Solved TAX RETURN PROJECT PREPARATION of FORM 1040 YEAR 2019

Understanding the 2019 Mississippi Pass Through Entity Tax Return

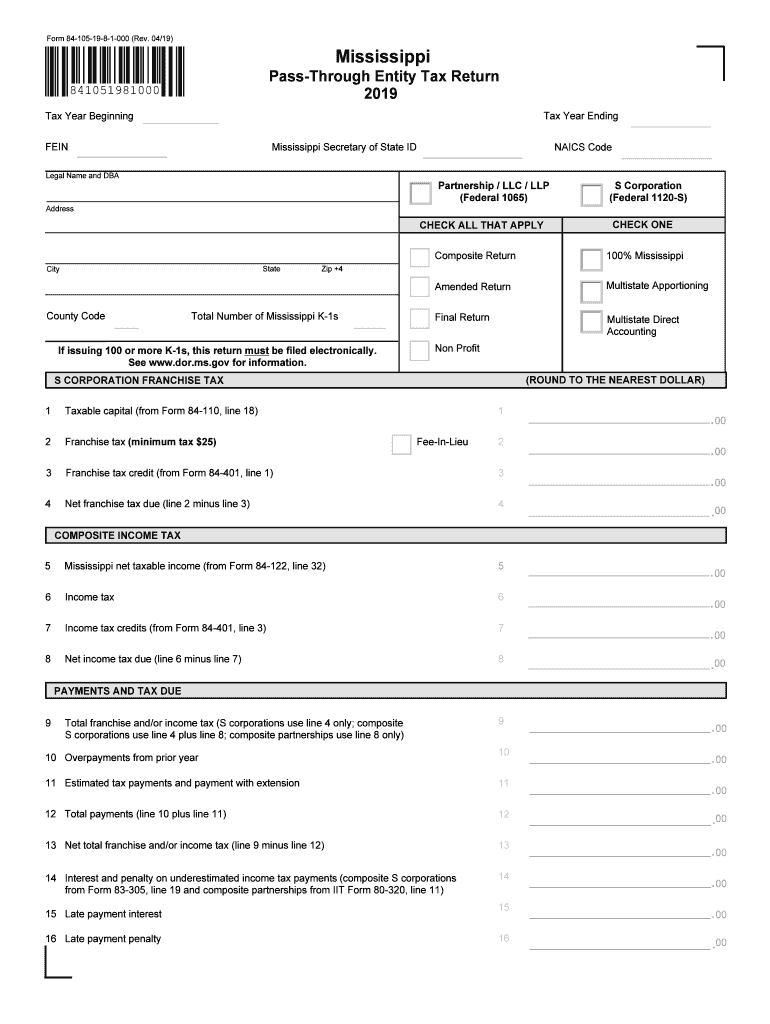

The 2019 Mississippi Pass Through Entity Tax Return is specifically designed for entities such as partnerships, limited liability companies (LLCs), and S corporations that pass their income, deductions, and credits through to their owners. This form allows these entities to report their income and calculate the tax owed on behalf of their owners. Understanding the nuances of this form is essential for compliance and accurate reporting.

Key Elements of the 2019 Mississippi Pass Through Entity Tax Return

Several critical components must be included in the 2019 Mississippi Pass Through Entity Tax Return. These elements typically encompass:

- Entity identification information, including name, address, and federal employer identification number (EIN).

- Details of income, deductions, and credits that the entity is passing through to its owners.

- Calculation of the entity's tax liability based on Mississippi tax laws.

- Information regarding each owner's share of income, deductions, and credits.

Steps to Complete the 2019 Mississippi Pass Through Entity Tax Return

Completing the 2019 Mississippi Pass Through Entity Tax Return involves several steps to ensure accuracy and compliance. Here’s a simplified process:

- Gather all necessary financial documents, including income statements and expense reports.

- Complete the entity identification section with accurate details.

- Report total income, deductions, and credits on the appropriate lines of the form.

- Calculate the total tax liability and ensure it aligns with Mississippi tax regulations.

- Distribute the appropriate shares of income and deductions to each owner.

- Review the completed form for accuracy before submission.

Filing Deadlines for the 2019 Mississippi Pass Through Entity Tax Return

The filing deadline for the 2019 Mississippi Pass Through Entity Tax Return is typically the fifteenth day of the fourth month following the end of the entity's tax year. For entities operating on a calendar year, this means the return is due by April 15, 2020. It is crucial to adhere to these deadlines to avoid penalties and interest on any unpaid tax.

Required Documents for Filing

When preparing to file the 2019 Mississippi Pass Through Entity Tax Return, certain documents are essential. These may include:

- Financial statements detailing income and expenses.

- Partnership agreements or operating agreements for LLCs.

- Schedule K-1 forms for each owner, detailing their share of income and deductions.

- Any supporting documentation for deductions or credits claimed.

Form Submission Methods

The 2019 Mississippi Pass Through Entity Tax Return can be submitted through various methods. Entities may choose to file electronically via approved tax software or submit a paper return by mail. It is advisable to retain copies of all submitted forms and supporting documents for record-keeping purposes.

Quick guide on how to complete solved tax return project preparation of form 1040 year

Complete Solved TAX RETURN PROJECT PREPARATION OF FORM 1040 YEAR effortlessly on any device

The management of online documents has become increasingly favored by organizations and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle Solved TAX RETURN PROJECT PREPARATION OF FORM 1040 YEAR on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Solved TAX RETURN PROJECT PREPARATION OF FORM 1040 YEAR with ease

- Find Solved TAX RETURN PROJECT PREPARATION OF FORM 1040 YEAR and click on Get Form to begin.

- Employ the tools we offer to complete your form.

- Highlight pertinent sections of your documents or conceal sensitive data using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign feature, which takes moments and holds the same legal validity as a customary wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to submit your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Solved TAX RETURN PROJECT PREPARATION OF FORM 1040 YEAR and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct solved tax return project preparation of form 1040 year

Create this form in 5 minutes!

How to create an eSignature for the solved tax return project preparation of form 1040 year

How to create an electronic signature for the Solved Tax Return Project Preparation Of Form 1040 Year in the online mode

How to create an eSignature for your Solved Tax Return Project Preparation Of Form 1040 Year in Google Chrome

How to generate an eSignature for putting it on the Solved Tax Return Project Preparation Of Form 1040 Year in Gmail

How to make an electronic signature for the Solved Tax Return Project Preparation Of Form 1040 Year right from your smartphone

How to make an electronic signature for the Solved Tax Return Project Preparation Of Form 1040 Year on iOS

How to make an electronic signature for the Solved Tax Return Project Preparation Of Form 1040 Year on Android OS

People also ask

-

What is a 2019 Mississippi pass through entity tax return?

A 2019 Mississippi pass through entity tax return is a tax filing that entities such as partnerships and S corporations must submit to report income, deductions, and credits passed through to their owners. This form ensures that the state government receives an accurate account of how income is distributed among owners and taxed indirectly.

-

How can airSlate SignNow help with 2019 Mississippi pass through entity tax returns?

airSlate SignNow provides a streamlined process for preparing and signing the 2019 Mississippi pass through entity tax return documents. With easy sending and eSigning features, businesses can efficiently handle necessary documentation, ensuring timely submission and compliance with state regulations.

-

What are the pricing options for using airSlate SignNow in relation to tax returns?

airSlate SignNow offers competitive pricing plans tailored for businesses of all sizes. By utilizing airSlate SignNow for your 2019 Mississippi pass through entity tax return, you gain a cost-effective solution that reduces paper usage and accelerates the documentation process.

-

What features does airSlate SignNow offer specifically for tax return documents?

airSlate SignNow offers features like customizable templates, bulk sending, and secure storage for tax return documents, including the 2019 Mississippi pass through entity tax return. These features provide convenience and help ensure documents are readily accessible when needed.

-

Are there integrations available for airSlate SignNow that assist with tax returns?

Yes, airSlate SignNow integrates with a variety of accounting and tax software solutions. This integration facilitates easy data transfer and synchronization, streamlining the process of completing your 2019 Mississippi pass through entity tax return.

-

How does airSlate SignNow ensure the security of tax return documents?

airSlate SignNow prioritizes document security, employing industry-standard encryption and compliance with data protection regulations. This ensures that your 2019 Mississippi pass through entity tax return, along with any sensitive information contained within it, is securely stored and transmitted.

-

Can airSlate SignNow help in tracking the status of my 2019 Mississippi pass through entity tax return?

Absolutely! With airSlate SignNow, you can easily track the status of your documents, including the 2019 Mississippi pass through entity tax return. Notifications and reminders keep you informed about who has signed and when, allowing you to manage your tax filings more effectively.

Get more for Solved TAX RETURN PROJECT PREPARATION OF FORM 1040 YEAR

- Sunpass commercial account application form

- Standard citation page 1 minnesota judicial branch mncourts form

- Puppy evaluation form

- Minnesota urolith center quantitative urolith analysis form

- Contract trust pdf form

- Cdc 2142 citizen s complaint against employee of the form

- Cape cod violetry form

- Application to amend certificateofbirth la form

Find out other Solved TAX RETURN PROJECT PREPARATION OF FORM 1040 YEAR

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document