Oklahoma Tax CommissionInjured Spouse Claim and Al 2023

What is the Oklahoma Tax Commission Injured Spouse Claim and Al

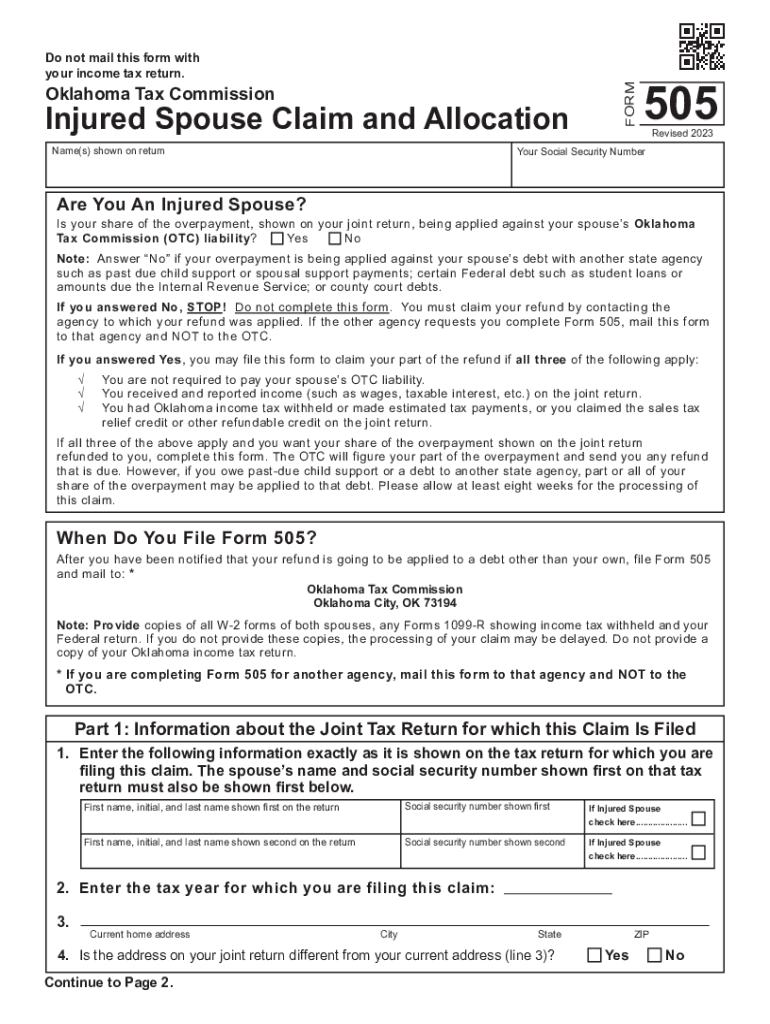

The Oklahoma Tax Commission Injured Spouse Claim is a specific form that allows a spouse to request their share of a tax refund that may be withheld due to the other spouse's tax liabilities. This claim is essential for individuals who may be affected by their partner's debts, ensuring that they can recover their portion of any joint tax refund. The form aims to protect the rights of the injured spouse by providing a legal avenue to claim their rightful share, thereby promoting fairness in tax refund distribution.

How to use the Oklahoma Tax Commission Injured Spouse Claim and Al

Using the Oklahoma Tax Commission Injured Spouse Claim involves a straightforward process. First, the injured spouse must complete the designated form accurately, providing necessary personal information and details about the joint tax return. It is crucial to include all required documentation, such as copies of the tax return and any relevant notices from the IRS. Once completed, the form can be submitted to the Oklahoma Tax Commission for processing. Understanding the instructions and ensuring all details are correct can significantly enhance the chances of a successful claim.

Steps to complete the Oklahoma Tax Commission Injured Spouse Claim and Al

Completing the Oklahoma Tax Commission Injured Spouse Claim involves several key steps:

- Gather necessary documents, including your joint tax return and any IRS notices.

- Fill out the Injured Spouse Claim form with accurate personal and financial information.

- Clearly indicate the portion of the refund you are claiming as the injured spouse.

- Review the form for accuracy and completeness before submission.

- Submit the form to the Oklahoma Tax Commission via the preferred submission method.

Eligibility Criteria

To be eligible for the Oklahoma Tax Commission Injured Spouse Claim, certain criteria must be met. The individual must have filed a joint tax return with a spouse who has outstanding debts, such as child support or tax liabilities. Additionally, the injured spouse must have reported income or tax withholdings on the joint return that are separate from the debts of the other spouse. Meeting these criteria is essential for a successful claim and ensures that the injured spouse can recover their rightful share of the tax refund.

Required Documents

When submitting the Oklahoma Tax Commission Injured Spouse Claim, specific documents are necessary for processing. These typically include:

- A copy of the joint tax return for the year in question.

- Any IRS notices regarding the tax refund or debts owed.

- Proof of income that supports the claim of the injured spouse.

- Identification documents, such as a driver's license or Social Security card.

Form Submission Methods

The Oklahoma Tax Commission Injured Spouse Claim can be submitted through various methods to accommodate different preferences. Options typically include:

- Online submission via the Oklahoma Tax Commission's official website.

- Mailing the completed form to the designated address provided by the commission.

- In-person submission at local Oklahoma Tax Commission offices, if available.

Quick guide on how to complete oklahoma tax commissioninjured spouse claim and al

Complete Oklahoma Tax CommissionInjured Spouse Claim And Al effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents swiftly without delays. Manage Oklahoma Tax CommissionInjured Spouse Claim And Al on any device with airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Oklahoma Tax CommissionInjured Spouse Claim And Al with ease

- Obtain Oklahoma Tax CommissionInjured Spouse Claim And Al and then click Get Form to begin.

- Utilize the tools we provide to finish your form.

- Emphasize important sections of your documents or conceal sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Generate your electronic signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and then click the Done button to preserve your changes.

- Choose your preferred method for delivering your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Oklahoma Tax CommissionInjured Spouse Claim And Al to ensure effective communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct oklahoma tax commissioninjured spouse claim and al

Create this form in 5 minutes!

How to create an eSignature for the oklahoma tax commissioninjured spouse claim and al

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Oklahoma Tax Commission Injured Spouse Claim and Al?

The Oklahoma Tax Commission Injured Spouse Claim and Al is a process that allows individuals to claim their portion of a tax refund that may have been applied to their spouse's tax debts. This claim is essential for protecting your financial interests and ensuring you receive your rightful refund. Understanding this process can help you navigate tax issues more effectively.

-

How can airSlate SignNow assist with the Oklahoma Tax Commission Injured Spouse Claim and Al?

airSlate SignNow provides a streamlined platform for preparing and eSigning documents related to the Oklahoma Tax Commission Injured Spouse Claim and Al. Our user-friendly interface simplifies the process, allowing you to focus on your claim rather than paperwork. With our solution, you can ensure that your documents are completed accurately and submitted on time.

-

What are the pricing options for using airSlate SignNow for my claims?

airSlate SignNow offers flexible pricing plans that cater to various needs, including individual users and businesses. Our cost-effective solutions ensure that you can manage your Oklahoma Tax Commission Injured Spouse Claim and Al without breaking the bank. You can choose a plan that fits your budget while still accessing all necessary features.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes a range of features designed to enhance document management for the Oklahoma Tax Commission Injured Spouse Claim and Al. Key features include customizable templates, secure eSigning, and real-time tracking of document status. These tools help you manage your claims efficiently and effectively.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes security, ensuring that all documents related to the Oklahoma Tax Commission Injured Spouse Claim and Al are protected. We utilize advanced encryption and secure storage solutions to safeguard your sensitive information. You can trust that your documents are safe with us.

-

Can I integrate airSlate SignNow with other software for my claims?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, enhancing your workflow for the Oklahoma Tax Commission Injured Spouse Claim and Al. Whether you use accounting software or document management systems, our integrations help streamline your processes and improve efficiency.

-

What benefits can I expect from using airSlate SignNow for my claims?

Using airSlate SignNow for your Oklahoma Tax Commission Injured Spouse Claim and Al provides numerous benefits, including time savings, increased accuracy, and enhanced organization. Our platform simplifies the entire process, allowing you to focus on what matters most—getting your refund. Experience the convenience of eSigning and document management with us.

Get more for Oklahoma Tax CommissionInjured Spouse Claim And Al

- Myemgchart form

- Form 300 finished goods retention sample register log

- Bill of lading ceva ground formerly scg

- April fools by kelly hashway form

- Childrens medical report 250490128 form

- Medical claim form bcbstx

- Private transportation release consent form westminster college wcmo

- For faster authorization home health care re authorization form

Find out other Oklahoma Tax CommissionInjured Spouse Claim And Al

- Sign North Dakota Quitclaim Deed Free

- Sign Oregon Quitclaim Deed Simple

- Sign West Virginia Quitclaim Deed Free

- How Can I Sign North Dakota Warranty Deed

- How Do I Sign Oklahoma Warranty Deed

- Sign Florida Postnuptial Agreement Template Online

- Sign Colorado Prenuptial Agreement Template Online

- Help Me With Sign Colorado Prenuptial Agreement Template

- Sign Missouri Prenuptial Agreement Template Easy

- Sign New Jersey Postnuptial Agreement Template Online

- Sign North Dakota Postnuptial Agreement Template Simple

- Sign Texas Prenuptial Agreement Template Online

- Sign Utah Prenuptial Agreement Template Mobile

- Sign West Virginia Postnuptial Agreement Template Myself

- How Do I Sign Indiana Divorce Settlement Agreement Template

- Sign Indiana Child Custody Agreement Template Now

- Sign Minnesota Divorce Settlement Agreement Template Easy

- How To Sign Arizona Affidavit of Death

- Sign Nevada Divorce Settlement Agreement Template Free

- Sign Mississippi Child Custody Agreement Template Free