Electronic Funds Transfer Eft Form

What is the Electronic Funds Transfer EFT Form

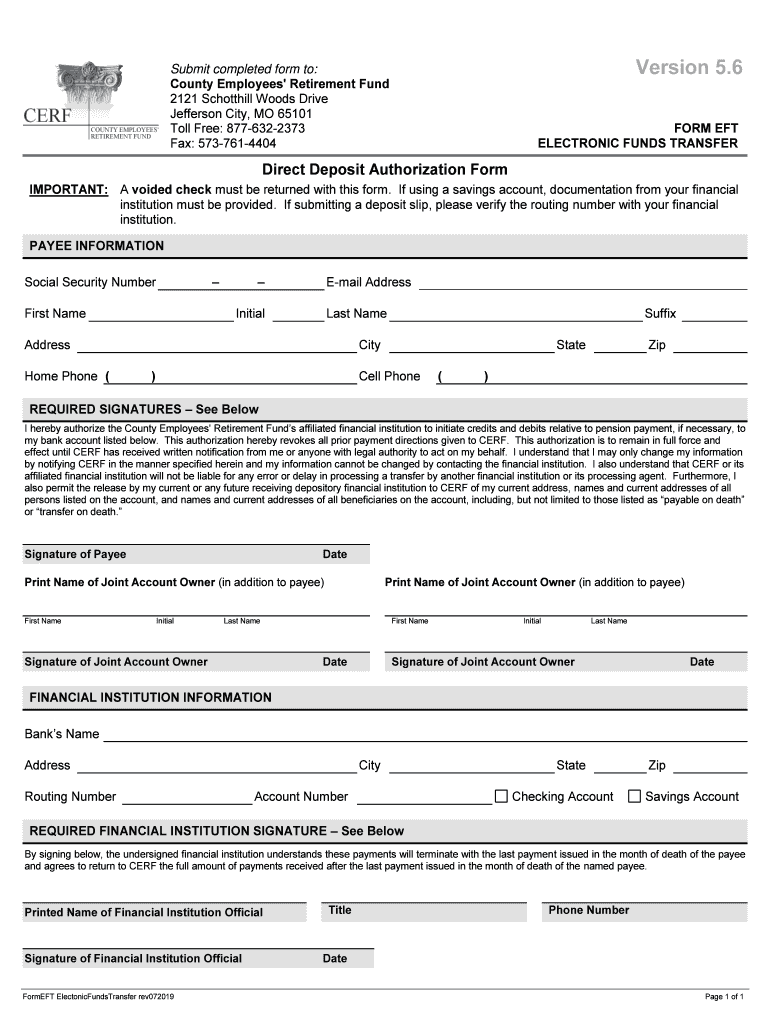

The Electronic Funds Transfer (EFT) form is a document used to authorize the transfer of funds electronically from one bank account to another. This form is essential for various transactions, including payroll deposits, vendor payments, and tax refunds. By using the EFT form, individuals and businesses can streamline their financial processes, reduce the risk of errors associated with paper checks, and ensure timely payments.

How to Use the Electronic Funds Transfer EFT Form

To effectively use the Electronic Funds Transfer EFT form, follow these steps:

- Obtain the EFT form from the relevant financial institution or agency.

- Fill in the required information, including account numbers, bank details, and the type of transaction.

- Review the completed form for accuracy to prevent delays in processing.

- Submit the form according to the institution's guidelines, which may include online submission, mailing, or in-person delivery.

Steps to Complete the Electronic Funds Transfer EFT Form

Completing the Electronic Funds Transfer EFT form involves several key steps:

- Gather necessary information, such as your bank account number and routing number.

- Indicate the type of transfer you are authorizing, whether it is a one-time payment or recurring transfer.

- Sign and date the form to authorize the transaction.

- Submit the form to your bank or the agency requesting the transfer.

Key Elements of the Electronic Funds Transfer EFT Form

The Electronic Funds Transfer EFT form includes several critical components:

- Account Information: Details about the bank account from which funds will be withdrawn.

- Recipient Information: The bank account details of the recipient, including the routing number.

- Transaction Type: Specification of whether the transfer is a one-time or recurring transaction.

- Authorization Signature: A required signature to validate the transaction.

Legal Use of the Electronic Funds Transfer EFT Form

The Electronic Funds Transfer EFT form is governed by regulations that ensure secure and lawful transactions. Users must comply with the Electronic Fund Transfer Act, which outlines consumer rights and responsibilities. This includes providing accurate information and obtaining proper authorization for transactions. Misuse of the form can lead to legal consequences, including penalties for fraud or unauthorized transfers.

