United States, primarily for reporting income and deductions related to certain types of income. This form is typically utilized by individuals or entities who need to provide detailed information about their financial activities for a given tax year. It helps the Internal Revenue Service (IRS) assess tax liabilities accurately and ensures compliance with federal tax regulations.

How to obtain the Form 40 Schedules Nd

To obtain the Form 40 Schedules Nd, individuals can visit the official IRS website, where the form is available for download in PDF format. Alternatively, taxpayers can request a physical copy by contacting the IRS directly or visiting local IRS offices. It is important to ensure that the correct version of the form is obtained to avoid any filing issues.

Steps to complete the Form 40 Schedules Nd

Completing the Form 40 Schedules Nd involves several key steps:

- Gather all necessary financial documents, including income statements, receipts for deductions, and any relevant tax forms.

- Carefully read the instructions provided with the form to understand the requirements and guidelines.

- Fill out the form accurately, ensuring that all information is complete and correct.

- Review the completed form for any errors or omissions before submission.

- Submit the form by the specified deadline, either electronically or via mail, as per the instructions.

Key elements of the Form 40 Schedules Nd

The Form 40 Schedules Nd includes several key elements that are crucial for accurate reporting:

- Personal Information: Basic identification details such as name, address, and Social Security number.

- Income Reporting: Sections for reporting various types of income, including wages, dividends, and interest.

- Deductions: Areas to claim deductions that can reduce taxable income, such as business expenses and charitable contributions.

- Tax Computation: Calculations to determine the total tax owed based on reported income and deductions.

IRS Guidelines

When using the Form 40 Schedules Nd, it is essential to follow the IRS guidelines to ensure compliance. The IRS provides detailed instructions that outline how to fill out the form, what information is required, and how to submit it. Adhering to these guidelines helps prevent errors that could lead to delays in processing or potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form 40 Schedules Nd are typically aligned with the annual tax filing deadline. For most taxpayers, this date falls on April 15 of each year. However, it is crucial to check for any updates or changes to deadlines, especially if they fall on a weekend or holiday. Taxpayers should also consider any extensions that may apply, which can provide additional time for filing.

Quick guide on how to complete form 40 schedules nd

Complete [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with every tool you need to create, alter, and electronically sign your documents swiftly without any delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest method to modify and electronically sign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Make use of the tools provided to complete your form.

- Mark important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes only seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information carefully and click the Done button to preserve your changes.

- Select your preferred method of sharing your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 40 Schedules Nd

Create this form in 5 minutes!

How to create an eSignature for the form 40 schedules nd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 40 Schedules Nd?

Form 40 Schedules Nd is a document used for reporting specific financial information to tax authorities. It is essential for businesses to accurately complete this form to ensure compliance and avoid penalties. airSlate SignNow simplifies the process of filling out and eSigning Form 40 Schedules Nd, making it easier for users to manage their tax documentation.

-

How can airSlate SignNow help with Form 40 Schedules Nd?

airSlate SignNow provides a user-friendly platform that allows businesses to easily fill out and eSign Form 40 Schedules Nd. With its intuitive interface, users can streamline their document workflows, ensuring that all necessary information is captured accurately and efficiently. This helps save time and reduces the risk of errors in tax submissions.

-

What are the pricing options for using airSlate SignNow for Form 40 Schedules Nd?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of different businesses. Users can choose from various subscription options that provide access to features specifically designed for managing documents like Form 40 Schedules Nd. This ensures that businesses can find a plan that fits their budget while benefiting from a comprehensive eSigning solution.

-

Are there any integrations available for Form 40 Schedules Nd with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms, enhancing the workflow for managing Form 40 Schedules Nd. These integrations allow users to connect their existing tools, such as CRM systems and cloud storage services, making it easier to access and manage documents. This connectivity streamlines the entire process from creation to eSigning.

-

What features does airSlate SignNow offer for managing Form 40 Schedules Nd?

airSlate SignNow includes features such as customizable templates, automated reminders, and secure eSigning capabilities specifically for Form 40 Schedules Nd. These tools help users efficiently manage their documents while ensuring compliance with legal standards. Additionally, the platform provides tracking and audit trails for added security and transparency.

-

Can I use airSlate SignNow on mobile devices for Form 40 Schedules Nd?

Absolutely! airSlate SignNow is optimized for mobile devices, allowing users to manage Form 40 Schedules Nd on the go. This mobile accessibility ensures that you can fill out, eSign, and send documents from anywhere, making it convenient for busy professionals. The mobile app retains all the features available on the desktop version.

-

What are the benefits of using airSlate SignNow for Form 40 Schedules Nd?

Using airSlate SignNow for Form 40 Schedules Nd offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick eSigning and document management, which can signNowly speed up the tax filing process. Additionally, it provides a secure environment for sensitive information, ensuring compliance with data protection regulations.

Get more for Form 40 Schedules Nd

- Previous athletic participation form

- The immunization record is available to download from the health insurance and immunizations website at drexel form

- Immunization record drexel university form

- Berea college international application form 2018 2019

- Volunteer work comp election form

- Collegeuniversity date form

- Grades k 12 registration form 2018 2019

- Please only use form

Find out other Form 40 Schedules Nd

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe

- Sign Massachusetts Leave of Absence Agreement Simple

- Sign Connecticut Acknowledgement of Resignation Fast

- How To Sign Massachusetts Resignation Letter

- Sign New Mexico Resignation Letter Now

- How Do I Sign Oklahoma Junior Employment Offer Letter

- Sign Oklahoma Resignation Letter Simple

- How Do I Sign Oklahoma Acknowledgement of Resignation

- Can I Sign Pennsylvania Resignation Letter

- How To Sign Rhode Island Resignation Letter

- Sign Texas Resignation Letter Easy