Irs Non Filer Form 2014

What is the IRS Non Filer Form

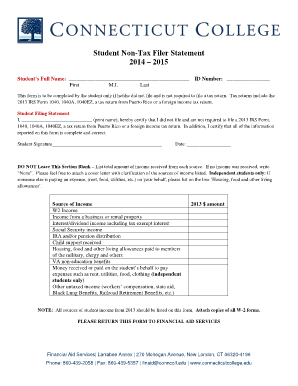

The IRS non filer tax form is designed for individuals who are not required to file a federal income tax return due to low income or other specific circumstances. This form allows these individuals to report their income and claim certain benefits, such as the Economic Impact Payment or other tax credits. By using the non filer form, individuals can ensure they are recognized by the IRS and can access available financial assistance.

How to Use the IRS Non Filer Form

To effectively use the IRS non filer tax form, individuals should first determine their eligibility based on income thresholds and other criteria. Once eligibility is confirmed, the form can be downloaded from the IRS website or filled out electronically. It is essential to provide accurate information, including Social Security numbers and income details, to avoid delays in processing. After completing the form, individuals can submit it electronically or by mail, depending on their preference.

Steps to Complete the IRS Non Filer Form

Completing the IRS non filer form involves several key steps:

- Gather necessary documents, including proof of income and identification.

- Download or access the non filer form online.

- Fill out the form with accurate personal and financial information.

- Review the completed form for any errors or omissions.

- Submit the form electronically or via mail, ensuring you keep a copy for your records.

Legal Use of the IRS Non Filer Form

The IRS non filer form is legally recognized and can be used to report income and claim tax credits. It is important to complete the form accurately to ensure compliance with IRS regulations. Misrepresentation or failure to report income can lead to penalties or legal consequences. Therefore, individuals should take care to follow the guidelines provided by the IRS when using this form.

Required Documents

When filling out the IRS non filer tax form, individuals must provide specific documents to support their claims. Required documents may include:

- Proof of income, such as pay stubs or bank statements.

- Social Security number or Individual Taxpayer Identification Number (ITIN).

- Identification documents, such as a driver’s license or state ID.

- Any relevant tax documents, such as W-2s or 1099s, if applicable.

Filing Deadlines / Important Dates

Filing deadlines for the IRS non filer form typically align with the annual tax filing season. Individuals should be aware of key dates, such as the start of the tax filing season and the final deadline for submission. For the most accurate information, it is advisable to check the IRS website or consult with a tax professional to ensure timely filing and compliance with all regulations.

Quick guide on how to complete irs non filer form

Prepare Irs Non Filer Form effortlessly on any device

Digital document management has surged in popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can obtain the correct format and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents quickly without delays. Manage Irs Non Filer Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to modify and electronically sign Irs Non Filer Form effortlessly

- Locate Irs Non Filer Form and click on Get Form to initiate the process.

- Use the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new document versions. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choosing. Alter and electronically sign Irs Non Filer Form to guarantee excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs non filer form

Create this form in 5 minutes!

How to create an eSignature for the irs non filer form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a non filer tax form, and why do I need it?

A non filer tax form is a document that individuals who have not filed their taxes must submit to the IRS. It is essential for recording your income and ensuring compliance with tax regulations. By using a non filer tax form, you can clarify your tax status and avoid potential penalties.

-

How can airSlate SignNow help with non filer tax forms?

airSlate SignNow streamlines the process of completing and submitting your non filer tax form. With our easy-to-use electronic signature features, you can quickly fill out your form, sign it, and send it to the appropriate agencies. Our platform ensures that you can manage your documentation efficiently and securely.

-

Are there any costs associated with using airSlate SignNow for non filer tax forms?

Yes, airSlate SignNow offers various pricing plans, allowing you to choose one that best suits your needs. Each plan includes access to our features for managing non filer tax forms and other documents. Compare our pricing options to find the most cost-effective solution for your tax documentation.

-

What features does airSlate SignNow offer for managing non filer tax forms?

airSlate SignNow provides features like customizable templates, electronic signatures, and real-time tracking for non filer tax forms. You can easily create, edit, and send your documents all from one platform. Our tools simplify the management of your tax forms, making compliance effortless.

-

Can I integrate airSlate SignNow with other software for tax filing?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and financial software, enhancing your tax filing experience. By connecting with your preferred applications, you can streamline your workflow and manage your non filer tax forms more efficiently.

-

Is airSlate SignNow secure for handling sensitive non filer tax forms?

Yes, airSlate SignNow prioritizes security and complies with industry protocols to ensure the safety of your non filer tax forms. Our platform uses encryption and secure storage solutions to protect your data against unauthorized access. Feel confident that your sensitive information is safe with us.

-

How long does it take to complete a non filer tax form using airSlate SignNow?

Completing a non filer tax form with airSlate SignNow can be done in minutes, depending on your readiness with the information required. Our user-friendly interface and pre-built templates enable you to quickly fill out and submit your forms. Time is saved by eliminating the need for printing and mailing.

Get more for Irs Non Filer Form

Find out other Irs Non Filer Form

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple

- How To Sign Kentucky Assignment of Lien

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe