T3 Form 2018

What is the T3 Form

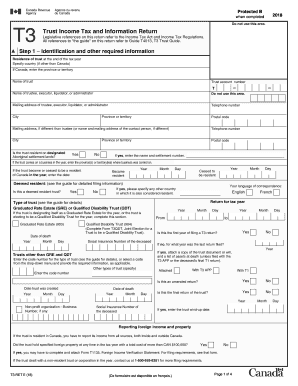

The T3 Form, also known as the T3 Trust Income Tax and Information Return, is a tax document used in Canada to report income earned by trusts. This form is essential for ensuring that trusts comply with tax regulations set by the Canada Revenue Agency (CRA). The T3 Form provides a detailed account of income, deductions, and distributions made to beneficiaries during the tax year. It is crucial for trustees to accurately complete this form to avoid penalties and ensure proper tax reporting.

Steps to Complete the T3 Form

Completing the T3 Form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents related to the trust's income, including bank statements, investment income, and any other relevant financial records. Next, fill out the form with accurate information regarding the trust's income, expenses, and distributions to beneficiaries. It is important to double-check all entries for accuracy, as errors can lead to delays or penalties. Finally, review the completed form with a tax professional, if needed, before submitting it to the CRA.

Key Elements of the T3 Form

The T3 Form includes several critical sections that must be completed. These sections typically cover:

- Trust Identification: Basic information about the trust, including its name, address, and trust number.

- Income Reporting: Detailed reporting of various types of income earned by the trust, such as dividends, interest, and capital gains.

- Deductions: Any allowable deductions related to the trust's income, which can help reduce the taxable amount.

- Distributions: Information about distributions made to beneficiaries, which must be reported to ensure proper tax treatment.

Legal Use of the T3 Form

The T3 Form serves a legal purpose in the context of Canadian tax law. It is required for trusts to report their income and fulfill their tax obligations. Failure to file the T3 Form accurately and on time can result in penalties and interest charges imposed by the CRA. Additionally, trustees are legally responsible for ensuring that the information reported is complete and accurate, as incorrect filings can lead to legal ramifications for both the trustee and the trust itself.

Who Issues the Form

The T3 Form is issued by the Canada Revenue Agency (CRA), which is the federal agency responsible for administering tax laws in Canada. The CRA provides guidelines and instructions for completing the form, ensuring that trustees understand their obligations and the information required. It is essential for trustees to refer to the CRA's official resources when preparing the T3 Form to ensure compliance with current tax regulations.

Examples of Using the T3 Form

Trustees may encounter various scenarios where the T3 Form is applicable. For instance, if a family trust earns rental income from a property, the trustee must report this income on the T3 Form. Similarly, if a trust distributes dividends to its beneficiaries, these distributions must also be documented on the form. Each of these examples highlights the importance of accurate reporting to maintain compliance with tax laws and ensure that beneficiaries receive their correct tax information.

Quick guide on how to complete 2000 t3ret fillable form 2018

A brief guide on how to create your T3 Form

Finding the appropriate template can be difficult when you need to submit official international documents. Even if you possess the form you require, it may be tedious to swiftly fill it out according to all the specifications if you are using printed copies instead of managing everything digitally. airSlate SignNow is the web-based electronic signature platform that assists you in navigating these challenges. It enables you to obtain your T3 Form and swiftly fill it out and sign it on-site without the need to reprint documents if you make an error.

Here are the steps you need to follow to create your T3 Form with airSlate SignNow:

- Click the Get Form button to immediately upload your document to our editor.

- Begin with the first vacant field, input your information, and continue with the Next tool.

- Complete the empty fields using the Cross and Check tools from the top panel.

- Choose the Highlight or Line options to emphasize the most important details.

- Click on Image and upload one if your T3 Form necessitates it.

- Use the right-side panel to add more fields for you or others to complete if required.

- Review your responses and validate the form by clicking Date, Initials, and Sign.

- Sketch, type, upload your eSignature, or capture it using a camera or QR code.

- Complete the editing process by clicking the Done button and selecting your file-sharing preferences.

Once your T3 Form is ready, you can distribute it as you wish - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely store all your completed documents in your account, organized in folders according to your preferences. Don’t spend time on manual document preparation; try airSlate SignNow!

Create this form in 5 minutes or less

Find and fill out the correct 2000 t3ret fillable form 2018

FAQs

-

I'm trying to fill out a free fillable tax form. It won't let me click "done with this form" or "efile" which?

From https://www.irs.gov/pub/irs-utl/... (emphasis mine):DONE WITH THIS FORM — Select this button to save and close the form you are currently viewing and return to your 1040 form. This button is disabled when you are in your 1040 formSo, it appears, and without them mentioning it while you're working on it, that button is for all forms except 1040. Thank you to the other response to this question. I would never have thought of just clicking the Step 2 tab.

-

How do I make a PDF a fillable form?

1. Open it with Foxit PhantomPDF and choose Form > Form Recognition > Run Form Field Recognition . All fillable fields in the document will be recognized and highlighted.2. Add form fields from Form > Form Fields > click a type of form field button and the cursor changes to crosshair . And the Designer Assistant is selected automatically.3. All the corresponding type of form fields will be automatically named with the text near the form fields (Take the text fields for an example as below).4. Click the place you want to add the form field. To edit the form field further, please refer to the properties of different buttons from “Buttons”.

-

Is there a service that will allow me to create a fillable form on a webpage, and then email a PDF copy of each form filled out?

You can use Fill which is has a free forever plan.You can use Fill to turn your PDF document into an online document which can be completed, signed and saved as a PDF, online.You will end up with a online fillable PDF like this:w9 || FillWhich can be embedded in your website should you wish.InstructionsStep 1: Open an account at Fill and clickStep 2: Check that all the form fields are mapped correctly, if not drag on the text fields.Step 3: Save it as a templateStep 4: Goto your templates and find the correct form. Then click on the embed settings to grab your form URL.

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

-

How do I fill out the CAT 2018 application form?

The procedure for filling up the CAT Application form is very simple. I’ll try to explain it to you in simple words.I have provided a link below for CAT registration.See, first you have to register, then fill in details in the application form, upload images, pay the registration fee and finally submit the form.Now, to register online, you have to enter details such as your name, date of birth, email id, mobile number and choose your country. You must and must enter your own personal email id and mobile number, as you will receive latest updates on CAT exam through email and SMS only.Submit the registration details, after which an OTP will be sent to the registered email id and mobile number.Once the registration part is over, you will get the Login credentials.Next, you need to fill in your personal details, academic details, work experience details, etc.Upload scanned images of your photograph, and signature as per the specifications.Pay the registration fee, which is Rs. 950 for SC/ST/PWD category candidates and Rs. 1900 for all other categories by online mode (Credit Card/ Debit Card/ Net Banking).Final step - Submit the form and do not forget to take the print out of the application form. if not print out then atleast save it somewhere.CAT 2018 Registration (Started): Date, Fees, CAT 2018 Online Application iimcat.ac.in

-

How do I fill out a fillable PDF on an iPad?

there is an app for that !signNow Fill & Sign on the App Store

-

How do I transfer data from Google Sheets cells to a PDF fillable form?

I refer you a amazing pdf editor, her name is Puspita, She work in fiverr, She is just amazing, Several time I am use her services. You can contact with her.puspitasaha : I will create fillable pdf form or edit pdf file for $5 on www.fiverr.com

Create this form in 5 minutes!

How to create an eSignature for the 2000 t3ret fillable form 2018

How to generate an electronic signature for your 2000 T3ret Fillable Form 2018 in the online mode

How to make an electronic signature for your 2000 T3ret Fillable Form 2018 in Google Chrome

How to generate an eSignature for putting it on the 2000 T3ret Fillable Form 2018 in Gmail

How to generate an electronic signature for the 2000 T3ret Fillable Form 2018 right from your smart phone

How to make an eSignature for the 2000 T3ret Fillable Form 2018 on iOS

How to create an eSignature for the 2000 T3ret Fillable Form 2018 on Android devices

People also ask

-

What is the T3 Form and how is it used?

The T3 Form is a tax document used to report income earned by a trust. With airSlate SignNow, you can effortlessly eSign and send T3 Forms securely, ensuring compliance and accuracy in your financial reporting.

-

How can airSlate SignNow help with T3 Form management?

airSlate SignNow streamlines the management of T3 Forms by allowing users to create, send, and eSign documents electronically. This reduces paperwork and speeds up the process of submitting important tax documents.

-

Is there a cost associated with using airSlate SignNow for T3 Forms?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. You can choose a plan that fits your budget while gaining access to features specifically designed for managing T3 Forms and other documents.

-

Can I integrate airSlate SignNow with other software for T3 Form processing?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, enhancing your workflow for T3 Form processing. This integration allows for automatic data entry and document management, saving you time and reducing errors.

-

What features does airSlate SignNow offer for T3 Form signing?

airSlate SignNow provides features like customizable templates, in-person signing, and advanced security options for T3 Forms. These features ensure that your documents are not only easy to sign but also protected against unauthorized access.

-

How secure is the eSigning process for T3 Forms with airSlate SignNow?

The eSigning process for T3 Forms with airSlate SignNow is highly secure, utilizing encryption and authentication protocols. This guarantees that your sensitive information remains confidential and meets legal standards for electronic signatures.

-

Can I track the status of my T3 Form once sent via airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your sent T3 Forms in real-time. You will receive notifications when the document is viewed and signed, ensuring you stay informed throughout the signing process.

Get more for T3 Form

- Nova extreme ice video worksheet answers form

- What forms of dba look like

- You must complete this form if you are required to deposit on a semiweekly schedule or if your tax irs

- Survey questionnaire about community form

- Aerial lift pre use inspection checklist form

- Student immunization record charleston southern university form

- Kindergarten emergent literacy surveydoc form

- Johnson and wales application form

Find out other T3 Form

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online