Form ND 2 & Schedule 2 Optional Individual Income Tax Return

What is the Form ND 2 & Schedule 2 Optional Individual Income Tax Return

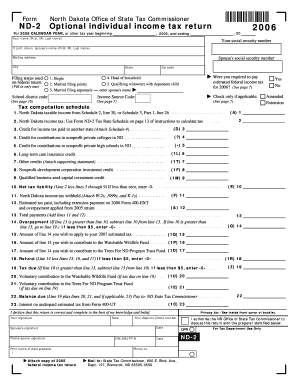

The Form ND 2 & Schedule 2 Optional Individual Income Tax Return is a specific tax form used by residents of North Dakota to report their income and calculate their tax liability. This form allows individuals to file their state income taxes, providing a structured way to report income, deductions, and credits. It is designed for those who may not be required to file a federal return but still need to fulfill their state tax obligations. Understanding this form is essential for ensuring compliance with North Dakota tax laws.

How to use the Form ND 2 & Schedule 2 Optional Individual Income Tax Return

Using the Form ND 2 & Schedule 2 involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including W-2s, 1099s, and any other relevant income statements. Next, fill out the form by providing your personal information, income details, and applicable deductions. It is important to follow the instructions carefully to avoid errors. Once completed, you can submit the form either electronically or by mail, depending on your preference and the options available for your filing situation.

Steps to complete the Form ND 2 & Schedule 2 Optional Individual Income Tax Return

Completing the Form ND 2 & Schedule 2 requires careful attention to detail. Start by entering your personal information, including your name, address, and Social Security number. Then, report your total income from all sources. After that, apply any deductions you qualify for, which may include standard deductions or itemized deductions. Calculate your tax liability based on the provided tax tables. Finally, review the form for accuracy before submitting it to ensure compliance with state regulations.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Form ND 2 & Schedule 2. Typically, the deadline for submitting your state income tax return aligns with the federal tax deadline, which is usually April fifteenth. However, if you require an extension, you may file for one, but it is important to check North Dakota's specific guidelines regarding extensions. Staying informed about these dates helps avoid penalties and ensures timely compliance with tax obligations.

Required Documents

To successfully complete the Form ND 2 & Schedule 2, certain documents are necessary. These include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of other income, such as interest or dividends

- Documentation for any deductions claimed, such as mortgage interest statements or receipts for charitable contributions

Having these documents ready will streamline the process and help ensure accurate reporting.

Eligibility Criteria

Eligibility to use the Form ND 2 & Schedule 2 is typically based on your residency status and income level. Generally, individuals who are residents of North Dakota and have income that meets the state's filing requirements must use this form. Additionally, certain exemptions may apply, such as for low-income earners or those who qualify for specific tax credits. Understanding these criteria is essential for determining whether this form is appropriate for your tax situation.

Quick guide on how to complete form nd 2 amp schedule 2 optional individual income tax return

Effortlessly prepare [SKS] on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

Ways to modify and eSign [SKS] with ease

- Locate [SKS] and click Get Form to initiate the process.

- Utilize the tools we provide to fill in your document.

- Emphasize important sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign [SKS] and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form ND 2 & Schedule 2 Optional Individual Income Tax Return

Create this form in 5 minutes!

How to create an eSignature for the form nd 2 amp schedule 2 optional individual income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form ND 2 & Schedule 2 Optional Individual Income Tax Return?

The Form ND 2 & Schedule 2 Optional Individual Income Tax Return is a tax form used by residents of North Dakota to report their income and calculate their tax liability. This form allows individuals to take advantage of optional deductions and credits, making it essential for accurate tax filing.

-

How can airSlate SignNow help with the Form ND 2 & Schedule 2 Optional Individual Income Tax Return?

airSlate SignNow provides a seamless platform for electronically signing and sending the Form ND 2 & Schedule 2 Optional Individual Income Tax Return. Our solution simplifies the process, ensuring that your tax documents are securely signed and submitted on time.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, including options for individuals and teams. Our cost-effective solution ensures that you can efficiently manage your Form ND 2 & Schedule 2 Optional Individual Income Tax Return without breaking the bank.

-

Are there any features specifically designed for tax document management?

Yes, airSlate SignNow includes features tailored for tax document management, such as customizable templates, secure storage, and automated reminders. These features make it easier to handle the Form ND 2 & Schedule 2 Optional Individual Income Tax Return and other important tax documents.

-

Can I integrate airSlate SignNow with my accounting software?

Absolutely! airSlate SignNow offers integrations with popular accounting software, allowing you to streamline your workflow. This means you can easily manage the Form ND 2 & Schedule 2 Optional Individual Income Tax Return alongside your financial records.

-

What are the benefits of using airSlate SignNow for tax filing?

Using airSlate SignNow for tax filing provides numerous benefits, including enhanced security, ease of use, and time savings. By utilizing our platform for the Form ND 2 & Schedule 2 Optional Individual Income Tax Return, you can ensure that your documents are handled efficiently and securely.

-

Is airSlate SignNow compliant with tax regulations?

Yes, airSlate SignNow is designed to comply with relevant tax regulations, ensuring that your Form ND 2 & Schedule 2 Optional Individual Income Tax Return is processed in accordance with legal standards. Our commitment to compliance helps you avoid potential issues during tax season.

Get more for Form ND 2 & Schedule 2 Optional Individual Income Tax Return

- Imaging services northwestern medicine form

- Immunization record card 2016 2019 form

- Patient authorization to disclose protected health centura health centura form

- Humana military form 2012 2019

- Markel insurance certificate of insurance forms 2015 2019

- Siho form

- Mru00695 phi release authorization06 06 16 form

- Dear beneficiary mgm benefits group form

Find out other Form ND 2 & Schedule 2 Optional Individual Income Tax Return

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe