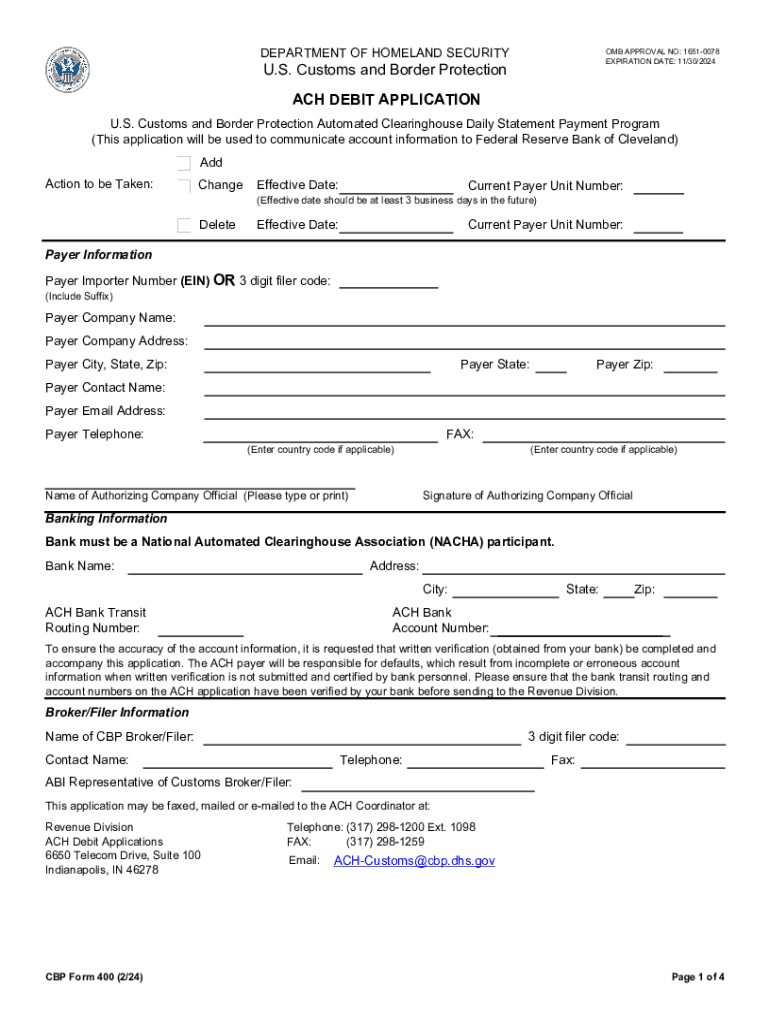

Payer Importer Number EIN or 3 Digit Filer Code Form

Understanding the Payer Importer Number EIN or 3-Digit Filer Code

The Payer Importer Number, also known as the 3-digit filer code, is a unique identifier assigned to businesses that file certain forms with the Internal Revenue Service (IRS) or other regulatory bodies. This code is essential for accurately processing tax documents and ensuring compliance with federal regulations. It typically consists of three digits and is used to identify the payer in various tax-related transactions.

How to Use the Payer Importer Number EIN or 3-Digit Filer Code

To effectively use the Payer Importer Number, it is important to include it on relevant tax forms and documents. This ensures that the IRS can correctly associate the submitted forms with the appropriate payer. When filling out forms such as the W-2 or 1099, the filer code should be entered in the designated field to prevent processing delays or errors. Additionally, it may be required when submitting electronic filings or when dealing with certain state tax agencies.

Obtaining the Payer Importer Number EIN or 3-Digit Filer Code

Businesses can obtain their Payer Importer Number by applying directly to the IRS. This process typically involves submitting Form SS-4, which is the application for an Employer Identification Number (EIN). Once the application is approved, the IRS will assign the filer code. It is important to ensure that all information provided is accurate to avoid delays in obtaining the code.

Key Elements of the Payer Importer Number EIN or 3-Digit Filer Code

The Payer Importer Number is composed of three key elements: the unique three-digit code, the associated taxpayer identification number (TIN), and the business name. Each element plays a crucial role in ensuring that tax documents are processed correctly. The three-digit code identifies the payer, while the TIN links the code to the specific business entity. Accurate representation of these elements is vital for compliance and record-keeping.

Legal Use of the Payer Importer Number EIN or 3-Digit Filer Code

The legal use of the Payer Importer Number is governed by IRS regulations and guidelines. Businesses must ensure that they use the correct code on all applicable forms to avoid penalties or compliance issues. Misuse of the filer code can result in fines or audits, making it essential for businesses to understand their obligations regarding the use of this identifier.

Examples of Using the Payer Importer Number EIN or 3-Digit Filer Code

Common examples of using the Payer Importer Number include its appearance on tax forms such as the W-2, which reports employee wages, and the 1099 series, which reports various types of income. For instance, when a business pays an independent contractor, it must include the correct filer code on the 1099 form to ensure proper reporting to the IRS. This helps maintain accurate records and supports compliance with tax laws.

Quick guide on how to complete payer importer number ein or 3 digit filer code

Effortlessly Prepare Payer Importer Number EIN OR 3 Digit Filer Code on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow supplies you with all the tools necessary to create, adjust, and eSign your documents promptly and without delays. Handle Payer Importer Number EIN OR 3 Digit Filer Code on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to Modify and eSign Payer Importer Number EIN OR 3 Digit Filer Code with Ease

- Locate Payer Importer Number EIN OR 3 Digit Filer Code and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you would prefer to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiring form searches, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Adjust and eSign Payer Importer Number EIN OR 3 Digit Filer Code to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the payer importer number ein or 3 digit filer code

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a filer code and how is it used in airSlate SignNow?

A filer code is a unique identifier used in airSlate SignNow to streamline document management and tracking. It helps users easily reference and organize their documents, ensuring that all parties involved can access the correct files efficiently.

-

How does using a filer code benefit my document workflow?

Using a filer code enhances your document workflow by providing a clear reference point for each document. This reduces confusion and increases efficiency, allowing teams to collaborate more effectively and track the status of documents in real-time.

-

Is there a cost associated with using a filer code in airSlate SignNow?

No, there is no additional cost for using a filer code in airSlate SignNow. The feature is included in the overall pricing plans, making it a cost-effective solution for businesses looking to improve their document management processes.

-

Can I customize my filer codes in airSlate SignNow?

Yes, airSlate SignNow allows users to customize their filer codes to better suit their organizational needs. This flexibility ensures that you can create a system that works best for your team, enhancing overall productivity.

-

What features are included with the filer code functionality?

The filer code functionality in airSlate SignNow includes document tracking, easy retrieval, and integration with other features like eSigning and document templates. This comprehensive approach ensures that you have all the tools necessary to manage your documents effectively.

-

How does airSlate SignNow integrate filer codes with other tools?

airSlate SignNow seamlessly integrates filer codes with various third-party applications, allowing for a cohesive workflow across platforms. This integration helps maintain consistency and ensures that all team members can access the necessary documents without hassle.

-

What types of businesses can benefit from using a filer code?

Any business that handles documents can benefit from using a filer code in airSlate SignNow. Whether you're in finance, healthcare, or education, the ability to organize and track documents efficiently is crucial for maintaining productivity and compliance.

Get more for Payer Importer Number EIN OR 3 Digit Filer Code

- Vollmacht form

- Fedex packaging test application form

- Wayne county interim support order form

- Nys division of cemeteries annual report form

- Av request form equipment setup for presentations meetings kcpublicschools

- Esb staff services form

- University of wisconsin superior transcript request form

- Contrato de apertura de credito en cuenta corriente form

Find out other Payer Importer Number EIN OR 3 Digit Filer Code

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe