Routing Form Template 2013

What is the Routing Form Template

The routing form template is a standardized document used primarily in business and financial transactions to facilitate the accurate and efficient processing of information. This template serves as a guide for individuals and organizations to ensure that all necessary details are included when submitting forms, particularly in contexts such as banking, tax submissions, or other formal applications. It typically includes sections for essential information such as sender and recipient details, transaction specifics, and any required signatures.

How to Use the Routing Form Template

To effectively use the routing form template, start by gathering all relevant information required for completion. This may include personal or business identification details, transaction amounts, and any specific instructions related to the form's purpose. Carefully fill out each section of the template, ensuring accuracy and clarity. Once completed, review the document for any errors or omissions before submission. Depending on the context, you may need to sign the form digitally or in person to validate it.

Steps to Complete the Routing Form Template

Completing the routing form template involves several key steps:

- Gather Information: Collect all necessary data, including names, addresses, and transaction details.

- Fill Out the Template: Carefully input the information into the designated fields of the template.

- Review for Accuracy: Double-check all entries to ensure there are no mistakes or missing information.

- Sign the Document: If required, provide your signature to authenticate the form.

- Submit the Form: Follow the appropriate submission method, whether online, by mail, or in person.

Legal Use of the Routing Form Template

The routing form template is legally recognized when filled out correctly and submitted according to applicable regulations. It is important to ensure that all information provided is accurate and truthful, as any discrepancies can lead to legal issues or penalties. Familiarity with relevant laws and guidelines is crucial, especially in contexts such as tax submissions or financial transactions, where compliance is mandatory.

Key Elements of the Routing Form Template

Essential components of the routing form template typically include:

- Sender Information: Name, address, and contact details of the person or entity submitting the form.

- Recipient Information: Name and address of the individual or organization receiving the document.

- Transaction Details: Specifics regarding the nature of the transaction or purpose of the form.

- Signature Line: A designated area for the signature of the sender or authorized representative.

- Date: The date on which the form is completed and submitted.

Examples of Using the Routing Form Template

There are various scenarios in which the routing form template can be utilized effectively. For instance, businesses may use it to streamline the process of submitting tax documents, such as the W-9 form, to the IRS. Additionally, it can be employed in financial institutions for processing loan applications or account changes. Each use case emphasizes the importance of clear communication and proper documentation in formal transactions.

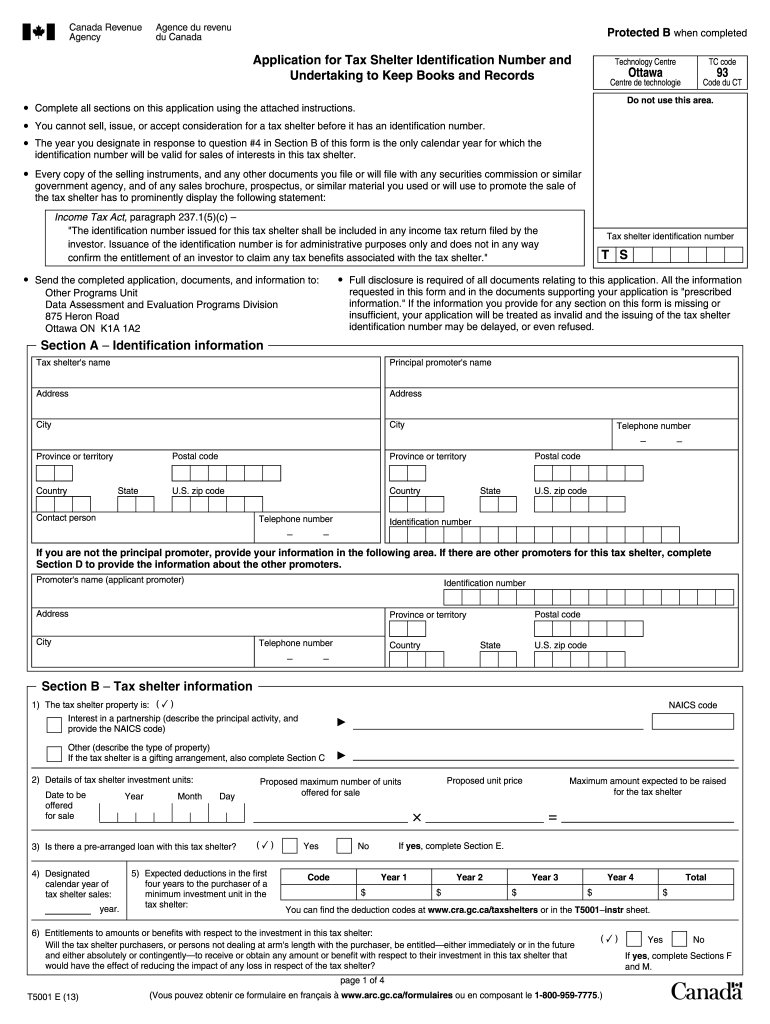

Quick guide on how to complete application for tax shelter identification number and undertaking to keep books and records cra arc gc

A concise guide on how to prepare your Routing Form Template

Locating the right template can be a challenge when you need to submit formal international documentation. Even if you possess the necessary form, it might be difficult to quickly complete it according to all the specifications if you are using printed copies instead of handling everything digitally. airSlate SignNow is the web-based electronic signature solution that assists you in overcoming these hurdles. It enables you to select your Routing Form Template and swiftly fill it out and sign it on-site without the need to reprint documents if you make a typographical error.

