Streamlined Sales Tax Compliance Checklist Amended 525 Form

What is the Streamlined Sales Tax Compliance Checklist Amended 525

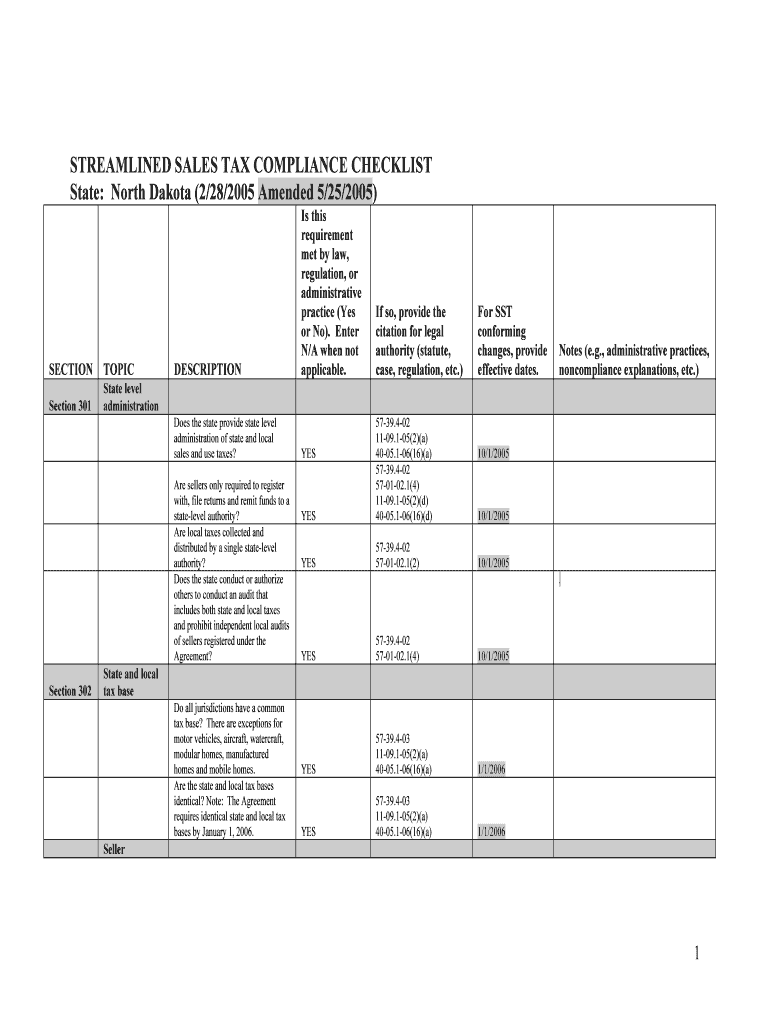

The Streamlined Sales Tax Compliance Checklist Amended 525 is a crucial document designed to assist businesses in adhering to sales tax regulations across multiple states. This checklist simplifies the compliance process by providing a structured approach to ensure that all necessary steps are followed. It is particularly beneficial for businesses operating in states that participate in the Streamlined Sales Tax Agreement, aiming to reduce the burden of sales tax compliance.

How to use the Streamlined Sales Tax Compliance Checklist Amended 525

To effectively use the Streamlined Sales Tax Compliance Checklist Amended 525, businesses should first familiarize themselves with the specific requirements outlined in the checklist. Each item on the checklist corresponds to a necessary compliance action or documentation needed. It is advisable to review the checklist thoroughly before initiating any sales tax processes to ensure that all aspects are covered, thereby minimizing the risk of errors or omissions.

Steps to complete the Streamlined Sales Tax Compliance Checklist Amended 525

Completing the Streamlined Sales Tax Compliance Checklist Amended 525 involves several key steps:

- Gather all relevant sales tax documents, including previous filings and receipts.

- Review the checklist items to ensure all compliance actions are addressed.

- Complete any necessary forms or documentation as indicated on the checklist.

- Submit the completed checklist along with any required documents to the appropriate state tax authority.

Key elements of the Streamlined Sales Tax Compliance Checklist Amended 525

The key elements of the Streamlined Sales Tax Compliance Checklist Amended 525 include:

- Identification of the business and its tax obligations.

- Documentation of sales tax collected and remitted.

- Verification of compliance with state-specific sales tax laws.

- Submission deadlines and filing requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Streamlined Sales Tax Compliance Checklist Amended 525 can vary by state. It is essential for businesses to be aware of these dates to avoid penalties. Typically, deadlines will align with quarterly or annual sales tax filing periods. Keeping a calendar of important dates can help ensure timely compliance.

Penalties for Non-Compliance

Failure to comply with the requirements outlined in the Streamlined Sales Tax Compliance Checklist Amended 525 can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. Businesses should prioritize compliance to avoid these consequences and maintain good standing with tax authorities.

Quick guide on how to complete streamlined sales tax compliance checklist amended 525

Complete [SKS] effortlessly on any device

Online document management has become popular with companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can find the appropriate form and securely save it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your paperwork swiftly without delays. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and simplify any document-based task today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight essential sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal authority as a traditional handwritten signature.

- Review all the information and click the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, text message (SMS), or invite link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your needs in document administration in just a few clicks from any device of your choice. Modify and eSign [SKS] and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Streamlined Sales Tax Compliance Checklist Amended 525

Create this form in 5 minutes!

How to create an eSignature for the streamlined sales tax compliance checklist amended 525

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Streamlined Sales Tax Compliance Checklist Amended 525?

The Streamlined Sales Tax Compliance Checklist Amended 525 is a comprehensive guide designed to help businesses navigate the complexities of sales tax compliance. It outlines the necessary steps and documentation required to ensure compliance with streamlined sales tax regulations. By following this checklist, businesses can minimize the risk of errors and penalties.

-

How can the Streamlined Sales Tax Compliance Checklist Amended 525 benefit my business?

Utilizing the Streamlined Sales Tax Compliance Checklist Amended 525 can signNowly reduce the time and effort spent on sales tax compliance. It provides a clear framework for understanding your obligations, which can lead to improved accuracy in tax filings. This ultimately helps in avoiding costly mistakes and enhances your business's financial health.

-

Is the Streamlined Sales Tax Compliance Checklist Amended 525 suitable for all business sizes?

Yes, the Streamlined Sales Tax Compliance Checklist Amended 525 is designed to be applicable for businesses of all sizes. Whether you are a small startup or a large corporation, this checklist can be tailored to meet your specific compliance needs. Its versatility makes it an essential tool for any business looking to streamline their sales tax processes.

-

What features are included in the Streamlined Sales Tax Compliance Checklist Amended 525?

The Streamlined Sales Tax Compliance Checklist Amended 525 includes detailed steps for compliance, documentation requirements, and best practices for sales tax management. It also offers tips for maintaining accurate records and staying updated with changing regulations. These features ensure that businesses are well-equipped to handle their sales tax obligations effectively.

-

How much does the Streamlined Sales Tax Compliance Checklist Amended 525 cost?

The pricing for the Streamlined Sales Tax Compliance Checklist Amended 525 varies based on the specific needs of your business. We offer competitive pricing options that cater to different budgets, ensuring that you receive value for your investment. For a detailed quote, please contact our sales team.

-

Can the Streamlined Sales Tax Compliance Checklist Amended 525 integrate with other software?

Yes, the Streamlined Sales Tax Compliance Checklist Amended 525 can be integrated with various accounting and tax software solutions. This integration allows for seamless data transfer and enhances the efficiency of your sales tax compliance processes. By using compatible software, you can automate many aspects of compliance, saving time and reducing errors.

-

How often should I update my Streamlined Sales Tax Compliance Checklist Amended 525?

It is recommended to review and update your Streamlined Sales Tax Compliance Checklist Amended 525 regularly, especially when there are changes in tax laws or your business operations. Keeping the checklist current ensures that you remain compliant with the latest regulations. Regular updates help in maintaining accuracy and avoiding potential compliance issues.

Get more for Streamlined Sales Tax Compliance Checklist Amended 525

- Building perm application form revised january 10 2017 2016

- D 1 sun life global investments form

- Tenant billing information water 2012 2018

- Hamilton commercial corridor housing loan and grant program application hamilton commercial corridor housing loan and grant form

- Commercial corridor housing loan and grant program application form commercial corridor housing loan and grant program

- Application for tax shelter identification number and undertaking to keep books and records cra arc gc form

- Mbt rl1 2014 2019 form

- 2000 t3ret fillable form 2018

Find out other Streamlined Sales Tax Compliance Checklist Amended 525

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online