Form North Dakota Office of State Tax Commissioner 60 EXT Purpose S Corporation Extension Payment How to Make Payment Complete T

Understanding the Form North Dakota Office Of State Tax Commissioner 60 EXT Purpose S Corporation Extension Payment

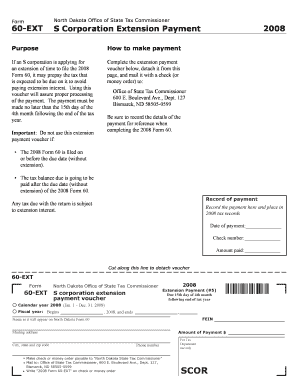

The Form North Dakota Office Of State Tax Commissioner 60 EXT is specifically designed for S Corporations seeking an extension for their tax payments. This form allows businesses to request additional time to file their tax returns while ensuring that any payments due are submitted on time. By using this form, S Corporations can avoid penalties associated with late payments and maintain compliance with state tax regulations.

How to Use the Form North Dakota Office Of State Tax Commissioner 60 EXT

To effectively use the Form North Dakota Office Of State Tax Commissioner 60 EXT, begin by downloading the form from the official state tax website or obtaining a physical copy. Complete the required fields, including your business name, tax identification number, and the amount of payment due. After filling out the form, detach the payment voucher from the main document, and ensure that you send it along with a check or money order to the specified address. This process helps ensure that your payment is processed correctly and on time.

Steps to Complete the Form North Dakota Office Of State Tax Commissioner 60 EXT

Completing the Form North Dakota Office Of State Tax Commissioner 60 EXT involves several straightforward steps:

- Download or obtain the form.

- Fill in your business information accurately, including name and tax ID.

- Indicate the payment amount you are submitting.

- Detach the payment voucher from the form.

- Mail the voucher along with your check or money order to the designated address.

Following these steps will help ensure that your extension payment is processed without issues.

Legal Use of the Form North Dakota Office Of State Tax Commissioner 60 EXT

The legal use of the Form North Dakota Office Of State Tax Commissioner 60 EXT is essential for S Corporations to comply with state tax laws. By submitting this form, businesses are formally requesting an extension for their tax payment, which is recognized by the state tax authority. Properly utilizing this form helps prevent penalties for late payments and maintains the corporation's good standing with the state.

Filing Deadlines for the Form North Dakota Office Of State Tax Commissioner 60 EXT

It is crucial to be aware of the filing deadlines associated with the Form North Dakota Office Of State Tax Commissioner 60 EXT. Typically, the extension request must be submitted by the original due date of the tax return. This ensures that the S Corporation is granted the necessary time to file without incurring penalties. Always check the latest state guidelines for any updates on deadlines.

Required Documents for Filing

When filing the Form North Dakota Office Of State Tax Commissioner 60 EXT, ensure you have the following documents ready:

- The completed extension payment voucher.

- A check or money order for the payment amount.

- Your business's tax identification number.

Having these documents prepared will streamline the filing process and help avoid delays.

Quick guide on how to complete form north dakota office of state tax commissioner 60 ext purpose s corporation extension payment how to make payment complete

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to access the correct form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents promptly and without delays. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Adjust and Electronically Sign [SKS] with Ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to share your form, via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Alter and electronically sign [SKS] and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form North Dakota Office Of State Tax Commissioner 60 EXT Purpose S Corporation Extension Payment How To Make Payment Complete T

Create this form in 5 minutes!

How to create an eSignature for the form north dakota office of state tax commissioner 60 ext purpose s corporation extension payment how to make payment complete

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form North Dakota Office Of State Tax Commissioner 60 EXT Purpose S Corporation Extension Payment?

The Form North Dakota Office Of State Tax Commissioner 60 EXT Purpose S Corporation Extension Payment is a document used by S Corporations in North Dakota to request an extension for filing their tax returns. This form allows businesses to make their extension payment and ensures compliance with state tax regulations.

-

How do I complete the extension payment voucher?

To complete the extension payment voucher, fill out the required information on the Form North Dakota Office Of State Tax Commissioner 60 EXT Purpose S Corporation Extension Payment. After filling it out, detach it from the page and mail it along with a check or money order to the specified address to ensure your payment is processed correctly.

-

What payment methods are accepted for the extension payment?

For the Form North Dakota Office Of State Tax Commissioner 60 EXT Purpose S Corporation Extension Payment, payments can be made via check or money order. Ensure that your payment is made out to the appropriate authority and includes your business information to avoid delays.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for tax document management streamlines the process of sending and eSigning important documents like the Form North Dakota Office Of State Tax Commissioner 60 EXT Purpose S Corporation Extension Payment. It provides a cost-effective solution that enhances efficiency and ensures that your documents are securely managed and easily accessible.

-

Is there a fee associated with filing the extension payment?

Yes, there may be a fee associated with filing the Form North Dakota Office Of State Tax Commissioner 60 EXT Purpose S Corporation Extension Payment, depending on the amount due. It's important to check the latest guidelines from the North Dakota Office of State Tax Commissioner for any applicable fees.

-

Can I track my extension payment once submitted?

Once you submit your Form North Dakota Office Of State Tax Commissioner 60 EXT Purpose S Corporation Extension Payment, tracking may not be directly available. However, keeping a copy of your payment and any confirmation from the mailing service can help you verify that your payment was sent.

-

What happens if I miss the extension payment deadline?

If you miss the deadline for the Form North Dakota Office Of State Tax Commissioner 60 EXT Purpose S Corporation Extension Payment, you may incur penalties and interest on the amount due. It's crucial to submit your payment on time to avoid these additional costs.

Get more for Form North Dakota Office Of State Tax Commissioner 60 EXT Purpose S Corporation Extension Payment How To Make Payment Complete T

Find out other Form North Dakota Office Of State Tax Commissioner 60 EXT Purpose S Corporation Extension Payment How To Make Payment Complete T

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation