Schedule 3 Fill in State of North Dakota Form

What is the Schedule 3 Fill in State Of North Dakota

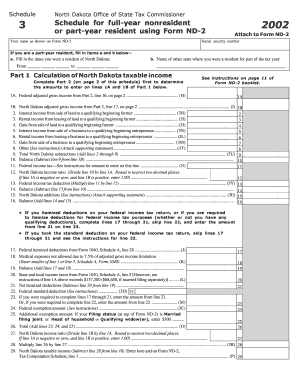

The Schedule 3 form in North Dakota is a tax document used to report specific types of income that may not be included on the standard tax return. This form is particularly important for individuals who have income from sources such as partnerships, S corporations, estates, or trusts. The information provided on Schedule 3 helps the state tax authorities assess the taxpayer's overall income and tax liability accurately.

How to use the Schedule 3 Fill in State Of North Dakota

To use the Schedule 3 form effectively, taxpayers should first gather all relevant financial documents, including income statements from partnerships or S corporations. Once collected, the taxpayer should fill out the form by entering the required information in the designated fields. It is essential to ensure that all figures are accurate and that the form is signed before submission to avoid processing delays.

Steps to complete the Schedule 3 Fill in State Of North Dakota

Completing the Schedule 3 form involves several key steps:

- Gather all necessary documentation related to your income sources.

- Carefully fill out each section of the form, ensuring all information is complete and accurate.

- Double-check your calculations to confirm that all amounts are correct.

- Sign the form to validate your submission.

- Submit the completed Schedule 3 along with your main tax return by the designated deadline.

Filing Deadlines / Important Dates

Taxpayers in North Dakota should be aware of the filing deadlines for the Schedule 3 form. Typically, the deadline coincides with the state income tax return deadline, which is usually April 15. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. It is crucial to check for any updates or changes in deadlines each tax year.

Key elements of the Schedule 3 Fill in State Of North Dakota

The Schedule 3 form includes several key elements that taxpayers must complete:

- Identification information, including the taxpayer's name and Social Security number.

- Details of income received from partnerships, S corporations, or other entities.

- Any applicable deductions or credits related to the reported income.

- Signature and date to certify the accuracy of the information provided.

Legal use of the Schedule 3 Fill in State Of North Dakota

The Schedule 3 form is legally required for taxpayers who receive income from specific sources that are not reported on the standard tax return. Failing to file this form when required can result in penalties and interest on unpaid taxes. It is essential for taxpayers to understand their obligations under North Dakota tax law to ensure compliance.

Quick guide on how to complete schedule 3 fill in state of north dakota

Complete [SKS] effortlessly on any device

Web-based document management has seen a rise in popularity among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the resources required to create, alter, and eSign your documents quickly without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Use the available tools to complete your document.

- Emphasize relevant parts of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule 3 Fill in State Of North Dakota

Create this form in 5 minutes!

How to create an eSignature for the schedule 3 fill in state of north dakota

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule 3 Fill in State Of North Dakota?

The Schedule 3 Fill in State Of North Dakota is a specific form used for reporting certain types of income and deductions. It is essential for individuals and businesses to accurately complete this form to ensure compliance with state tax regulations. airSlate SignNow provides an efficient way to fill out and eSign this document, streamlining the process.

-

How can airSlate SignNow help with the Schedule 3 Fill in State Of North Dakota?

airSlate SignNow simplifies the process of completing the Schedule 3 Fill in State Of North Dakota by offering an intuitive interface for filling out forms. Users can easily input their information, save their progress, and eSign the document securely. This ensures that your submissions are accurate and timely.

-

Is there a cost associated with using airSlate SignNow for the Schedule 3 Fill in State Of North Dakota?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs. The cost is competitive and provides access to features that make completing the Schedule 3 Fill in State Of North Dakota easier. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for the Schedule 3 Fill in State Of North Dakota?

airSlate SignNow includes features such as customizable templates, secure eSigning, and cloud storage for your documents. These features enhance the user experience when filling out the Schedule 3 Fill in State Of North Dakota, making it more efficient and organized. Additionally, you can track the status of your documents in real-time.

-

Can I integrate airSlate SignNow with other software for the Schedule 3 Fill in State Of North Dakota?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow. This means you can easily import data from other platforms when filling out the Schedule 3 Fill in State Of North Dakota, saving you time and reducing errors.

-

What are the benefits of using airSlate SignNow for the Schedule 3 Fill in State Of North Dakota?

Using airSlate SignNow for the Schedule 3 Fill in State Of North Dakota provides numerous benefits, including increased efficiency, enhanced security, and ease of use. The platform allows you to complete and eSign documents from anywhere, ensuring that you can manage your tax forms on the go. This flexibility can signNowly reduce stress during tax season.

-

Is airSlate SignNow secure for handling the Schedule 3 Fill in State Of North Dakota?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your data is protected while filling out the Schedule 3 Fill in State Of North Dakota. The platform uses encryption and secure servers to safeguard your information. You can trust that your sensitive documents are handled with the utmost care.

Get more for Schedule 3 Fill in State Of North Dakota

Find out other Schedule 3 Fill in State Of North Dakota

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe