M1M, Additions and Subtractions Minnesota Department of Form

What is the M1M, Additions And Subtractions Minnesota Department Of

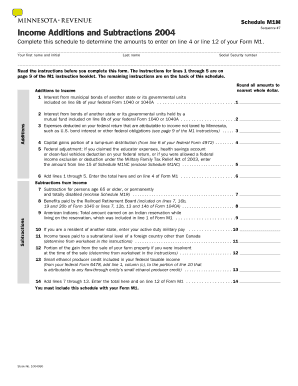

The M1M form, officially known as Additions and Subtractions, is a critical document used by taxpayers in Minnesota to report specific adjustments to their income. This form allows individuals to make necessary additions or subtractions to their federal adjusted gross income, ensuring that their state tax obligations accurately reflect their financial situation. The adjustments may include items such as tax-exempt interest, state income tax refunds, and various deductions that are unique to Minnesota tax law.

How to use the M1M, Additions And Subtractions Minnesota Department Of

Using the M1M form involves a straightforward process. Taxpayers should first gather all relevant financial documents, including their federal tax return. Next, they will need to identify which additions and subtractions apply to their situation. The form provides clear instructions on how to calculate these adjustments, ensuring that all entries are accurate. Once completed, the M1M can be submitted alongside the Minnesota income tax return, allowing for a comprehensive overview of the taxpayer's financial obligations.

Steps to complete the M1M, Additions And Subtractions Minnesota Department Of

Completing the M1M form requires careful attention to detail. Here are the essential steps:

- Gather your federal tax return and any supporting documents.

- Review the M1M instructions to understand the required additions and subtractions.

- Fill out the form, ensuring that each line reflects accurate figures based on your financial documents.

- Double-check all calculations to avoid errors.

- Submit the completed M1M form with your Minnesota income tax return.

Key elements of the M1M, Additions And Subtractions Minnesota Department Of

The M1M form includes several key elements that taxpayers must be aware of. These include:

- Additions: Items that increase your taxable income, such as certain types of interest and state tax refunds.

- Subtractions: Deductions that reduce your taxable income, including specific exemptions and credits unique to Minnesota.

- Instructions: Detailed guidance on how to fill out the form correctly, including examples of common additions and subtractions.

Legal use of the M1M, Additions And Subtractions Minnesota Department Of

The M1M form is legally required for Minnesota taxpayers who need to report adjustments to their income. Accurate completion of this form is essential to comply with state tax laws. Failing to report necessary additions or subtractions can result in penalties or audits. Therefore, it is crucial for taxpayers to understand their legal obligations regarding the use of the M1M form.

Filing Deadlines / Important Dates

Timely filing of the M1M form is important to avoid penalties. The deadline for submitting the M1M typically aligns with the state income tax return deadline, which is usually April fifteenth each year. Taxpayers should be aware of any extensions that may apply and ensure that they submit their forms on time to maintain compliance with Minnesota tax regulations.

Quick guide on how to complete m1m additions and subtractions minnesota department of

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight important sections of your documents or conceal sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Generate your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to M1M, Additions And Subtractions Minnesota Department Of

Create this form in 5 minutes!

How to create an eSignature for the m1m additions and subtractions minnesota department of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the M1M, Additions And Subtractions Minnesota Department Of form?

The M1M, Additions And Subtractions Minnesota Department Of form is used to report adjustments to your Minnesota taxable income. This form allows taxpayers to add or subtract specific amounts from their federal adjusted gross income to accurately calculate their state tax liability.

-

How can airSlate SignNow help with the M1M, Additions And Subtractions Minnesota Department Of form?

airSlate SignNow streamlines the process of completing and submitting the M1M, Additions And Subtractions Minnesota Department Of form by providing an easy-to-use platform for eSigning and document management. This ensures that your forms are filled out correctly and submitted on time, reducing the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the M1M, Additions And Subtractions Minnesota Department Of form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans are designed to be cost-effective, ensuring that you can manage your M1M, Additions And Subtractions Minnesota Department Of forms without breaking the bank.

-

What features does airSlate SignNow offer for managing the M1M, Additions And Subtractions Minnesota Department Of form?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking, which are essential for managing the M1M, Additions And Subtractions Minnesota Department Of form. These features enhance efficiency and ensure compliance with state regulations.

-

Can I integrate airSlate SignNow with other software for the M1M, Additions And Subtractions Minnesota Department Of form?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage your M1M, Additions And Subtractions Minnesota Department Of form alongside your existing tools. This integration helps streamline your workflow and improve productivity.

-

What are the benefits of using airSlate SignNow for the M1M, Additions And Subtractions Minnesota Department Of form?

Using airSlate SignNow for the M1M, Additions And Subtractions Minnesota Department Of form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform simplifies the eSigning process, making it easier for you to focus on your business.

-

How secure is airSlate SignNow when handling the M1M, Additions And Subtractions Minnesota Department Of form?

airSlate SignNow prioritizes security by employing advanced encryption and compliance measures to protect your documents, including the M1M, Additions And Subtractions Minnesota Department Of form. You can trust that your sensitive information is safe and secure throughout the signing process.

Get more for M1M, Additions And Subtractions Minnesota Department Of

Find out other M1M, Additions And Subtractions Minnesota Department Of

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now