60 ES Nd Form

What is the 60 ES Nd

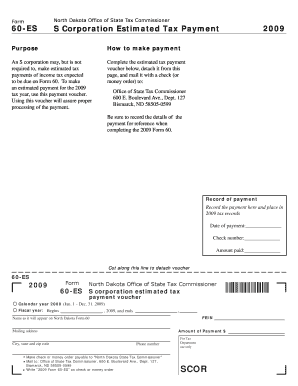

The 60 ES Nd is a specific form used in various administrative and legal contexts within the United States. It is primarily utilized for reporting certain financial or tax-related information. Understanding the purpose and function of this form is essential for individuals and businesses to ensure compliance with relevant regulations.

How to use the 60 ES Nd

Using the 60 ES Nd involves several key steps. First, gather all necessary information and documentation required to complete the form accurately. This may include personal identification details, financial records, and any specific data relevant to the purpose of the form. Next, fill out the form carefully, ensuring that all fields are completed as required. Finally, submit the form through the appropriate channels, whether online, by mail, or in person, based on the guidelines provided for the specific use of the form.

Steps to complete the 60 ES Nd

Completing the 60 ES Nd involves a systematic approach:

- Review the instructions provided with the form to understand the requirements.

- Collect all necessary documents and information before starting to fill out the form.

- Fill in the form accurately, ensuring all required fields are completed.

- Double-check the information for accuracy and completeness.

- Submit the form as directed, ensuring it reaches the appropriate authority by the deadline.

Legal use of the 60 ES Nd

The legal use of the 60 ES Nd is governed by specific regulations that outline its purpose and the obligations of those who must file it. Compliance with these regulations is crucial to avoid potential penalties. The form serves as an official record and may be required for various legal and financial transactions, making its accurate completion and timely submission essential for legal compliance.

Required Documents

When preparing to complete the 60 ES Nd, certain documents are typically required. These may include:

- Personal identification, such as a driver's license or Social Security number.

- Financial statements or records relevant to the information being reported.

- Any previous forms or documentation that may support the current submission.

Having these documents ready can streamline the process and help ensure accuracy when filling out the form.

Filing Deadlines / Important Dates

Filing deadlines for the 60 ES Nd can vary based on the specific context in which it is used. It is important to be aware of these dates to ensure timely submission. Missing a deadline can result in penalties or delays in processing. Typically, these deadlines are outlined in the instructions accompanying the form or through official announcements from the relevant authorities.

Quick guide on how to complete 60 es nd

Handle [SKS] seamlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can easily locate the correct form and securely keep it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly without any holdups. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and enhance any document-related task today.

The simplest way to alter and eSign [SKS] effortlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to finalize your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or mislaid files, laborious form searching, or mistakes that necessitate reprinting new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 60 ES Nd

Create this form in 5 minutes!

How to create an eSignature for the 60 es nd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 60 ES Nd feature in airSlate SignNow?

The 60 ES Nd feature in airSlate SignNow allows users to efficiently manage and sign documents electronically. This feature streamlines the signing process, making it faster and more secure for businesses. With 60 ES Nd, you can enhance your workflow and ensure compliance with legal standards.

-

How much does airSlate SignNow cost with the 60 ES Nd feature?

Pricing for airSlate SignNow varies based on the plan you choose, but it remains cost-effective even with the 60 ES Nd feature. You can select from different tiers that suit your business needs, ensuring you get the best value for your investment. Visit our pricing page for detailed information on each plan.

-

What are the key benefits of using the 60 ES Nd feature?

The 60 ES Nd feature offers numerous benefits, including increased efficiency, reduced turnaround time for document signing, and enhanced security. By utilizing this feature, businesses can improve their operational workflows and ensure that documents are signed promptly. This ultimately leads to better customer satisfaction.

-

Can I integrate airSlate SignNow with other tools while using the 60 ES Nd feature?

Yes, airSlate SignNow supports integrations with various tools and platforms while utilizing the 60 ES Nd feature. This allows you to connect your existing software solutions seamlessly, enhancing your overall productivity. Check our integrations page for a list of compatible applications.

-

Is the 60 ES Nd feature suitable for small businesses?

Absolutely! The 60 ES Nd feature is designed to cater to businesses of all sizes, including small businesses. It provides an easy-to-use interface and cost-effective solutions that help small businesses manage their document signing needs efficiently. This makes it an ideal choice for startups and growing companies.

-

How secure is the 60 ES Nd feature in airSlate SignNow?

The 60 ES Nd feature in airSlate SignNow is built with robust security measures to protect your documents and data. We utilize encryption and secure storage to ensure that your information remains confidential and safe from unauthorized access. Trust in our commitment to maintaining the highest security standards.

-

What types of documents can I sign using the 60 ES Nd feature?

With the 60 ES Nd feature, you can sign a wide variety of documents, including contracts, agreements, and forms. This versatility makes it suitable for different industries and use cases. Whether you need to sign legal documents or internal memos, airSlate SignNow has you covered.

Get more for 60 ES Nd

Find out other 60 ES Nd

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast

- Electronic signature Louisiana Land lease agreement Fast

- How Do I eSignature Arizona Attorney Approval

- How Can I eSignature North Carolina Retainer Agreement Template

- Electronic signature New York Land lease agreement Secure

- eSignature Ohio Attorney Approval Now

- eSignature Pennsylvania Retainer Agreement Template Secure

- Electronic signature Texas Land lease agreement Free

- Electronic signature Kentucky Landlord lease agreement Later

- Electronic signature Wisconsin Land lease agreement Myself