Form M 1PR Property Tax Refund Revenue State Mn

What is the Form M-1PR Property Tax Refund Revenue State MN

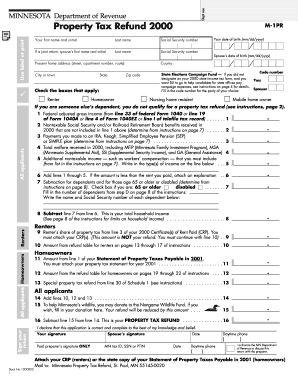

The Form M-1PR is a property tax refund application used in Minnesota. This form allows eligible homeowners and renters to claim a refund on property taxes paid. The Minnesota Department of Revenue administers this program, which aims to provide financial relief to individuals who meet specific criteria. The refund is based on income, property taxes paid, and the type of residency. Understanding the purpose of this form is crucial for those seeking to alleviate their property tax burden.

How to use the Form M-1PR Property Tax Refund Revenue State MN

Using the Form M-1PR involves several steps to ensure accurate completion and submission. First, gather all necessary documentation, including proof of income and property tax statements. Next, fill out the form with your personal information, including your name, address, and Social Security number. Be sure to accurately report your income and any property taxes paid. After completing the form, review it for errors before submitting it to the Minnesota Department of Revenue. Utilizing digital tools can streamline this process, making it easier to fill out and eSign the form.

Steps to complete the Form M-1PR Property Tax Refund Revenue State MN

Completing the Form M-1PR requires careful attention to detail. Follow these steps:

- Collect necessary documents, such as your property tax statement and income records.

- Enter your personal information, including your name and address.

- Provide your Social Security number and any other required identification.

- Report your total income for the year, ensuring accuracy.

- Detail the property taxes you have paid, as this will affect your refund amount.

- Review the form for completeness and accuracy.

- Submit the form electronically or via mail to the Minnesota Department of Revenue.

Eligibility Criteria

To qualify for a refund using the Form M-1PR, applicants must meet specific eligibility criteria. Generally, you must be a Minnesota resident who has paid property taxes on your home or rented a dwelling. Your income must fall below a certain threshold, which varies by household size. Additionally, the property must be your primary residence. Understanding these criteria is essential for determining your eligibility and ensuring a successful application.

Required Documents

When completing the Form M-1PR, several documents are necessary to support your application. These include:

- Your property tax statement, which details the taxes paid.

- Proof of income, such as W-2 forms or tax returns.

- Identification documents, including your Social Security number.

- Any additional documentation that may support your claim, such as proof of residency.

Having these documents ready will facilitate a smoother application process and increase the likelihood of receiving your refund.

Form Submission Methods

The Form M-1PR can be submitted through various methods to accommodate different preferences. Applicants may choose to submit the form online through the Minnesota Department of Revenue's website, which allows for a quicker processing time. Alternatively, you can mail the completed form to the appropriate address provided on the form. In some cases, in-person submissions may be possible at designated state offices. Selecting the right submission method can impact the speed and efficiency of your refund process.

Quick guide on how to complete form m 1pr property tax refund revenue state mn

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by both companies and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed papers, allowing you to locate the appropriate form and store it securely online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Manage [SKS] on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

How to Edit and Electronically Sign [SKS] with Ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive details with features that airSlate SignNow specifically offers for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether it be via email, SMS, an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and electronically sign [SKS] and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form M 1PR Property Tax Refund Revenue State Mn

Create this form in 5 minutes!

How to create an eSignature for the form m 1pr property tax refund revenue state mn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form M 1PR Property Tax Refund Revenue State Mn?

The Form M 1PR Property Tax Refund Revenue State Mn is a document used by residents of Minnesota to apply for property tax refunds. This form helps eligible homeowners and renters receive financial relief based on their property taxes paid. Understanding this form is crucial for maximizing your potential refund.

-

How can airSlate SignNow help with the Form M 1PR Property Tax Refund Revenue State Mn?

airSlate SignNow simplifies the process of completing and submitting the Form M 1PR Property Tax Refund Revenue State Mn. With our eSigning capabilities, you can easily fill out, sign, and send your documents securely. This ensures that your application is processed quickly and efficiently.

-

What are the pricing options for using airSlate SignNow for the Form M 1PR Property Tax Refund Revenue State Mn?

airSlate SignNow offers flexible pricing plans that cater to different needs, whether you're an individual or a business. Our plans are designed to be cost-effective, allowing you to manage your Form M 1PR Property Tax Refund Revenue State Mn submissions without breaking the bank. Check our website for detailed pricing information.

-

Are there any features specifically designed for the Form M 1PR Property Tax Refund Revenue State Mn?

Yes, airSlate SignNow includes features that streamline the completion of the Form M 1PR Property Tax Refund Revenue State Mn. These features include customizable templates, automated reminders, and secure cloud storage, ensuring that your documents are always accessible and organized.

-

What benefits does airSlate SignNow provide for filing the Form M 1PR Property Tax Refund Revenue State Mn?

Using airSlate SignNow for your Form M 1PR Property Tax Refund Revenue State Mn offers numerous benefits, including time savings and enhanced security. Our platform allows you to complete your forms quickly and securely, reducing the risk of errors and ensuring compliance with state regulations.

-

Can I integrate airSlate SignNow with other tools for managing the Form M 1PR Property Tax Refund Revenue State Mn?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage your Form M 1PR Property Tax Refund Revenue State Mn alongside your other business tools. This integration enhances your workflow and ensures that all your documents are in one place.

-

Is there customer support available for questions about the Form M 1PR Property Tax Refund Revenue State Mn?

Yes, airSlate SignNow provides dedicated customer support to assist you with any questions regarding the Form M 1PR Property Tax Refund Revenue State Mn. Our team is available to help you navigate the process and ensure that your submissions are successful.

Get more for Form M 1PR Property Tax Refund Revenue State Mn

Find out other Form M 1PR Property Tax Refund Revenue State Mn

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter