Memorandum for Setting for Hearing LAADPT019 Rev041015 Dotx Michigan Fiduciary Income Tax Return 2014

What is the Memorandum For Setting For Hearing LAADPT019 Rev041015 dotx Michigan Fiduciary Income Tax Return

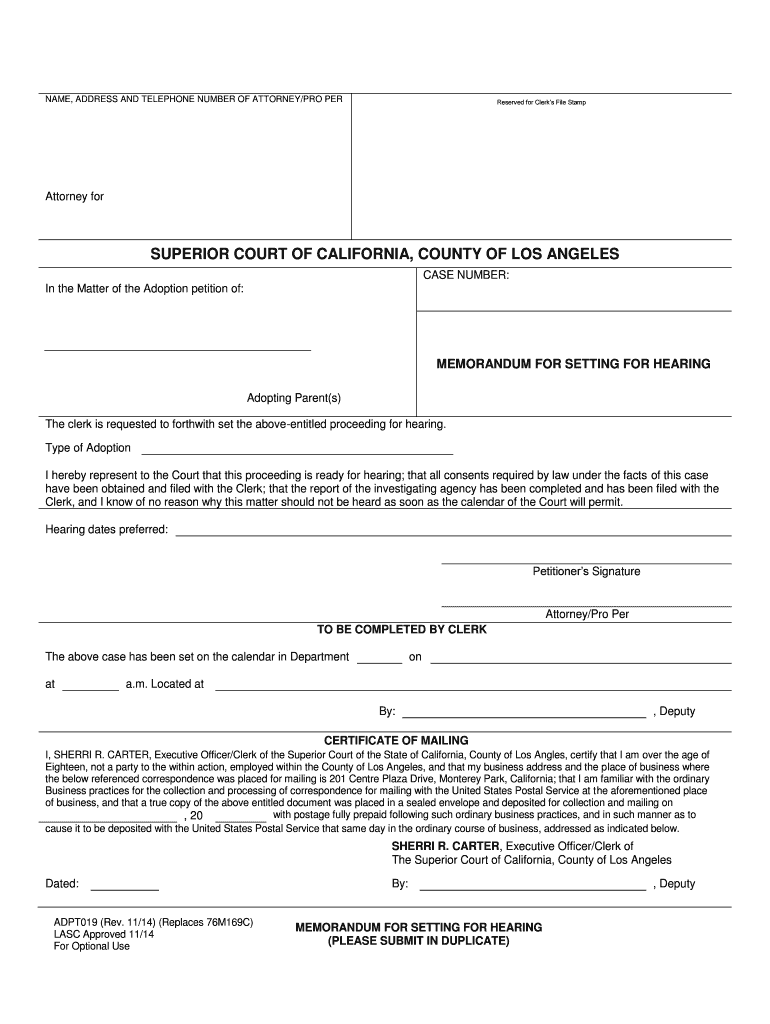

The Memorandum For Setting For Hearing LAADPT019 Rev041015 dotx Michigan Fiduciary Income Tax Return is a legal document used in Michigan's fiduciary tax process. This form is essential for initiating a hearing regarding a fiduciary income tax return, which may involve estates or trusts. It serves as a formal request to schedule a hearing, allowing the involved parties to present their case regarding tax obligations or disputes. Understanding this form is crucial for fiduciaries, as it outlines the necessary steps and requirements for compliance with state tax regulations.

How to use the Memorandum For Setting For Hearing LAADPT019 Rev041015 dotx Michigan Fiduciary Income Tax Return

Using the Memorandum For Setting For Hearing LAADPT019 Rev041015 dotx Michigan Fiduciary Income Tax Return involves several steps. Initially, the fiduciary must complete the form accurately, ensuring all required information is included. This includes identifying the parties involved, the nature of the dispute, and relevant tax details. Once completed, the memorandum should be filed with the appropriate court or tax authority. It is advisable to retain a copy for personal records. Understanding the proper usage of this document helps ensure that the hearing is scheduled and conducted in accordance with legal standards.

Steps to complete the Memorandum For Setting For Hearing LAADPT019 Rev041015 dotx Michigan Fiduciary Income Tax Return

Completing the Memorandum For Setting For Hearing LAADPT019 Rev041015 dotx Michigan Fiduciary Income Tax Return requires careful attention to detail. Follow these steps:

- Gather all necessary information regarding the fiduciary income tax return.

- Fill out the form, ensuring that all fields are completed accurately.

- Review the form for any errors or omissions.

- Sign the memorandum to authenticate it.

- Submit the completed form to the appropriate court or tax authority.

Each step is vital to ensure the memorandum is valid and that the hearing can proceed without delays.

Legal use of the Memorandum For Setting For Hearing LAADPT019 Rev041015 dotx Michigan Fiduciary Income Tax Return

The legal use of the Memorandum For Setting For Hearing LAADPT019 Rev041015 dotx Michigan Fiduciary Income Tax Return is defined by Michigan tax law. This document must be used in accordance with the regulations governing fiduciary income tax disputes. It is essential for the memorandum to be filed within specified timeframes to ensure compliance. The memorandum serves as a formal request for a hearing, making it a critical component in resolving tax-related issues. Proper legal use helps protect the rights of the fiduciary and ensures that all parties have the opportunity to present their case.

Key elements of the Memorandum For Setting For Hearing LAADPT019 Rev041015 dotx Michigan Fiduciary Income Tax Return

Several key elements must be included in the Memorandum For Setting For Hearing LAADPT019 Rev041015 dotx Michigan Fiduciary Income Tax Return to ensure its validity:

- Identifying Information: Names and addresses of all parties involved.

- Case Details: A brief description of the dispute and relevant tax issues.

- Requested Hearing Date: Proposed dates for the hearing, if applicable.

- Signature: The signature of the fiduciary or their representative.

Inclusion of these elements is crucial for the memorandum to be recognized legally and to facilitate the hearing process.

Filing Deadlines / Important Dates

Filing deadlines for the Memorandum For Setting For Hearing LAADPT019 Rev041015 dotx Michigan Fiduciary Income Tax Return are critical to ensure compliance with Michigan tax law. Typically, the memorandum must be filed within a specific timeframe following the issuance of a tax notice or determination. It is advisable to check the latest regulations or consult with a tax professional to confirm the exact deadlines. Missing these deadlines may result in the inability to contest tax decisions, emphasizing the importance of timely filing.

Quick guide on how to complete memorandum for setting for hearing laadpt019 rev041015dotx 2012 michigan fiduciary income tax return

Prepare Memorandum For Setting For Hearing LAADPT019 Rev041015 dotx Michigan Fiduciary Income Tax Return effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to easily find the correct form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Memorandum For Setting For Hearing LAADPT019 Rev041015 dotx Michigan Fiduciary Income Tax Return on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest method to edit and eSign Memorandum For Setting For Hearing LAADPT019 Rev041015 dotx Michigan Fiduciary Income Tax Return without any hassle

- Find Memorandum For Setting For Hearing LAADPT019 Rev041015 dotx Michigan Fiduciary Income Tax Return and then click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight relevant parts of your documents or conceal sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which only takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all details and then click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Memorandum For Setting For Hearing LAADPT019 Rev041015 dotx Michigan Fiduciary Income Tax Return, ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct memorandum for setting for hearing laadpt019 rev041015dotx 2012 michigan fiduciary income tax return

Create this form in 5 minutes!

How to create an eSignature for the memorandum for setting for hearing laadpt019 rev041015dotx 2012 michigan fiduciary income tax return

The way to create an electronic signature for your PDF document online

The way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

How to make an electronic signature for a PDF on Android OS

People also ask

-

What is the Memorandum For Setting For Hearing LAADPT019 Rev041015 dotx Michigan Fiduciary Income Tax Return?

The Memorandum For Setting For Hearing LAADPT019 Rev041015 dotx Michigan Fiduciary Income Tax Return is a crucial document for fiduciaries managing Michigan state taxes. It outlines the procedural framework necessary for hearings related to fiduciary income tax matters, ensuring compliance and systematic processing.

-

How can airSlate SignNow help me with the Memorandum For Setting For Hearing LAADPT019 Rev041015 dotx Michigan Fiduciary Income Tax Return?

airSlate SignNow simplifies the process of drafting, signing, and sending the Memorandum For Setting For Hearing LAADPT019 Rev041015 dotx Michigan Fiduciary Income Tax Return. Utilizing our platform, you can quickly eSign and securely share your documents, streamlining compliance and reducing administrative burdens.

-

What are the pricing options available for airSlate SignNow when dealing with the Memorandum For Setting For Hearing LAADPT019 Rev041015 dotx Michigan Fiduciary Income Tax Return?

airSlate SignNow offers competitive pricing tailored to your document management needs, including features for handling the Memorandum For Setting For Hearing LAADPT019 Rev041015 dotx Michigan Fiduciary Income Tax Return. Plans are designed for individuals, small businesses, and enterprises, ensuring flexibility and value for every budget.

-

Are there any integrations available for airSlate SignNow that assist with the Memorandum For Setting For Hearing LAADPT019 Rev041015 dotx Michigan Fiduciary Income Tax Return?

Yes, airSlate SignNow integrates with a variety of third-party applications, enhancing the efficiency of managing the Memorandum For Setting For Hearing LAADPT019 Rev041015 dotx Michigan Fiduciary Income Tax Return. Integrations with cloud storage services and business tools ensure seamless workflow and document accessibility.

-

What features does airSlate SignNow offer for handling the Memorandum For Setting For Hearing LAADPT019 Rev041015 dotx Michigan Fiduciary Income Tax Return?

airSlate SignNow provides features such as templates, customizable workflows, and advanced security options to facilitate the effective handling of the Memorandum For Setting For Hearing LAADPT019 Rev041015 dotx Michigan Fiduciary Income Tax Return. These features help improve efficiency and maintain the integrity of your legal documents.

-

Is it easy to use airSlate SignNow for the Memorandum For Setting For Hearing LAADPT019 Rev041015 dotx Michigan Fiduciary Income Tax Return?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it simple for anyone to create, edit, and eSign the Memorandum For Setting For Hearing LAADPT019 Rev041015 dotx Michigan Fiduciary Income Tax Return. Our intuitive interface ensures that you can manage your documents effortlessly, regardless of your technical expertise.

-

What are the benefits of using airSlate SignNow for the Memorandum For Setting For Hearing LAADPT019 Rev041015 dotx Michigan Fiduciary Income Tax Return?

Using airSlate SignNow for the Memorandum For Setting For Hearing LAADPT019 Rev041015 dotx Michigan Fiduciary Income Tax Return benefits you with enhanced security, reduced processing times, and the ability to stay organized. Our platform contributes to better compliance and increases the overall efficiency of managing your tax return documents.

Get more for Memorandum For Setting For Hearing LAADPT019 Rev041015 dotx Michigan Fiduciary Income Tax Return

Find out other Memorandum For Setting For Hearing LAADPT019 Rev041015 dotx Michigan Fiduciary Income Tax Return

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT