Schedule M1nr NonresidentsPart Year Residents Form

What is the Schedule M1nr NonresidentsPart Year Residents

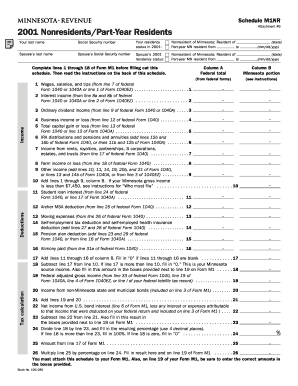

The Schedule M1nr NonresidentsPart Year Residents is a tax form used by individuals who are nonresidents or part-year residents of a state in the United States. This form is essential for reporting income earned within the state and calculating the appropriate tax liability. It allows taxpayers to declare their income accurately and ensures compliance with state tax laws. Understanding this form is crucial for those who have income sourced from a state while residing elsewhere, as it helps determine the correct amount of tax owed.

Steps to complete the Schedule M1nr NonresidentsPart Year Residents

Completing the Schedule M1nr NonresidentsPart Year Residents involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your residency status for the tax year, identifying the period of residency and nonresidency.

- Report your total income earned during the year, including income earned while a resident and nonresident.

- Calculate the amount of income that is taxable in the state, using the appropriate formulas provided in the form instructions.

- Complete all sections of the form, ensuring accuracy in reporting income and deductions.

- Review the form for any errors before submission.

Key elements of the Schedule M1nr NonresidentsPart Year Residents

Several key elements are crucial when filling out the Schedule M1nr NonresidentsPart Year Residents:

- Personal Information: Include your name, address, and Social Security number.

- Residency Period: Clearly state the dates you were a resident and a nonresident of the state.

- Income Reporting: Accurately report all income earned during the year, distinguishing between state-sourced and non-state-sourced income.

- Deductions: Identify any deductions that apply to your situation, which may reduce your taxable income.

- Tax Calculation: Follow the form’s guidelines to calculate the tax owed based on the reported income.

Legal use of the Schedule M1nr NonresidentsPart Year Residents

The Schedule M1nr NonresidentsPart Year Residents is legally required for individuals who meet specific criteria regarding residency and income sourcing. Filing this form accurately is crucial to comply with state tax laws and avoid potential penalties. It serves as a formal declaration of income and tax liability, ensuring that the state can assess tax obligations correctly. Failure to file or inaccuracies in the form can lead to legal repercussions, including fines or audits by tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule M1nr NonresidentsPart Year Residents typically align with the state’s tax filing deadlines. Generally, individuals must submit their forms by April fifteenth of the following tax year. However, it is important to check specific state regulations, as some states may have different deadlines. Extensions may be available, but they often require filing a separate request. Staying informed about these dates is essential to ensure timely compliance and avoid late fees.

Examples of using the Schedule M1nr NonresidentsPart Year Residents

There are various scenarios where the Schedule M1nr NonresidentsPart Year Residents would be applicable:

- A student who attends college in a different state while maintaining residency in their home state.

- A professional who works temporarily in a state but resides elsewhere.

- Individuals who move to a new state during the tax year, earning income in both the old and new states.

In each case, accurately reporting income and understanding the residency periods is crucial for compliance and tax calculation.

Quick guide on how to complete schedule m1nr nonresidentspart year residents

Easily Prepare [SKS] on Any Device

Managing documents online has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the right template and securely store it on the internet. airSlate SignNow supplies all the resources necessary to create, amend, and electronically sign your documents quickly without any delays. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify any document-driven procedure today.

The Easiest Way to Edit and Electronically Sign [SKS]

- Find [SKS] and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize important parts of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for this purpose.

- Generate your electronic signature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes requiring new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your choosing. Edit and electronically sign [SKS] to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule M1nr NonresidentsPart Year Residents

Create this form in 5 minutes!

How to create an eSignature for the schedule m1nr nonresidentspart year residents

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule M1nr NonresidentsPart Year Residents?

Schedule M1nr NonresidentsPart Year Residents is a tax form used by nonresidents and part-year residents in Minnesota to report income and calculate their tax liability. This form helps ensure that individuals pay the correct amount of tax based on their residency status and income earned in the state.

-

How can airSlate SignNow assist with Schedule M1nr NonresidentsPart Year Residents?

airSlate SignNow provides an efficient platform for eSigning and sending documents related to Schedule M1nr NonresidentsPart Year Residents. Our solution simplifies the process, allowing users to complete and submit their tax forms securely and quickly, ensuring compliance with state regulations.

-

What are the pricing options for using airSlate SignNow for Schedule M1nr NonresidentsPart Year Residents?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of individuals and businesses. Our cost-effective solutions ensure that you can manage your Schedule M1nr NonresidentsPart Year Residents documentation without breaking the bank, with options for monthly or annual subscriptions.

-

Are there any features specifically designed for Schedule M1nr NonresidentsPart Year Residents?

Yes, airSlate SignNow includes features that streamline the completion of Schedule M1nr NonresidentsPart Year Residents. These features include customizable templates, automated reminders, and secure storage, making it easier for users to manage their tax documents efficiently.

-

Can I integrate airSlate SignNow with other software for Schedule M1nr NonresidentsPart Year Residents?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing your workflow for Schedule M1nr NonresidentsPart Year Residents. This integration allows for easy data transfer and ensures that your documents are always up-to-date.

-

What benefits does airSlate SignNow offer for managing Schedule M1nr NonresidentsPart Year Residents?

Using airSlate SignNow for Schedule M1nr NonresidentsPart Year Residents provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and stored securely, giving you peace of mind during tax season.

-

Is airSlate SignNow user-friendly for completing Schedule M1nr NonresidentsPart Year Residents?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate and complete their Schedule M1nr NonresidentsPart Year Residents. Our intuitive interface allows users to quickly find the tools they need to manage their documents effectively.

Get more for Schedule M1nr NonresidentsPart Year Residents

Find out other Schedule M1nr NonresidentsPart Year Residents

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free