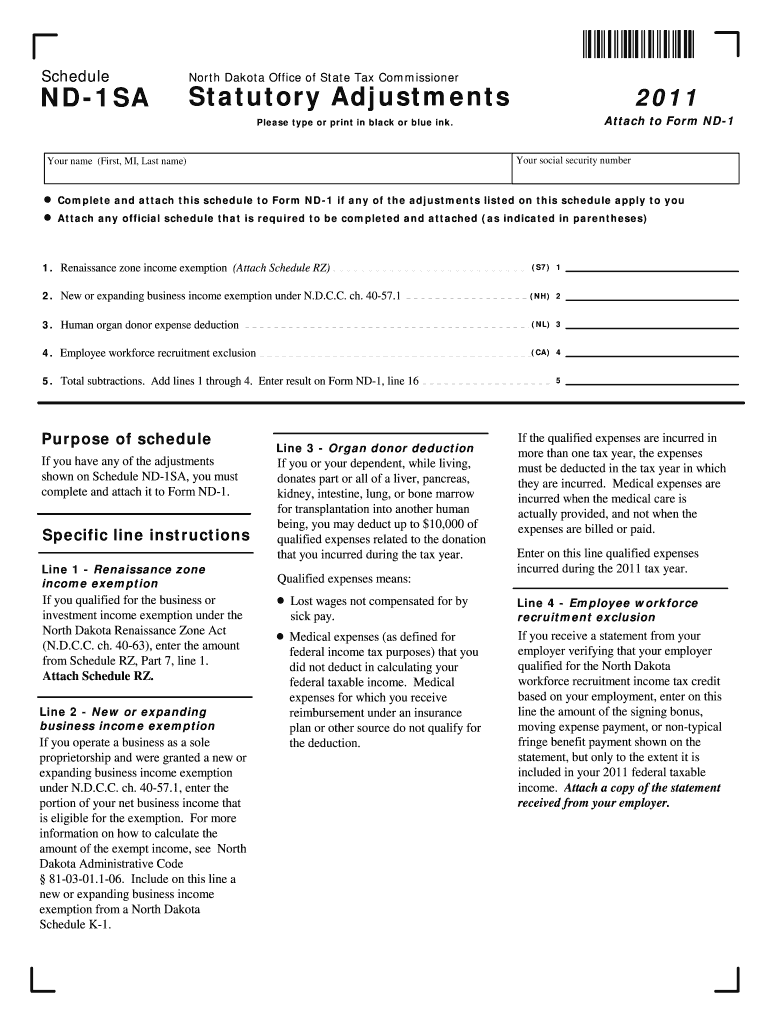

Schedule ND 1SA North Dakota Office of State Tax Commissioner Statutory Adjustments Attach to Form ND 1 Please Type or Print in

What is the Schedule ND 1SA?

The Schedule ND 1SA is a form used by taxpayers in North Dakota to report statutory adjustments. This form is attached to the ND 1, which is the primary individual income tax return for residents of North Dakota. The adjustments reported on the Schedule ND 1SA can affect the taxpayer's overall income tax calculation, ensuring that all relevant deductions and credits are accurately reflected. It is essential for individuals to complete this form correctly to comply with state tax regulations.

How to use the Schedule ND 1SA

To use the Schedule ND 1SA, taxpayers must first obtain the form, which can typically be found on the North Dakota Office of State Tax Commissioner's website. After acquiring the form, individuals should carefully read the instructions provided to understand what information is required. Taxpayers will need to fill out the form by reporting any necessary adjustments to their income, such as specific deductions or credits applicable under North Dakota tax law. Once completed, this form must be attached to the ND 1 when filing the state income tax return.

Steps to complete the Schedule ND 1SA

Completing the Schedule ND 1SA involves several key steps:

- Gather all relevant financial documents, including W-2s, 1099s, and any other income statements.

- Review the instructions for the Schedule ND 1SA to understand the required adjustments.

- Fill out the form by entering the necessary information in the designated fields, ensuring accuracy.

- Double-check all entries for completeness and correctness.

- Attach the completed Schedule ND 1SA to your ND 1 form before submission.

Key elements of the Schedule ND 1SA

The Schedule ND 1SA includes several key elements that taxpayers must be aware of:

- Taxpayer Information: This section requires personal details such as name, address, and Social Security number.

- Adjustment Entries: Taxpayers must report specific adjustments to their income, which may include items like pension income or student loan interest.

- Signature: The form must be signed and dated by the taxpayer, certifying that the information provided is accurate.

State-specific rules for the Schedule ND 1SA

North Dakota has specific rules governing the use of the Schedule ND 1SA. Taxpayers must comply with state tax laws, which may differ from federal regulations. For example, certain deductions available at the federal level may not apply in North Dakota, and vice versa. It is important for taxpayers to familiarize themselves with these state-specific rules to ensure compliance and to maximize potential tax benefits.

Filing Deadlines / Important Dates

Taxpayers must be aware of important deadlines when filing the Schedule ND 1SA. Typically, the deadline for submitting state income tax returns, including the ND 1 and any attached schedules, is April fifteenth of each year. If taxpayers need additional time, they may file for an extension, but it is crucial to understand that any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Quick guide on how to complete schedule nd 1sa north dakota office of state tax commissioner statutory adjustments attach to form nd 1 please type or print in

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained signNow traction among companies and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed forms, allowing you to access the correct template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

The Easiest Way to Modify and Electronically Sign [SKS] with Ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or conceal sensitive information using the tools specifically provided by airSlate SignNow for this purpose.

- Create your signature with the Sign feature, which only takes a few seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your amendments.

- Select your preferred method for sharing your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, cumbersome form searches, or errors that require new copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Modify and electronically sign [SKS] and ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule nd 1sa north dakota office of state tax commissioner statutory adjustments attach to form nd 1 please type or print in

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule ND 1SA North Dakota Office Of State Tax Commissioner Statutory Adjustments?

The Schedule ND 1SA North Dakota Office Of State Tax Commissioner Statutory Adjustments is a form used to report specific adjustments to your North Dakota tax return. It is essential for ensuring accurate tax calculations and compliance with state regulations. Completing this form correctly can help you avoid penalties and ensure you receive any eligible refunds.

-

How do I complete the Schedule ND 1SA North Dakota Office Of State Tax Commissioner Statutory Adjustments?

To complete the Schedule ND 1SA North Dakota Office Of State Tax Commissioner Statutory Adjustments, you need to gather your financial documents and follow the instructions provided on the form. Make sure to type or print in black or blue ink for clarity. If you have questions, consider consulting a tax professional for assistance.

-

What are the benefits of using airSlate SignNow for submitting the Schedule ND 1SA?

Using airSlate SignNow to submit the Schedule ND 1SA North Dakota Office Of State Tax Commissioner Statutory Adjustments streamlines the process of eSigning and sending documents. Our platform is user-friendly and cost-effective, ensuring that you can complete your tax forms efficiently. Additionally, it provides secure storage and easy access to your documents.

-

Is there a cost associated with using airSlate SignNow for tax forms?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our plans are designed to be cost-effective while providing robust features for document management and eSigning. You can choose a plan that fits your budget and requirements for handling the Schedule ND 1SA North Dakota Office Of State Tax Commissioner Statutory Adjustments.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers integrations with various tax preparation software and business applications. This allows you to seamlessly manage your documents and eSign the Schedule ND 1SA North Dakota Office Of State Tax Commissioner Statutory Adjustments without switching between platforms, enhancing your workflow efficiency.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features for document management, including eSigning, templates, and secure cloud storage. These features make it easy to prepare and submit the Schedule ND 1SA North Dakota Office Of State Tax Commissioner Statutory Adjustments. You can track document status and ensure that all necessary signatures are obtained promptly.

-

How secure is my information when using airSlate SignNow?

Your information is highly secure when using airSlate SignNow. We implement advanced encryption and security protocols to protect your data during transmission and storage. This ensures that your Schedule ND 1SA North Dakota Office Of State Tax Commissioner Statutory Adjustments and other sensitive documents remain confidential and secure.

Get more for Schedule ND 1SA North Dakota Office Of State Tax Commissioner Statutory Adjustments Attach To Form ND 1 Please Type Or Print In

Find out other Schedule ND 1SA North Dakota Office Of State Tax Commissioner Statutory Adjustments Attach To Form ND 1 Please Type Or Print In

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors