Schedule ME Credit for Wages Paid to Mobilized Employee Schedule ME Credit for Wages Paid to Mobilized Employee Form

Understanding the Schedule ME Credit for Wages Paid to Mobilized Employees

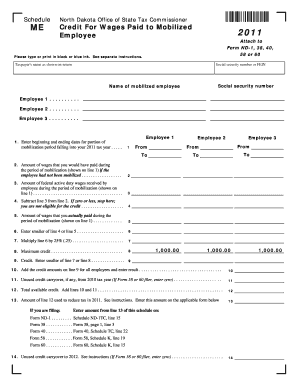

The Schedule ME Credit for Wages Paid to Mobilized Employees is a tax credit available to businesses that continue to pay wages to employees who have been mobilized for military service. This credit aims to alleviate the financial burden on employers while supporting employees serving in the military. It is essential for businesses to recognize the eligibility criteria and the benefits associated with this credit to ensure compliance and maximize potential savings.

Steps to Complete the Schedule ME Credit for Wages Paid to Mobilized Employees

Completing the Schedule ME Credit for Wages Paid to Mobilized Employees involves several steps. First, gather all necessary documentation, including payroll records and proof of military mobilization. Next, accurately fill out the form by providing details about the wages paid during the mobilization period. Ensure that all calculations are correct to avoid errors that could delay processing. Finally, submit the completed form along with your tax return to the appropriate tax authority.

Eligibility Criteria for the Schedule ME Credit for Wages Paid to Mobilized Employees

To qualify for the Schedule ME Credit, businesses must meet specific eligibility criteria. The employee must be a member of the military who has been called to active duty. Additionally, the employer must have continued to pay wages to the employee during their mobilization. It is crucial to keep detailed records of the wages paid and the duration of the mobilization to substantiate the claim for the credit.

Required Documents for the Schedule ME Credit for Wages Paid to Mobilized Employees

When applying for the Schedule ME Credit, businesses should prepare a set of required documents. These documents typically include:

- Payroll records showing wages paid to the mobilized employee.

- Military orders or documentation confirming the employee's mobilization status.

- Tax returns for the applicable tax year.

Having these documents readily available will facilitate a smoother application process and ensure compliance with IRS requirements.

Filing Deadlines for the Schedule ME Credit for Wages Paid to Mobilized Employees

It is important to be aware of filing deadlines when submitting the Schedule ME Credit. Typically, the credit should be claimed on the employer's tax return for the year in which the wages were paid. Employers should consult the IRS guidelines for specific dates and ensure that all forms are submitted on time to avoid penalties or missed opportunities for claiming the credit.

IRS Guidelines for the Schedule ME Credit for Wages Paid to Mobilized Employees

The IRS provides specific guidelines regarding the Schedule ME Credit for Wages Paid to Mobilized Employees. These guidelines outline the eligibility requirements, documentation needed, and the process for claiming the credit. Employers should review the IRS publications related to this credit to ensure they are following the most current regulations and procedures.

Quick guide on how to complete schedule me credit for wages paid to mobilized employee schedule me credit for wages paid to mobilized employee

Handle [SKS] seamlessly on any device

Digital document management has gained traction among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to alter and eSign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, either by email, SMS, invitation link, or download it to your computer.

Eliminate concerns of lost or misplaced documents, laborious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] while ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule ME Credit For Wages Paid To Mobilized Employee Schedule ME Credit For Wages Paid To Mobilized Employee

Create this form in 5 minutes!

How to create an eSignature for the schedule me credit for wages paid to mobilized employee schedule me credit for wages paid to mobilized employee

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule ME Credit For Wages Paid To Mobilized Employee?

The Schedule ME Credit For Wages Paid To Mobilized Employee is a tax credit designed to support businesses that continue to pay employees who are mobilized for military service. This credit helps offset the costs associated with maintaining payroll for these employees, ensuring that businesses can manage their workforce effectively during challenging times.

-

How can airSlate SignNow assist with the Schedule ME Credit For Wages Paid To Mobilized Employee?

airSlate SignNow provides an efficient platform for businesses to manage documentation related to the Schedule ME Credit For Wages Paid To Mobilized Employee. With our easy-to-use eSigning features, you can quickly prepare and send necessary forms, ensuring compliance and timely submissions.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Whether you are a small business or a large enterprise, you can find a plan that fits your budget while providing the necessary tools to manage the Schedule ME Credit For Wages Paid To Mobilized Employee efficiently.

-

What features does airSlate SignNow offer for managing employee documents?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure cloud storage. These tools streamline the process of managing documents related to the Schedule ME Credit For Wages Paid To Mobilized Employee, making it easier for businesses to stay organized and compliant.

-

Are there any benefits to using airSlate SignNow for tax credits?

Yes, using airSlate SignNow can signNowly enhance your ability to manage tax credits like the Schedule ME Credit For Wages Paid To Mobilized Employee. Our platform simplifies document handling, reduces processing time, and ensures that you have all necessary documentation readily available for audits or claims.

-

Can airSlate SignNow integrate with other software for payroll management?

Absolutely! airSlate SignNow integrates seamlessly with various payroll and HR management software. This integration allows businesses to efficiently manage the Schedule ME Credit For Wages Paid To Mobilized Employee alongside their existing payroll systems, ensuring a smooth workflow.

-

How secure is the information shared through airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect all information shared on our platform, including documents related to the Schedule ME Credit For Wages Paid To Mobilized Employee. You can trust that your data is safe with us.

Get more for Schedule ME Credit For Wages Paid To Mobilized Employee Schedule ME Credit For Wages Paid To Mobilized Employee

Find out other Schedule ME Credit For Wages Paid To Mobilized Employee Schedule ME Credit For Wages Paid To Mobilized Employee

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template