Here are the steps you should follow to prepare your Routing Form Template with airSlate SignNow:

- Click the Obtain Form button to instantly load your document into our editor.

- Begin with the first empty field, enter the required information, and move on with the Next tool.

- Fill in the empty fields using the Cross and Check tools from the menu above.

- Choose the Highlight or Line options to mark the most crucial details.

- Click on Image and upload one if your Routing Form Template necessitates it.

- Make use of the right-side pane to add additional fields for you or others to complete if needed.

- Review your responses and finalize the form by clicking Date, Initials, and Sign.

- Draw, type, upload your eSignature, or capture it using a camera or QR code.

- Complete your modifications to the form by clicking the Finish button and selecting your file-sharing preferences.

Once your Routing Form Template is prepared, you can share it in your preferred manner - send it to your recipients via email, SMS, fax, or print it directly from the editor. You can also securely store all your completed documents in your account, organized in folders based on your preferences. Don’t spend time on manual document completion; try airSlate SignNow!

Create this form in 5 minutes or less

Find and fill out the correct application for tax shelter identification number and undertaking to keep books and records cra arc gc

FAQs

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

Create this form in 5 minutes!

How to create an eSignature for the application for tax shelter identification number and undertaking to keep books and records cra arc gc

How to make an eSignature for the Application For Tax Shelter Identification Number And Undertaking To Keep Books And Records Cra Arc Gc online

How to create an electronic signature for your Application For Tax Shelter Identification Number And Undertaking To Keep Books And Records Cra Arc Gc in Google Chrome

How to make an eSignature for signing the Application For Tax Shelter Identification Number And Undertaking To Keep Books And Records Cra Arc Gc in Gmail

How to create an eSignature for the Application For Tax Shelter Identification Number And Undertaking To Keep Books And Records Cra Arc Gc from your smart phone

How to generate an eSignature for the Application For Tax Shelter Identification Number And Undertaking To Keep Books And Records Cra Arc Gc on iOS devices

How to create an electronic signature for the Application For Tax Shelter Identification Number And Undertaking To Keep Books And Records Cra Arc Gc on Android

People also ask

-

What is a routing form template?

A routing form template is a pre-designed document that allows businesses to streamline their signing process by defining the order in which signers receive and sign a document. With airSlate SignNow, you can create customized routing form templates that fit your specific workflow needs.

-

How can I create a routing form template using airSlate SignNow?

Creating a routing form template in airSlate SignNow is simple. You can start by selecting an existing document or creating a new one. From there, you can customize the routing order, add fields for signers, and save your template for future use, ensuring a smoother signing workflow.

-

Are there any costs associated with using a routing form template?

While airSlate SignNow offers various pricing plans, using a routing form template is typically included in all subscription tiers. Each plan contains features that cater to different business needs, so you can choose one that aligns with your budget while enjoying the benefits of efficient document management.

-

What are the benefits of using a routing form template?

The primary benefits of using a routing form template include increased efficiency and enhanced user experience. By specifying the sequence of signers, airSlate SignNow helps to eliminate delays, reduce errors, and ensure that documents are signed in the correct order, ultimately speeding up your business processes.

-

Can I customize my routing form template?

Absolutely! airSlate SignNow allows users to fully customize their routing form templates. You can add fields, set signing conditions, and adjust the routing order to best suit the needs of your business, ensuring that the template aligns with your unique workflows.

-

Does airSlate SignNow integrate with other applications for routing form templates?

Yes, airSlate SignNow offers seamless integrations with a variety of applications, which enhances the functionality of your routing form template. This integration allows for automated workflows, enabling you to connect with CRM systems, cloud storage services, and more to streamline your document processes.

-

What types of documents can I use with a routing form template?

You can use a routing form template for various types of documents including contracts, agreements, and forms. airSlate SignNow supports multiple file formats, allowing you to easily transform any document into an efficient routing form template for electronic signing.

Get more for Routing Form Template

- Illness form

- Attorney in fact 100062153 form

- Form pc 212a connecticut probate courts

- Saq c v3 1 pci security standards council pcissc form

- Aashto t245 pdf form

- Spartanburg county request for absentee ballot application spartanburgcounty form

- Exceptions statement form

- Helen giddings great start grant form

Find out other Routing Form Template

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter