RI 8736 Application for Automatic Extension of Time to File RI Tax Ri Form

What is the RI 8736 Application For Automatic Extension Of Time To File RI Tax Ri

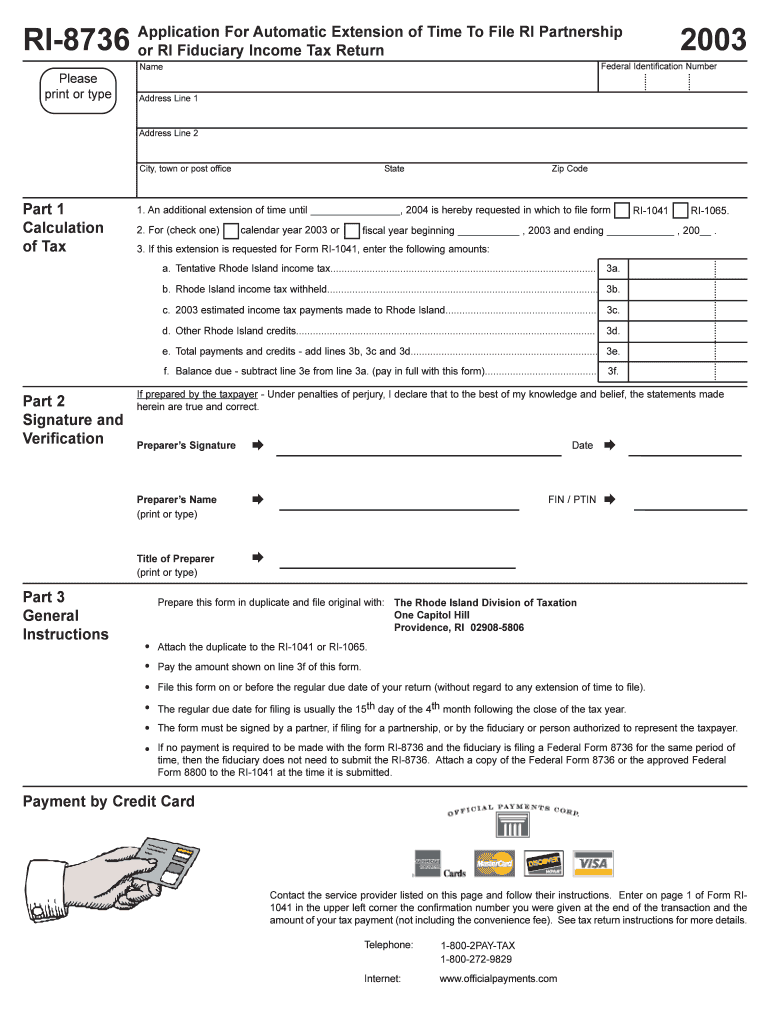

The RI 8736 Application For Automatic Extension Of Time To File RI Tax Ri is a specific form used by taxpayers in Rhode Island to request an extension for filing their state tax returns. This application allows individuals and businesses to extend their filing deadline, providing additional time to prepare their tax documents without incurring penalties for late submission. It is essential for taxpayers to understand that while this form grants an extension for filing, it does not extend the time to pay any taxes owed. Taxpayers must still estimate and pay their tax liabilities by the original due date to avoid interest and penalties.

Steps to complete the RI 8736 Application For Automatic Extension Of Time To File RI Tax Ri

Completing the RI 8736 form involves several straightforward steps. First, gather all necessary financial documents and information relevant to your tax situation. Next, accurately fill out the form, ensuring that you provide your name, address, and Social Security number or Employer Identification Number. It is crucial to indicate the tax year for which you are requesting the extension. After filling out the form, review it for any errors or omissions. Finally, submit the completed application by the specified deadline, either electronically or via mail, to the appropriate Rhode Island tax authority.

Required Documents

When filing the RI 8736 Application For Automatic Extension Of Time To File RI Tax Ri, certain documents may be necessary to support your application. These typically include your previous year’s tax return, any income statements such as W-2s or 1099s, and documentation of any deductions or credits you plan to claim. Having these documents on hand can help ensure that you accurately estimate your tax liability and complete the form correctly. While not all documents need to be submitted with the application, they are essential for your records and for preparing your eventual tax return.

Form Submission Methods

The RI 8736 form can be submitted through various methods, providing flexibility for taxpayers. You may choose to file the application online through the Rhode Island Division of Taxation's website, which offers a convenient electronic submission option. Alternatively, you can print the completed form and mail it to the designated address provided on the form. In some cases, in-person submission may also be possible at local tax offices. It is important to follow the instructions carefully to ensure that your application is processed in a timely manner.

Eligibility Criteria

To be eligible for the RI 8736 Application For Automatic Extension Of Time To File RI Tax Ri, taxpayers must meet specific criteria. Generally, any individual or business required to file a Rhode Island tax return may apply for an extension. This includes residents, non-residents, and part-year residents who have income subject to Rhode Island tax. However, it is essential to note that the extension does not apply to all types of taxes, and taxpayers must still comply with payment deadlines for any taxes owed to avoid penalties.

Penalties for Non-Compliance

Failure to file the RI 8736 Application For Automatic Extension Of Time To File RI Tax Ri by the deadline can result in penalties. If a taxpayer does not submit the application on time, they may face late filing penalties, which can accumulate quickly. Additionally, if taxes owed are not paid by the original due date, interest and further penalties may apply. Understanding these consequences is crucial for taxpayers to avoid unnecessary financial burdens and ensure compliance with Rhode Island tax regulations.

Quick guide on how to complete ri 8736 application for automatic extension of time to file ri tax ri

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the needed form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to modify and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and guarantee excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ri 8736 application for automatic extension of time to file ri tax ri

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the RI 8736 Application For Automatic Extension Of Time To File RI Tax Ri?

The RI 8736 Application For Automatic Extension Of Time To File RI Tax Ri is a form that allows taxpayers in Rhode Island to request an extension for filing their state tax returns. This application provides additional time to prepare and submit your tax documents without incurring penalties.

-

How can airSlate SignNow help with the RI 8736 Application For Automatic Extension Of Time To File RI Tax Ri?

airSlate SignNow simplifies the process of completing and submitting the RI 8736 Application For Automatic Extension Of Time To File RI Tax Ri. With our platform, you can easily fill out the form, eSign it, and send it directly to the Rhode Island tax authorities, ensuring a hassle-free experience.

-

Is there a cost associated with using airSlate SignNow for the RI 8736 Application?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions provide access to features that streamline the completion of the RI 8736 Application For Automatic Extension Of Time To File RI Tax Ri, making it a valuable investment for your tax filing process.

-

What features does airSlate SignNow offer for the RI 8736 Application?

airSlate SignNow includes features such as customizable templates, eSignature capabilities, and secure document storage, all of which enhance the process of submitting the RI 8736 Application For Automatic Extension Of Time To File RI Tax Ri. These features ensure that your documents are handled efficiently and securely.

-

Can I integrate airSlate SignNow with other software for tax filing?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, allowing you to streamline your workflow when dealing with the RI 8736 Application For Automatic Extension Of Time To File RI Tax Ri. This integration helps you manage your documents and data more effectively.

-

What are the benefits of using airSlate SignNow for tax applications?

Using airSlate SignNow for tax applications like the RI 8736 Application For Automatic Extension Of Time To File RI Tax Ri provides numerous benefits, including time savings, reduced paperwork, and enhanced security. Our platform ensures that your documents are processed quickly and accurately, giving you peace of mind.

-

How secure is my information when using airSlate SignNow for the RI 8736 Application?

Security is a top priority at airSlate SignNow. When you use our platform for the RI 8736 Application For Automatic Extension Of Time To File RI Tax Ri, your information is protected with advanced encryption and secure storage protocols, ensuring that your sensitive data remains confidential.

Get more for RI 8736 Application For Automatic Extension Of Time To File RI Tax Ri

- Enrollment form louisiana pathways northwestern state

- 2020 pcr political contribution refund application form

- Appsbowlcom is online now open webinfo form

- Sfhss open enrollment application city amp county of san francisco employee form

- Form 81 110 19 8 1 000 rev

- Solved tax return project preparation of form 1040 year

- Non commercial drivers license penndot form

- Residency affidavit individual transferor form

Find out other RI 8736 Application For Automatic Extension Of Time To File RI Tax Ri

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF