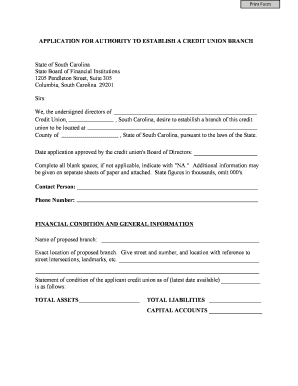

Credit Union Branch Application Office of the Commissioner of Form

What is the Credit Union Branch Application Office Of The Commissioner Of

The Credit Union Branch Application, overseen by the Office of the Commissioner, is a formal request that credit unions must submit to establish a new branch location. This application is essential for compliance with state regulations and ensures that the proposed branch meets all necessary legal and operational standards. The process helps maintain the integrity and stability of the credit union system within the United States.

Steps to complete the Credit Union Branch Application Office Of The Commissioner Of

Completing the Credit Union Branch Application involves several key steps:

- Gather required information: Collect details about the credit union, including its charter number, current branches, and financial statements.

- Provide branch details: Specify the proposed location, including the address and any relevant demographic information that supports the need for the branch.

- Submit supporting documentation: Include any necessary documents, such as a business plan, financial projections, and evidence of community need.

- Review and verification: Ensure all information is accurate and complete before submission to avoid delays in processing.

- File the application: Submit the application through the appropriate channels, as outlined by the Office of the Commissioner.

Legal use of the Credit Union Branch Application Office Of The Commissioner Of

The legal use of the Credit Union Branch Application is primarily to ensure that credit unions comply with state and federal regulations when expanding their services. This application serves as a legal document that outlines the credit union's intent to operate a new branch, which must be approved by the Office of the Commissioner. Failure to adhere to the legal requirements can result in penalties or denial of the application.

Key elements of the Credit Union Branch Application Office Of The Commissioner Of

Several key elements are essential for a complete Credit Union Branch Application:

- Identification of the credit union: Include the legal name, charter number, and contact information.

- Proposed branch location: Provide the physical address and rationale for selecting the site.

- Financial viability: Submit financial statements and projections that demonstrate the branch's potential success.

- Community impact: Explain how the new branch will serve the community and enhance access to financial services.

- Compliance with regulations: Affirm that the credit union will adhere to all applicable laws and regulations.

Eligibility Criteria

To be eligible to submit the Credit Union Branch Application, a credit union must meet specific criteria, including:

- Being a federally or state-chartered credit union in good standing.

- Having a demonstrated need for a new branch based on community demographics.

- Maintaining adequate financial resources to support the establishment and operation of the new branch.

- Complying with all regulatory requirements set forth by the Office of the Commissioner.

Application Process & Approval Time

The application process for the Credit Union Branch Application typically involves the following stages:

- Submission: After completing the application and gathering all necessary documents, the credit union submits the application to the Office of the Commissioner.

- Review: The Office will review the application for completeness and compliance with regulations.

- Approval or denial: The credit union will receive a decision, which may take several weeks, depending on the complexity of the application and the workload of the Office.

Quick guide on how to complete credit union branch application office of the commissioner of

Accomplish [SKS] effortlessly on any device

Digital document management has gained traction with companies and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or mislaid files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management in just a few clicks from any device you choose. Modify and eSign [SKS] and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the credit union branch application office of the commissioner of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Credit Union Branch Application Office Of The Commissioner Of?

The Credit Union Branch Application Office Of The Commissioner Of is a formal process that credit unions must follow to establish a new branch. This application ensures compliance with regulatory standards and helps maintain the integrity of the financial system. By utilizing airSlate SignNow, you can streamline this application process with eSigning capabilities.

-

How can airSlate SignNow assist with the Credit Union Branch Application Office Of The Commissioner Of?

airSlate SignNow provides an efficient platform for managing the Credit Union Branch Application Office Of The Commissioner Of. With our eSigning features, you can easily send, sign, and store documents securely. This not only saves time but also ensures that your application is processed smoothly and efficiently.

-

What are the pricing options for using airSlate SignNow for the Credit Union Branch Application Office Of The Commissioner Of?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses handling the Credit Union Branch Application Office Of The Commissioner Of. Our plans are designed to be cost-effective, ensuring you get the best value for your investment. You can choose from monthly or annual subscriptions based on your usage requirements.

-

What features does airSlate SignNow offer for the Credit Union Branch Application Office Of The Commissioner Of?

airSlate SignNow includes a variety of features that enhance the Credit Union Branch Application Office Of The Commissioner Of process. Key features include customizable templates, secure eSigning, document tracking, and integration with other business tools. These features help ensure that your application process is efficient and compliant.

-

Are there any benefits to using airSlate SignNow for the Credit Union Branch Application Office Of The Commissioner Of?

Using airSlate SignNow for the Credit Union Branch Application Office Of The Commissioner Of offers numerous benefits, including increased efficiency and reduced paperwork. Our platform allows for quick document turnaround, which can signNowly speed up the approval process. Additionally, the secure nature of our service ensures that sensitive information is protected.

-

Can airSlate SignNow integrate with other software for the Credit Union Branch Application Office Of The Commissioner Of?

Yes, airSlate SignNow can seamlessly integrate with various software solutions to enhance the Credit Union Branch Application Office Of The Commissioner Of process. This includes CRM systems, document management tools, and other business applications. These integrations help streamline workflows and improve overall productivity.

-

Is airSlate SignNow compliant with regulations for the Credit Union Branch Application Office Of The Commissioner Of?

Absolutely, airSlate SignNow is designed to comply with all relevant regulations for the Credit Union Branch Application Office Of The Commissioner Of. Our platform adheres to industry standards for security and data protection, ensuring that your documents are handled in a compliant manner. This gives you peace of mind while managing your applications.

Get more for Credit Union Branch Application Office Of The Commissioner Of

- Real estate office policy manual template 100073588 form

- Clickit realty reviews 48848923 form

- Ct600 2018 company tax return ct600 2018 company tax return form

- Title 24 california energy code compliance at each construction form

- Under federal fmla employees are entitled to take ctgov form

- New voter form

- Application for permit driver license or non driver id card permit driver license or non driver id application form

- Hsbc account opening form 12005958

Find out other Credit Union Branch Application Office Of The Commissioner Of

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF