Minnesota Department of Revenue Revenue State Mn Form

Understanding the Minnesota Department of Revenue

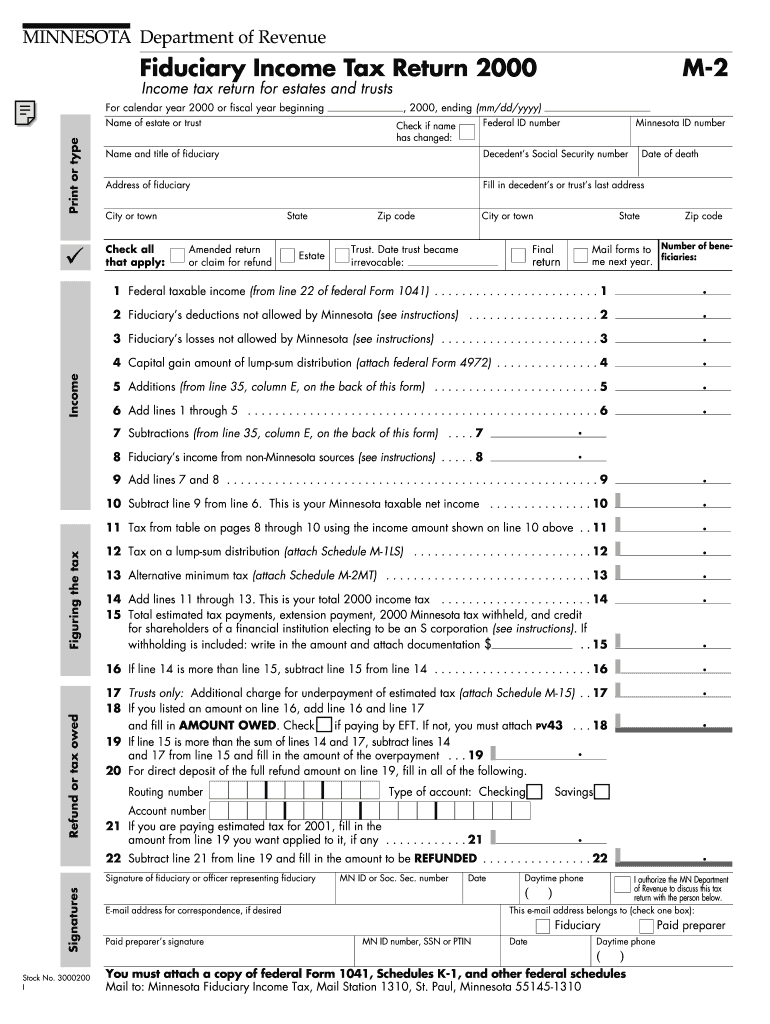

The Minnesota Department of Revenue is the state agency responsible for administering tax laws and collecting taxes in Minnesota. This department oversees various tax-related activities, including income, sales, and property taxes. It plays a crucial role in ensuring compliance with state tax regulations and providing resources to help taxpayers understand their obligations. The agency also manages tax refunds and enforces tax laws to maintain fairness in the state's tax system.

Steps to Complete the Minnesota Department of Revenue Forms

Completing forms from the Minnesota Department of Revenue involves several key steps. First, identify the specific form required for your tax situation, such as income tax returns or sales tax permits. Next, gather all necessary documentation, including income statements, deductions, and credits. Carefully fill out the form, ensuring all information is accurate and complete. After completing the form, review it for any errors before submission. Finally, choose your submission method, whether online, by mail, or in person, to ensure timely processing.

Required Documents for Minnesota Department of Revenue Forms

When preparing to submit forms to the Minnesota Department of Revenue, specific documents are typically required. These may include:

- W-2 forms from employers

- 1099 forms for additional income

- Receipts for deductible expenses

- Proof of residency for certain tax credits

- Previous year’s tax returns for reference

Having these documents ready will facilitate a smoother filing process and help ensure compliance with state tax laws.

Form Submission Methods for the Minnesota Department of Revenue

The Minnesota Department of Revenue offers multiple methods for submitting forms, catering to different preferences and needs. Taxpayers can file forms online through the department's website, which is often the fastest option. Alternatively, forms can be mailed to the appropriate address provided on the form itself. For those who prefer face-to-face interaction, in-person submissions can be made at designated department offices. Each method has its own processing times, so it's essential to choose the one that aligns with your filing deadlines.

Legal Use of Minnesota Department of Revenue Forms

Forms from the Minnesota Department of Revenue are legally binding documents used to report income, claim deductions, and fulfill tax obligations. Accurate completion and submission of these forms are critical to avoid penalties and ensure compliance with state tax laws. Taxpayers should be aware that providing false information on these forms can lead to legal consequences, including fines and potential criminal charges. Therefore, it is vital to understand the legal implications of the information provided.

Eligibility Criteria for Minnesota Department of Revenue Forms

Eligibility criteria for various forms from the Minnesota Department of Revenue can vary based on the type of tax being filed. For example, income tax forms may require individuals to meet specific income thresholds or residency requirements. Additionally, certain tax credits may only be available to taxpayers who meet particular qualifications, such as age or family status. It is important for taxpayers to review the eligibility requirements for each form to ensure they qualify before submission.

Quick guide on how to complete minnesota department of revenue revenue state mn

Effortlessly Prepare [SKS] on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage [SKS] on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-based process today.

The easiest way to edit and eSign [SKS] with minimal effort

- Obtain [SKS] and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Select key sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign [SKS] to guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Minnesota Department Of Revenue Revenue State Mn

Create this form in 5 minutes!

How to create an eSignature for the minnesota department of revenue revenue state mn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Minnesota Department Of Revenue Revenue State Mn?

The Minnesota Department Of Revenue Revenue State Mn is the state agency responsible for collecting taxes and managing revenue in Minnesota. It oversees various tax programs and ensures compliance with state tax laws. Understanding its functions can help businesses navigate their tax obligations effectively.

-

How can airSlate SignNow help with Minnesota Department Of Revenue Revenue State Mn compliance?

airSlate SignNow provides an efficient way to manage and eSign documents required for compliance with the Minnesota Department Of Revenue Revenue State Mn. Our platform streamlines the document workflow, ensuring that all necessary forms are completed and submitted accurately. This reduces the risk of errors and helps maintain compliance with state regulations.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans designed to meet the needs of various businesses. Our plans are cost-effective and provide access to essential features that facilitate document management and eSigning. For specific pricing details related to the Minnesota Department Of Revenue Revenue State Mn, please visit our pricing page.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure cloud storage. These tools help businesses efficiently manage their documents, especially those related to the Minnesota Department Of Revenue Revenue State Mn. Our platform ensures that all documents are easily accessible and securely stored.

-

Can airSlate SignNow integrate with other software for tax management?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax management software. This integration allows businesses to streamline their processes and ensure that documents related to the Minnesota Department Of Revenue Revenue State Mn are easily accessible. By connecting your tools, you can enhance productivity and maintain compliance.

-

What are the benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow for eSigning offers numerous benefits, including increased efficiency, reduced turnaround times, and enhanced security. Our platform is designed to simplify the signing process, making it easier for businesses to handle documents related to the Minnesota Department Of Revenue Revenue State Mn. This leads to faster transactions and improved customer satisfaction.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive tax documents. We implement advanced encryption and security measures to protect your data, especially when dealing with the Minnesota Department Of Revenue Revenue State Mn. You can trust our platform to keep your information secure.

Get more for Minnesota Department Of Revenue Revenue State Mn

- Family educational rights and privacy actferpaoffice of form

- Authorization agreement for automatic deposits ecu form

- Preceptorsschool of nursingthe university of texas at austin form

- Forms4indd

- This form is not an application to be admitted to la sierra university or pacific union college

- Accident claim form clemson university

- Immunization waiver for new non degree student less than 6 credits immunization waiver form for new students first semester

- Undergraduate non degree application brooklyncunyedu brooklyn cuny form

Find out other Minnesota Department Of Revenue Revenue State Mn

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free