Form 1071 Quarterly Tax Statement 2024-2026

What is the Form 1071 Quarterly Tax Statement

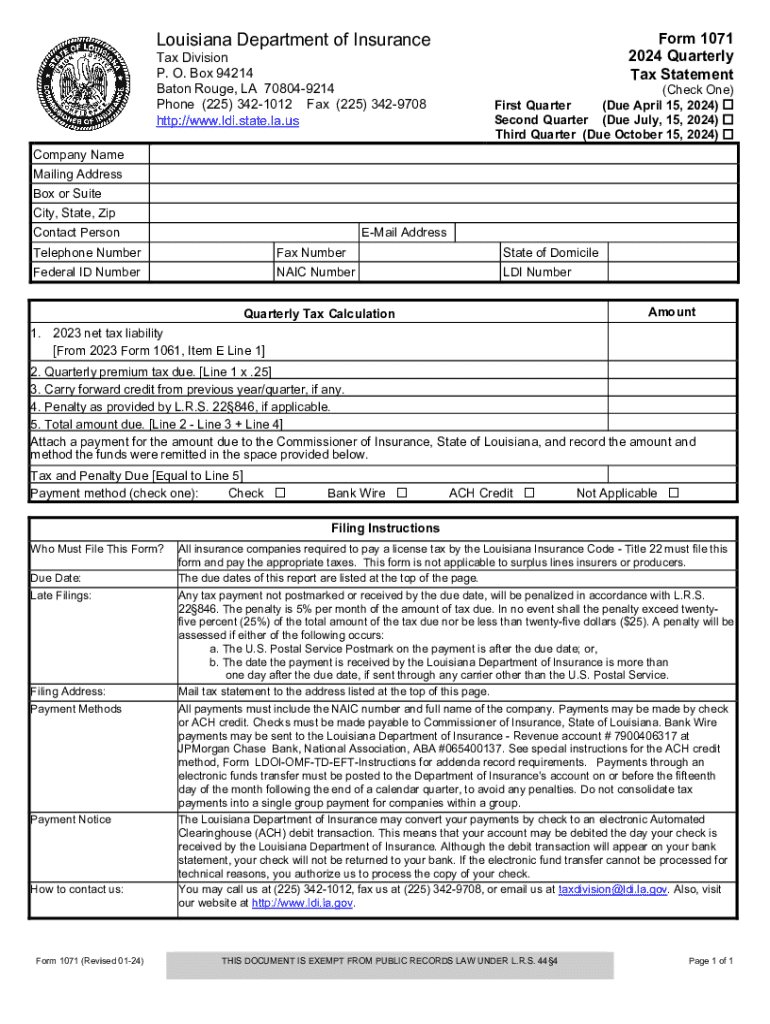

The Louisiana Form 1071 is a quarterly tax statement that businesses must file to report their sales and use tax collections. This form is essential for ensuring compliance with state tax regulations and provides the Louisiana Department of Revenue with necessary data regarding taxable sales. The information collected through this form helps the state assess tax liabilities accurately and allocate funds appropriately.

Steps to complete the Form 1071 Quarterly Tax Statement

Completing the Louisiana Form 1071 involves several key steps:

- Gather all relevant sales data for the quarter, including gross sales, exempt sales, and taxable sales.

- Calculate the total amount of sales tax collected during the reporting period.

- Fill out the form with accurate figures, ensuring all sections are completed as required.

- Review the form for accuracy to prevent any errors that could lead to penalties.

- Submit the form by the deadline, ensuring it is sent to the appropriate state office.

How to obtain the Form 1071 Quarterly Tax Statement

The Louisiana Form 1071 can be obtained through the Louisiana Department of Revenue's official website. It is available in a downloadable format, allowing businesses to print and fill it out manually. Additionally, businesses may also request a physical copy by contacting the department directly. Ensuring you have the latest version of the form is crucial for compliance.

Filing Deadlines / Important Dates

Businesses must adhere to specific deadlines when filing the Louisiana Form 1071. Generally, the form is due on the 20th day of the month following the end of each quarter. For example, the due dates are typically April 20 for the first quarter, July 20 for the second quarter, October 20 for the third quarter, and January 20 for the fourth quarter. Missing these deadlines can result in penalties and interest on unpaid taxes.

Penalties for Non-Compliance

Failure to file the Louisiana Form 1071 on time or inaccuracies in reporting can lead to significant penalties. The state may impose fines based on the amount of tax due and the length of time the form is late. Additionally, interest may accrue on any unpaid taxes, further increasing the financial burden on the business. It is essential to file accurately and on time to avoid these consequences.

Key elements of the Form 1071 Quarterly Tax Statement

The Louisiana Form 1071 includes several critical elements that businesses must complete. These elements typically consist of:

- Business identification information, including name, address, and tax identification number.

- Details of total sales, including gross sales, exempt sales, and taxable sales.

- Calculation of total sales tax collected during the reporting period.

- Signature of the authorized representative certifying the accuracy of the information provided.

Quick guide on how to complete form 1071 quarterly tax statement

Prepare Form 1071 Quarterly Tax Statement effortlessly on any device

Digital document management has become a trend among companies and individuals. It offers a superb environmentally friendly substitute for traditional printed and signed documents, as you can access the correct form and safely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Handle Form 1071 Quarterly Tax Statement on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and eSign Form 1071 Quarterly Tax Statement with ease

- Obtain Form 1071 Quarterly Tax Statement and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow manages all your document administration needs in just a few clicks from any device of your choice. Alter and eSign Form 1071 Quarterly Tax Statement and guarantee outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1071 quarterly tax statement

Create this form in 5 minutes!

How to create an eSignature for the form 1071 quarterly tax statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the louisiana form 1071?

The louisiana form 1071 is a specific document required for certain business transactions in Louisiana. It is essential for compliance with state regulations and ensures that your business operations are legally sound. Understanding this form is crucial for any business operating in Louisiana.

-

How can airSlate SignNow help with the louisiana form 1071?

airSlate SignNow simplifies the process of completing and eSigning the louisiana form 1071. Our platform allows you to fill out the form electronically, ensuring accuracy and saving time. With our user-friendly interface, you can easily manage your documents and streamline your workflow.

-

Is there a cost associated with using airSlate SignNow for the louisiana form 1071?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are designed to be cost-effective, providing excellent value for the features offered. You can choose a plan that best suits your requirements for handling the louisiana form 1071.

-

What features does airSlate SignNow offer for the louisiana form 1071?

airSlate SignNow provides features such as document templates, eSignature capabilities, and secure cloud storage for the louisiana form 1071. These features enhance efficiency and ensure that your documents are easily accessible and securely stored. Additionally, you can track the status of your documents in real-time.

-

Can I integrate airSlate SignNow with other applications for the louisiana form 1071?

Absolutely! airSlate SignNow offers integrations with various applications, making it easy to manage the louisiana form 1071 alongside your other business tools. Whether you use CRM systems, cloud storage, or project management tools, our platform can seamlessly connect with them to enhance your workflow.

-

What are the benefits of using airSlate SignNow for the louisiana form 1071?

Using airSlate SignNow for the louisiana form 1071 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to complete and sign documents quickly, which can signNowly speed up your business processes. Additionally, your data is protected with advanced security measures.

-

Is airSlate SignNow user-friendly for completing the louisiana form 1071?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete the louisiana form 1071. Our intuitive interface guides you through the process, ensuring that you can fill out and eSign documents without any technical difficulties. You can get started quickly, even if you're not tech-savvy.

Get more for Form 1071 Quarterly Tax Statement

- Contractual relationship pdf form

- Core phonics survey record form

- Boatus foundation chapter 1 worksheet answers form

- Yes bank a2 form

- Asha ceu form

- Form w 3c rev june transmittal of corrected wage and tax statements

- B 200 25 withholding tax on owners of a pass through entity form

- Rural health care practitioner tax credit form

Find out other Form 1071 Quarterly Tax Statement

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free