Form 538 H Claim for Credit or Refund of Property Tax 2023-2026

What is the Form 538 H Claim For Credit Or Refund Of Property Tax

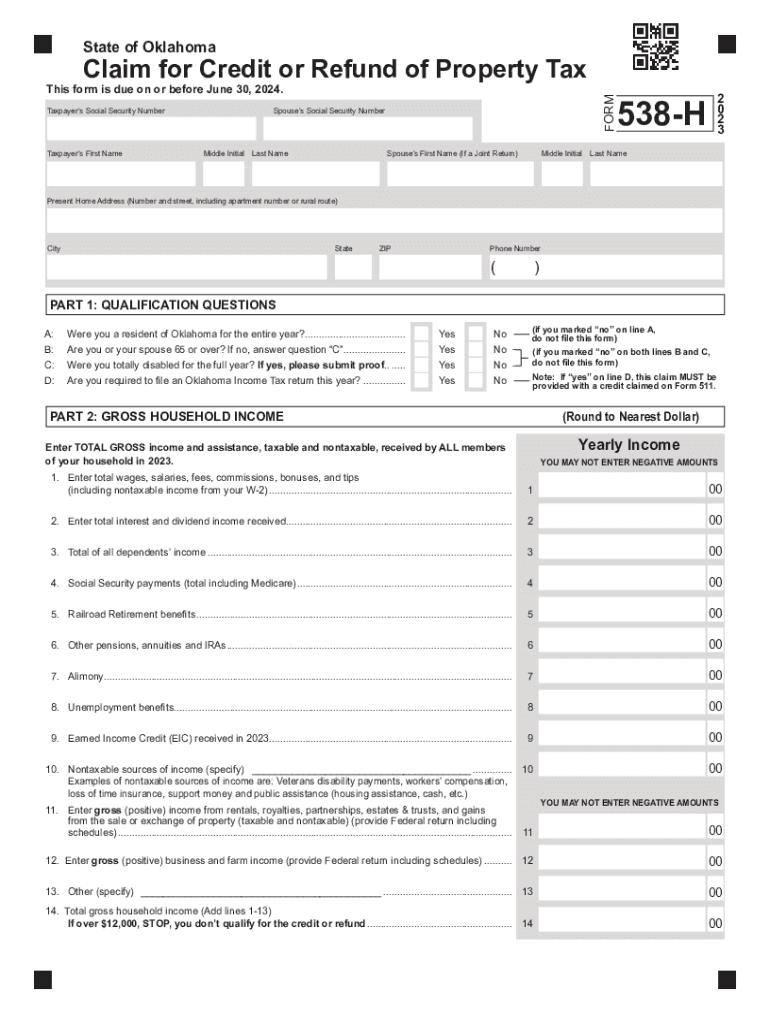

The Form 538 H is a specific document used in Oklahoma for claiming a credit or refund of property tax. This form is primarily intended for individuals and entities who believe they have overpaid property taxes or qualify for certain exemptions. By filing this form, taxpayers can seek reimbursement for taxes they have paid that exceed their actual liability, ensuring they are not unduly burdened by excessive taxation.

How to use the Form 538 H Claim For Credit Or Refund Of Property Tax

Using the Form 538 H involves several steps to ensure proper submission and processing. First, gather all necessary documentation that supports your claim, such as previous tax statements and proof of payment. Next, accurately complete the form, providing all required information, including your name, address, and details about the property in question. Once filled out, submit the form to the appropriate local tax authority, either online, by mail, or in person, depending on the options available in your jurisdiction.

Steps to complete the Form 538 H Claim For Credit Or Refund Of Property Tax

Completing the Form 538 H requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from the Oklahoma tax authority.

- Fill in your personal information, including your name, address, and contact details.

- Provide information about the property for which you are claiming a refund, including its location and tax identification number.

- Clearly state the reason for your claim, detailing any overpayment or applicable exemptions.

- Attach any supporting documents that verify your claim, such as tax receipts or exemption certificates.

- Review the form for accuracy before submission.

Eligibility Criteria

To qualify for filing the Form 538 H, taxpayers must meet specific criteria. Generally, individuals or entities that have paid property taxes in Oklahoma and believe they have overpaid or are eligible for a refund due to exemptions can file this form. It is essential to ensure that all claims are supported by appropriate documentation and that the claim is submitted within the designated filing period to avoid denial.

Required Documents

When submitting the Form 538 H, certain documents are necessary to support your claim. These typically include:

- Previous property tax statements showing payments made.

- Proof of any exemptions that apply to your property.

- Any relevant correspondence with the tax authority regarding your property tax assessments.

Having these documents ready will facilitate a smoother processing of your claim.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Form 538 H. Typically, claims must be submitted within a specific timeframe following the tax year in which the overpayment occurred. For property tax refunds, this deadline is often set by the Oklahoma tax authority, and missing it may result in the forfeiture of your right to claim a refund. Always check the latest guidelines to ensure compliance with these timelines.

Quick guide on how to complete form 538 h claim for credit or refund of property tax

Effortlessly Prepare Form 538 H Claim For Credit Or Refund Of Property Tax on Any Device

Digital document management has gained immense popularity among companies and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to swiftly create, modify, and eSign your documents without delays. Manage Form 538 H Claim For Credit Or Refund Of Property Tax seamlessly on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Edit and eSign Form 538 H Claim For Credit Or Refund Of Property Tax with Ease

- Locate Form 538 H Claim For Credit Or Refund Of Property Tax and click on Get Form to initiate.

- Utilize the tools provided to fill out your form.

- Emphasize key sections of your documents or redact sensitive information using the specific tools offered by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and eSign Form 538 H Claim For Credit Or Refund Of Property Tax and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 538 h claim for credit or refund of property tax

Create this form in 5 minutes!

How to create an eSignature for the form 538 h claim for credit or refund of property tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 538 h and how can airSlate SignNow help?

Form 538 h is a specific document used for various administrative purposes. airSlate SignNow simplifies the process of filling out and eSigning form 538 h, ensuring that your documents are completed accurately and efficiently.

-

How much does it cost to use airSlate SignNow for form 538 h?

airSlate SignNow offers competitive pricing plans that cater to different business needs. You can choose a plan that fits your budget while ensuring you have all the necessary features to manage form 538 h effectively.

-

What features does airSlate SignNow provide for managing form 538 h?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for form 538 h. These tools enhance your workflow and ensure compliance with legal standards.

-

Can I integrate airSlate SignNow with other applications for form 538 h?

Yes, airSlate SignNow offers seamless integrations with various applications, allowing you to manage form 538 h alongside your existing tools. This integration helps streamline your processes and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for form 538 h?

Using airSlate SignNow for form 538 h provides numerous benefits, including time savings, reduced paperwork, and enhanced security. The platform ensures that your documents are handled professionally and securely.

-

Is airSlate SignNow user-friendly for completing form 538 h?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete form 538 h. The intuitive interface allows users to navigate the platform effortlessly.

-

How does airSlate SignNow ensure the security of form 538 h?

airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your form 538 h. This commitment to security ensures that your sensitive information remains confidential.

Get more for Form 538 H Claim For Credit Or Refund Of Property Tax

- Borang tempahan bilik mesyuarat form

- Dot form 4220 44

- Annual physical examination masters division boxer usaboxingca form

- First aid report form word

- Lic602a form

- Ordre de virement permanent en xpf nouvelle cal donie wallis ccp form

- Mohave county court summons search form

- Autopay agreement template form

Find out other Form 538 H Claim For Credit Or Refund Of Property Tax

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later