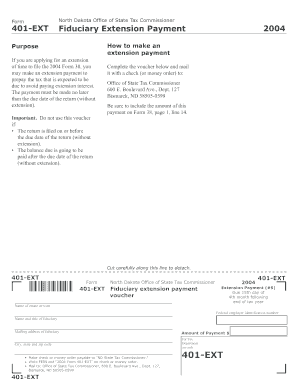

Form 401 EXT Fiduciary Extension Payment Nd

What is the Form 401 EXT Fiduciary Extension Payment Nd

The Form 401 EXT Fiduciary Extension Payment Nd is a tax form used in the United States for fiduciaries to request an extension of time to file certain tax returns. This form is particularly relevant for estates and trusts that may require additional time to prepare their tax documents accurately. By submitting this form, fiduciaries can avoid penalties associated with late filings while ensuring compliance with IRS regulations. It is essential to understand the specific requirements and implications of using this form to maintain proper tax records and obligations.

How to use the Form 401 EXT Fiduciary Extension Payment Nd

Using the Form 401 EXT Fiduciary Extension Payment Nd involves several key steps. First, determine if you qualify for an extension based on your circumstances. Next, accurately complete the form, providing all necessary information about the fiduciary entity and the tax year in question. After filling out the form, it should be submitted to the appropriate tax authority, either electronically or via mail. It is important to retain a copy of the submitted form for your records, as it serves as proof of your extension request.

Steps to complete the Form 401 EXT Fiduciary Extension Payment Nd

Completing the Form 401 EXT Fiduciary Extension Payment Nd requires careful attention to detail. Follow these steps:

- Gather relevant information, including the fiduciary's name, address, and taxpayer identification number.

- Indicate the type of tax return for which you are requesting an extension.

- Provide the tax year for which the extension is being requested.

- Calculate any payment due, if applicable, and include this information on the form.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

Filing deadlines for the Form 401 EXT Fiduciary Extension Payment Nd are crucial to avoid penalties. Generally, the form must be submitted by the original due date of the tax return for which the extension is being requested. For most fiduciary returns, this date falls on the fifteenth day of the fourth month following the end of the tax year. It is advisable to check for any specific state requirements or changes in federal guidelines that may affect these deadlines.

Required Documents

When completing the Form 401 EXT Fiduciary Extension Payment Nd, certain documents may be necessary to support the extension request. These can include:

- Previous tax returns for the fiduciary entity.

- Financial statements or records that detail income and expenses.

- Any correspondence from the IRS related to the fiduciary's tax obligations.

Having these documents ready can facilitate the completion of the form and ensure accurate reporting.

Penalties for Non-Compliance

Failure to comply with the requirements related to the Form 401 EXT Fiduciary Extension Payment Nd can lead to significant penalties. If the form is not submitted by the deadline, the IRS may impose late filing fees and interest on any unpaid taxes. Additionally, fiduciaries may face challenges with their tax status, which can complicate future filings and financial reporting. Understanding these potential penalties emphasizes the importance of timely and accurate submissions.

Quick guide on how to complete form 401 ext fiduciary extension payment nd

Finish [SKS] effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive data with the tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign [SKS] to ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 401 EXT Fiduciary Extension Payment Nd

Create this form in 5 minutes!

How to create an eSignature for the form 401 ext fiduciary extension payment nd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 401 EXT Fiduciary Extension Payment Nd?

The Form 401 EXT Fiduciary Extension Payment Nd is a tax form used by fiduciaries in North Dakota to request an extension for filing their income tax returns. This form allows fiduciaries to ensure they meet their tax obligations while providing additional time to prepare their filings accurately.

-

How can airSlate SignNow help with the Form 401 EXT Fiduciary Extension Payment Nd?

airSlate SignNow streamlines the process of completing and submitting the Form 401 EXT Fiduciary Extension Payment Nd by providing an easy-to-use platform for eSigning and document management. With our solution, you can quickly fill out the form, obtain necessary signatures, and send it directly to the relevant authorities.

-

What are the pricing options for using airSlate SignNow for Form 401 EXT Fiduciary Extension Payment Nd?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including options for individuals and larger organizations. Our pricing is designed to be cost-effective, ensuring that you can manage your Form 401 EXT Fiduciary Extension Payment Nd without breaking the bank.

-

Are there any features specifically for managing Form 401 EXT Fiduciary Extension Payment Nd?

Yes, airSlate SignNow includes features tailored for managing the Form 401 EXT Fiduciary Extension Payment Nd, such as customizable templates, automated reminders, and secure storage. These features help ensure that your documents are completed accurately and submitted on time.

-

What benefits does airSlate SignNow provide for eSigning the Form 401 EXT Fiduciary Extension Payment Nd?

Using airSlate SignNow for eSigning the Form 401 EXT Fiduciary Extension Payment Nd offers numerous benefits, including enhanced security, reduced turnaround time, and improved compliance. Our platform ensures that your signatures are legally binding and that your documents are protected throughout the process.

-

Can I integrate airSlate SignNow with other software for managing Form 401 EXT Fiduciary Extension Payment Nd?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to manage your Form 401 EXT Fiduciary Extension Payment Nd alongside your existing tools. This integration helps streamline your workflow and enhances productivity.

-

Is there customer support available for questions about Form 401 EXT Fiduciary Extension Payment Nd?

Yes, airSlate SignNow provides dedicated customer support to assist you with any questions regarding the Form 401 EXT Fiduciary Extension Payment Nd. Our knowledgeable team is available to help you navigate the platform and ensure your documents are processed smoothly.

Get more for Form 401 EXT Fiduciary Extension Payment Nd

- Carer adjustment payment australian government department of form

- Request to withdraw a lodged document form

- Strata title body corporate tax return and instructions 2015 ato gov form

- Form 388 certificate of airworthinesschecklist 07 airworthiness directive aircraft

- Strata title body form

- Sydney water sewer choke claims 2011 2019 form

- Transport and main roads corporate forms

- Witness certificate 2013 2019 form

Find out other Form 401 EXT Fiduciary Extension Payment Nd

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT