Schedule M 1MTC MINNESOTA Department of Revenue Attachment Sequence #17 Minnesota Alternative Minimum Tax Credit Your Last Name Form

Understanding the Schedule M 1MTC

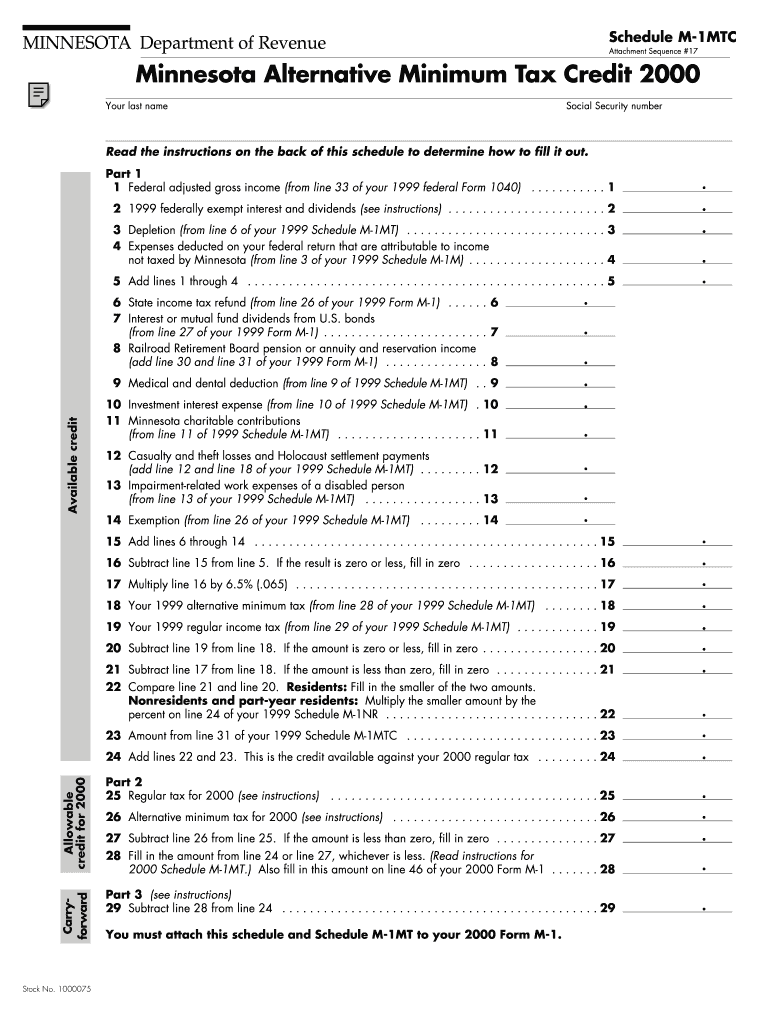

The Schedule M 1MTC is a specific form provided by the Minnesota Department of Revenue, used to claim the Minnesota Alternative Minimum Tax Credit. This form is essential for taxpayers who may be subject to the alternative minimum tax, allowing them to reduce their tax liability. It is important to accurately complete this form to ensure compliance with state tax regulations.

Steps to Complete the Schedule M 1MTC

To fill out the Schedule M 1MTC, follow these steps:

- Gather necessary information, including your last name and Social Security number.

- Read the instructions on the back of the schedule carefully to understand the requirements.

- Complete each section of the form, ensuring that all entries are accurate and legible.

- Double-check your calculations to avoid errors that could lead to delays or penalties.

- Submit the completed form along with your tax return by the designated deadline.

Eligibility Criteria for the Minnesota Alternative Minimum Tax Credit

To qualify for the Minnesota Alternative Minimum Tax Credit, you must meet certain eligibility criteria. These criteria typically include:

- Filing a Minnesota tax return for the applicable tax year.

- Having income that exceeds the alternative minimum tax threshold.

- Meeting any additional state-specific requirements outlined by the Minnesota Department of Revenue.

Required Documents for Filing

When completing the Schedule M 1MTC, you will need to provide specific documentation, including:

- Your completed Minnesota tax return.

- Any supporting documents related to income and deductions.

- Previous tax returns if applicable, to verify your tax history.

Form Submission Methods

The Schedule M 1MTC can be submitted through various methods, including:

- Online submission via the Minnesota Department of Revenue's e-filing system.

- Mailing the completed form to the appropriate address provided in the instructions.

- In-person submission at designated tax offices, if available.

Common Mistakes to Avoid

When filling out the Schedule M 1MTC, be mindful of common mistakes that could lead to complications:

- Failing to read the instructions thoroughly, which can result in incomplete or incorrect forms.

- Not double-checking personal information, such as your name and Social Security number.

- Omitting necessary supporting documents that validate your claims.

Quick guide on how to complete schedule m 1mtc minnesota department of revenue attachment sequence 17 minnesota alternative minimum tax credit your last name

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained traction among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Manage [SKS] on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related operation today.

How to Modify and Electronically Sign [SKS] with Ease

- Obtain [SKS] and click Get Form to begin.

- Employ the tools we provide to complete your form.

- Emphasize important sections of your documents or redact confidential information using tools that airSlate SignNow specifically provides for this purpose.

- Generate your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or errors that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign [SKS] and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule M 1MTC MINNESOTA Department Of Revenue Attachment Sequence #17 Minnesota Alternative Minimum Tax Credit Your Last Name

Create this form in 5 minutes!

How to create an eSignature for the schedule m 1mtc minnesota department of revenue attachment sequence 17 minnesota alternative minimum tax credit your last name

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule M 1MTC MINNESOTA Department Of Revenue Attachment Sequence #17?

The Schedule M 1MTC MINNESOTA Department Of Revenue Attachment Sequence #17 is a form used to claim the Minnesota Alternative Minimum Tax Credit. It is essential for taxpayers to accurately fill out this schedule to ensure they receive the appropriate credits. Be sure to include your last name and social security number as instructed.

-

How do I fill out the Schedule M 1MTC MINNESOTA Department Of Revenue Attachment Sequence #17?

To fill out the Schedule M 1MTC MINNESOTA Department Of Revenue Attachment Sequence #17, read the instructions on the back of the schedule carefully. This will guide you through the necessary steps to complete the form accurately, ensuring you include your last name and social security number.

-

What are the benefits of using airSlate SignNow for submitting my Schedule M 1MTC?

Using airSlate SignNow allows you to easily eSign and send your Schedule M 1MTC MINNESOTA Department Of Revenue Attachment Sequence #17 securely. Our platform is user-friendly and cost-effective, making it simple to manage your tax documents without hassle.

-

Is there a cost associated with using airSlate SignNow for tax documents?

Yes, airSlate SignNow offers various pricing plans to suit different needs. Our solutions are designed to be cost-effective while providing robust features for managing documents like the Schedule M 1MTC MINNESOTA Department Of Revenue Attachment Sequence #17.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various tax preparation software, enhancing your workflow. This allows you to manage your Schedule M 1MTC MINNESOTA Department Of Revenue Attachment Sequence #17 alongside other tax documents efficiently.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides features such as eSigning, document templates, and secure storage. These tools are particularly useful for managing forms like the Schedule M 1MTC MINNESOTA Department Of Revenue Attachment Sequence #17, ensuring you can complete your tax filings with ease.

-

How secure is my information when using airSlate SignNow?

Your information is highly secure with airSlate SignNow. We implement advanced encryption and security protocols to protect sensitive data, including your last name and social security number when filling out the Schedule M 1MTC MINNESOTA Department Of Revenue Attachment Sequence #17.

Get more for Schedule M 1MTC MINNESOTA Department Of Revenue Attachment Sequence #17 Minnesota Alternative Minimum Tax Credit Your Last Name

Find out other Schedule M 1MTC MINNESOTA Department Of Revenue Attachment Sequence #17 Minnesota Alternative Minimum Tax Credit Your Last Name

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile