Age 65 or OlderDisabled Subtraction Department of Revenue Form

What is the Age 65 Or Older Disabled Subtraction Department Of Revenue

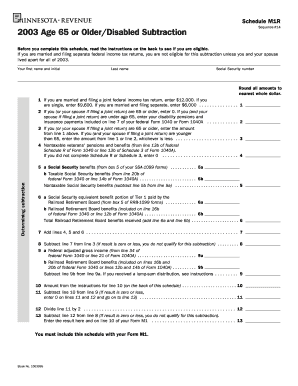

The Age 65 Or Older Disabled Subtraction is a tax benefit provided by the Department of Revenue in various states. This subtraction allows eligible individuals who are 65 years of age or older, or those who are disabled, to reduce their taxable income. By lowering the amount of income subject to taxation, this subtraction can lead to significant savings on state income taxes. The specifics of this subtraction, including eligibility criteria and the amount that can be deducted, vary by state.

Eligibility Criteria for the Age 65 Or Older Disabled Subtraction

To qualify for the Age 65 Or Older Disabled Subtraction, individuals generally must meet certain criteria:

- Must be at least 65 years old or have a qualifying disability.

- Must be a resident of the state where the subtraction is being claimed.

- Must meet income limits set by the Department of Revenue.

It is important to review the specific requirements for your state, as they can differ significantly.

Steps to Complete the Age 65 Or Older Disabled Subtraction

Completing the Age 65 Or Older Disabled Subtraction typically involves the following steps:

- Gather necessary documentation, including proof of age or disability.

- Obtain the appropriate tax forms from the Department of Revenue.

- Fill out the tax forms, ensuring to include the subtraction in the designated area.

- Double-check all entries for accuracy.

- Submit the completed forms by the state’s filing deadline.

Each state may have its own specific forms and submission guidelines, so it is advisable to consult the state Department of Revenue for detailed instructions.

Required Documents for the Age 65 Or Older Disabled Subtraction

When applying for the Age 65 Or Older Disabled Subtraction, certain documents are typically required:

- Proof of age, such as a birth certificate or driver's license.

- Documentation of disability, if applicable, which may include medical records or a disability benefits statement.

- Income statements to verify eligibility based on income limits.

Having these documents ready can streamline the application process and ensure compliance with state regulations.

Form Submission Methods

Individuals can submit the Age 65 Or Older Disabled Subtraction form through various methods, depending on state regulations:

- Online: Many states offer electronic filing options through their Department of Revenue websites.

- Mail: Completed forms can often be printed and mailed to the appropriate state tax office.

- In-Person: Some individuals may prefer to submit forms in person at local tax offices.

Each submission method may have different processing times, so it's beneficial to choose the one that best fits your needs.

Examples of Using the Age 65 Or Older Disabled Subtraction

Understanding how the Age 65 Or Older Disabled Subtraction works can be illustrated through examples:

- An individual aged 66 with a total income of $50,000 may qualify to subtract a certain amount from their taxable income, reducing their overall tax burden.

- A disabled taxpayer earning $40,000 might also be eligible for the subtraction, depending on their specific circumstances and state guidelines.

These examples highlight how the subtraction can provide financial relief for eligible taxpayers.

Quick guide on how to complete age 65 or olderdisabled subtraction department of revenue

Effortlessly Manage [SKS] on Any Device

The management of online documents has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to swiftly create, modify, and eSign your documents without any hindrances. Manage [SKS] on any device using the airSlate SignNow applications available for Android and iOS, and enhance any document-centric procedure today.

How to Edit and eSign [SKS] Effortlessly

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Generate your eSignature utilizing the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or invite link, or download it onto your computer.

Eliminate concerns about lost or mislaid files, tedious form searching, or mistakes that necessitate reprinting document copies. airSlate SignNow fulfills your requirements in document management in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Age 65 Or OlderDisabled Subtraction Department Of Revenue

Create this form in 5 minutes!

How to create an eSignature for the age 65 or olderdisabled subtraction department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Age 65 Or OlderDisabled Subtraction Department Of Revenue?

The Age 65 Or OlderDisabled Subtraction Department Of Revenue refers to a tax benefit available to eligible individuals who are 65 years or older or disabled. This subtraction allows qualifying taxpayers to reduce their taxable income, potentially lowering their overall tax liability. Understanding this benefit can help you maximize your tax savings.

-

How can airSlate SignNow assist with the Age 65 Or OlderDisabled Subtraction Department Of Revenue documentation?

airSlate SignNow provides an efficient platform for creating, sending, and eSigning documents related to the Age 65 Or OlderDisabled Subtraction Department Of Revenue. Our user-friendly interface simplifies the process of managing tax documents, ensuring you can easily submit necessary forms to the Department of Revenue. This streamlines your tax preparation and filing process.

-

What features does airSlate SignNow offer for tax-related documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax-related documents like those for the Age 65 Or OlderDisabled Subtraction Department Of Revenue. These features enhance efficiency and ensure that your documents are handled securely and professionally. You can also collaborate with tax professionals directly within the platform.

-

Is there a cost associated with using airSlate SignNow for tax documents?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including those related to the Age 65 Or OlderDisabled Subtraction Department Of Revenue. Our plans are designed to be cost-effective, providing excellent value for businesses and individuals alike. You can choose a plan that fits your budget while accessing all necessary features for document management.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software, making it easier to manage documents related to the Age 65 Or OlderDisabled Subtraction Department Of Revenue. This integration allows for a smooth workflow, ensuring that all your tax documents are organized and accessible in one place. You can enhance your productivity by connecting your favorite tools.

-

What are the benefits of using airSlate SignNow for tax documentation?

Using airSlate SignNow for tax documentation, including the Age 65 Or OlderDisabled Subtraction Department Of Revenue, offers numerous benefits such as increased efficiency, enhanced security, and reduced paper clutter. Our platform allows you to manage documents digitally, making it easier to track and store important tax information. This can lead to signNow time savings during tax season.

-

How secure is airSlate SignNow for handling sensitive tax documents?

Security is a top priority at airSlate SignNow, especially when handling sensitive tax documents like those for the Age 65 Or OlderDisabled Subtraction Department Of Revenue. We utilize advanced encryption and security protocols to protect your data. You can trust that your documents are safe and secure while using our platform.

Get more for Age 65 Or OlderDisabled Subtraction Department Of Revenue

Find out other Age 65 Or OlderDisabled Subtraction Department Of Revenue

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy

- How Can I eSign Wisconsin Escrow Agreement

- How To eSign Nebraska Sales Invoice Template

- eSign Nebraska Sales Invoice Template Simple

- eSign New York Sales Invoice Template Now