Filing Deadlines / Important Dates

When using the Electronic Funds Transfer EFT form, it is crucial to be aware of any relevant deadlines. For example, tax payments made via EFT may have specific due dates set by the IRS. Additionally, businesses should monitor their payroll schedules to ensure timely deposits. Staying informed about these dates can help avoid penalties and ensure smooth financial operations.

Quick guide on how to complete electronic funds transfer eft form

Complete Electronic Funds Transfer Eft Form effortlessly on any device

Online document management has become widely embraced by businesses and individuals alike. It offers an excellent environmentally friendly substitute to traditional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Electronic Funds Transfer Eft Form on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-based workflow today.

How to modify and eSign Electronic Funds Transfer Eft Form with ease

- Obtain Electronic Funds Transfer Eft Form and click Get Form to begin.

- Leverage the tools we provide to fill out your document.

- Highlight important sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal weight as a traditional wet ink signature.

- Verify the details and click on the Done button to save your updates.

- Choose how you'd like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate reprinting documents. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choice. Alter and eSign Electronic Funds Transfer Eft Form and guarantee exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the electronic funds transfer eft form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is electronic funds transfer EFT and how does it work?

Electronic funds transfer EFT is a digital method of transferring money from one bank account to another without the need for physical checks. It streamlines the payment process, allowing businesses to send and receive funds quickly and securely. With airSlate SignNow, you can easily integrate EFT into your document workflows for efficient transactions.

-

What are the benefits of using electronic funds transfer EFT?

Using electronic funds transfer EFT offers numerous benefits, including faster transaction times, reduced processing costs, and enhanced security. It minimizes the risk of lost or stolen checks and provides a reliable way to manage payments. By incorporating EFT into your business processes with airSlate SignNow, you can improve cash flow and operational efficiency.

-

How does airSlate SignNow support electronic funds transfer EFT?

airSlate SignNow supports electronic funds transfer EFT by providing a seamless integration that allows users to send and receive payments directly through the platform. This feature simplifies the payment process, ensuring that your transactions are secure and efficient. With our user-friendly interface, managing EFT transactions becomes a hassle-free experience.

-

Is there a cost associated with using electronic funds transfer EFT?

While electronic funds transfer EFT itself may not have a direct cost, there can be fees associated with the service providers or banks involved. airSlate SignNow offers competitive pricing plans that include EFT capabilities, ensuring you get a cost-effective solution for your business. It's essential to review your bank's fee structure to understand any potential charges.

-

Can I integrate electronic funds transfer EFT with other software?

Yes, airSlate SignNow allows for easy integration of electronic funds transfer EFT with various accounting and financial software. This capability enhances your workflow by automating payment processes and reducing manual entry errors. By connecting your existing tools with airSlate SignNow, you can create a more efficient financial management system.

-

What types of businesses can benefit from electronic funds transfer EFT?

Electronic funds transfer EFT is beneficial for businesses of all sizes, from small startups to large enterprises. Any organization that handles regular payments, such as invoices or payroll, can streamline their processes using EFT. With airSlate SignNow, businesses can enhance their payment efficiency and improve overall cash management.

-

How secure is electronic funds transfer EFT?

Electronic funds transfer EFT is generally considered a secure method of transferring funds, especially when using reputable platforms like airSlate SignNow. Our platform employs advanced encryption and security protocols to protect your financial data. By utilizing EFT, you can minimize the risks associated with traditional payment methods.

Get more for Electronic Funds Transfer Eft Form

Find out other Electronic Funds Transfer Eft Form

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement

- eSignature Alabama Trademark License Agreement Secure

- Electronic signature Maryland Rental agreement lease Myself

- How To Electronic signature Kentucky Rental lease agreement

- Can I Electronic signature New Hampshire Rental lease agreement forms

- Can I Electronic signature New Mexico Rental lease agreement forms

- How Can I Electronic signature Minnesota Rental lease agreement

- Electronic signature Arkansas Rental lease agreement template Computer

- Can I Electronic signature Mississippi Rental lease agreement

- Can I Electronic signature Missouri Rental lease contract

- Electronic signature New Jersey Rental lease agreement template Free

- Electronic signature New Jersey Rental lease agreement template Secure

- Electronic signature Vermont Rental lease agreement Mobile

- Electronic signature Maine Residential lease agreement Online

- Electronic signature Minnesota Residential lease agreement Easy

- Electronic signature Wyoming Rental lease agreement template Simple

- Electronic signature Rhode Island Residential lease agreement Online

- Electronic signature Florida Rental property lease agreement Free

- Can I Electronic signature Mississippi Rental property lease agreement