Oklahoma Tax Commission Injured Spouse Form 2009

What is the Oklahoma Tax Commission Injured Spouse Form

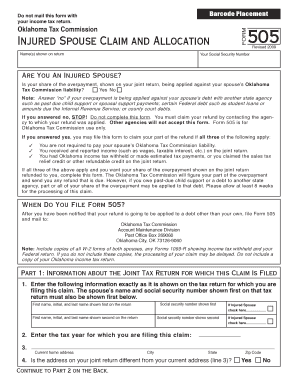

The Oklahoma Tax Commission Injured Spouse Form is a specific document designed for individuals who are filing jointly with a spouse but wish to protect their portion of a tax refund from being applied to their spouse's tax liabilities. This form allows the injured spouse to claim their share of the refund, ensuring that they do not lose out on funds that are rightfully theirs due to their partner's financial issues. It is essential for taxpayers in Oklahoma who find themselves in such situations to understand this form's purpose and implications.

Steps to complete the Oklahoma Tax Commission Injured Spouse Form

Completing the Oklahoma Tax Commission Injured Spouse Form involves several key steps:

- Gather necessary information, including your and your spouse's Social Security numbers, tax filing status, and income details.

- Clearly identify the tax refund amount that you believe is owed to you as the injured spouse.

- Fill out the form accurately, ensuring all sections are completed to avoid delays.

- Review the form for any errors or omissions before submission.

- Submit the form either electronically or via mail, depending on your preference and the requirements of the Oklahoma Tax Commission.

How to obtain the Oklahoma Tax Commission Injured Spouse Form

The Oklahoma Tax Commission Injured Spouse Form can be obtained through various channels. It is available on the official Oklahoma Tax Commission website, where taxpayers can download and print the form. Additionally, individuals can request a physical copy by contacting the Tax Commission directly. It is advisable to ensure that you are using the most current version of the form to avoid any issues during submission.

Legal use of the Oklahoma Tax Commission Injured Spouse Form

The legal use of the Oklahoma Tax Commission Injured Spouse Form is crucial for protecting your rights as a taxpayer. This form must be submitted within the appropriate timeframe and in accordance with state regulations. By completing the form, you assert your claim to your share of the tax refund, which can help prevent the state from applying it towards your spouse's debts. It is important to understand the legal implications and requirements associated with the form to ensure compliance and protect your financial interests.

Key elements of the Oklahoma Tax Commission Injured Spouse Form

Several key elements must be included in the Oklahoma Tax Commission Injured Spouse Form for it to be valid:

- Identification of both spouses, including names and Social Security numbers.

- Details regarding the tax refund amount being claimed.

- Clear indication of the injured spouse's income and tax contributions.

- Signatures of both spouses, affirming the accuracy of the information provided.

Form Submission Methods

The Oklahoma Tax Commission Injured Spouse Form can be submitted using different methods to accommodate various preferences:

- Online Submission: If available, this method allows for a quicker processing time.

- Mail Submission: Print and send the completed form to the designated address provided by the Oklahoma Tax Commission.

- In-Person Submission: Visit a local Tax Commission office to submit the form directly.

Quick guide on how to complete oklahoma tax commission injured spouse form

Prepare Oklahoma Tax Commission Injured Spouse Form effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your files swiftly and without delays. Handle Oklahoma Tax Commission Injured Spouse Form on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related task today.

How to modify and eSign Oklahoma Tax Commission Injured Spouse Form seamlessly

- Locate Oklahoma Tax Commission Injured Spouse Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your files or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign feature, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Decide how you want to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign Oklahoma Tax Commission Injured Spouse Form and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct oklahoma tax commission injured spouse form

Create this form in 5 minutes!

How to create an eSignature for the oklahoma tax commission injured spouse form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Oklahoma Tax Commission Injured Spouse Form?

The Oklahoma Tax Commission Injured Spouse Form is a document that allows a spouse to request their share of a tax refund when the other spouse has tax debts. By utilizing this form, you can ensure that your tax refund isn't used to pay off your partner's liabilities. It's an essential tool for protecting your financial interests during tax season.

-

How can airSlate SignNow help with the Oklahoma Tax Commission Injured Spouse Form?

airSlate SignNow simplifies the process of completing and submitting the Oklahoma Tax Commission Injured Spouse Form. Our platform allows you to easily fill out the form, sign electronically, and send it securely without the hassle of printing or mailing. This means faster processing times and greater convenience for you.

-

Is there a cost associated with using airSlate SignNow for the Oklahoma Tax Commission Injured Spouse Form?

Yes, airSlate SignNow offers a subscription-based pricing model, making it cost-effective for users needing to complete documents like the Oklahoma Tax Commission Injured Spouse Form. Our plans are designed to accommodate both individual users and businesses, allowing you to select an option that suits your needs and budget.

-

What features does airSlate SignNow offer for filling out the Oklahoma Tax Commission Injured Spouse Form?

With airSlate SignNow, you get features like easy document editing, electronic signatures, and secure cloud storage when filling out the Oklahoma Tax Commission Injured Spouse Form. Additionally, our platform provides real-time status updates and notifications, ensuring you are always informed about your document's progress.

-

Can I integrate airSlate SignNow with other applications while processing the Oklahoma Tax Commission Injured Spouse Form?

Absolutely! airSlate SignNow offers seamless integrations with popular applications such as Google Drive, Dropbox, and Microsoft Office. This allows you to manage your documents, including the Oklahoma Tax Commission Injured Spouse Form, more efficiently by accessing and sharing them from your preferred platforms.

-

How does airSlate SignNow ensure the security of my Oklahoma Tax Commission Injured Spouse Form?

airSlate SignNow prioritizes your data security. We employ robust encryption methods and secure electronic signatures, ensuring that your Oklahoma Tax Commission Injured Spouse Form is protected from unauthorized access. Our compliance with industry standards further enhances the security of all transactions.

-

What are the benefits of using airSlate SignNow for completing tax documents like the Oklahoma Tax Commission Injured Spouse Form?

Using airSlate SignNow for your tax documents, such as the Oklahoma Tax Commission Injured Spouse Form, offers numerous benefits including time savings, enhanced accuracy, and an overall user-friendly experience. Our platform reduces the complexity of tax forms and provides quick access to necessary templates, making tax season less stressful.

Get more for Oklahoma Tax Commission Injured Spouse Form

- Sa103f form

- Clinilog contour next form

- Dhs 901 semi annual transition plan report dhs 901 michigan form

- 1 a form

- Vac therapy insurance authorization form v

- Shippers letter of instrucktion ecu worldwide form

- Immunization record registro de inmunizaciones texas dshs texas form

- Dd form 2981 basic criminal history and statement of admission may 2014

Find out other Oklahoma Tax Commission Injured Spouse Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors