M1CD, Child and Dependent Care Credit Form

Understanding the M1CD, Child And Dependent Care Credit

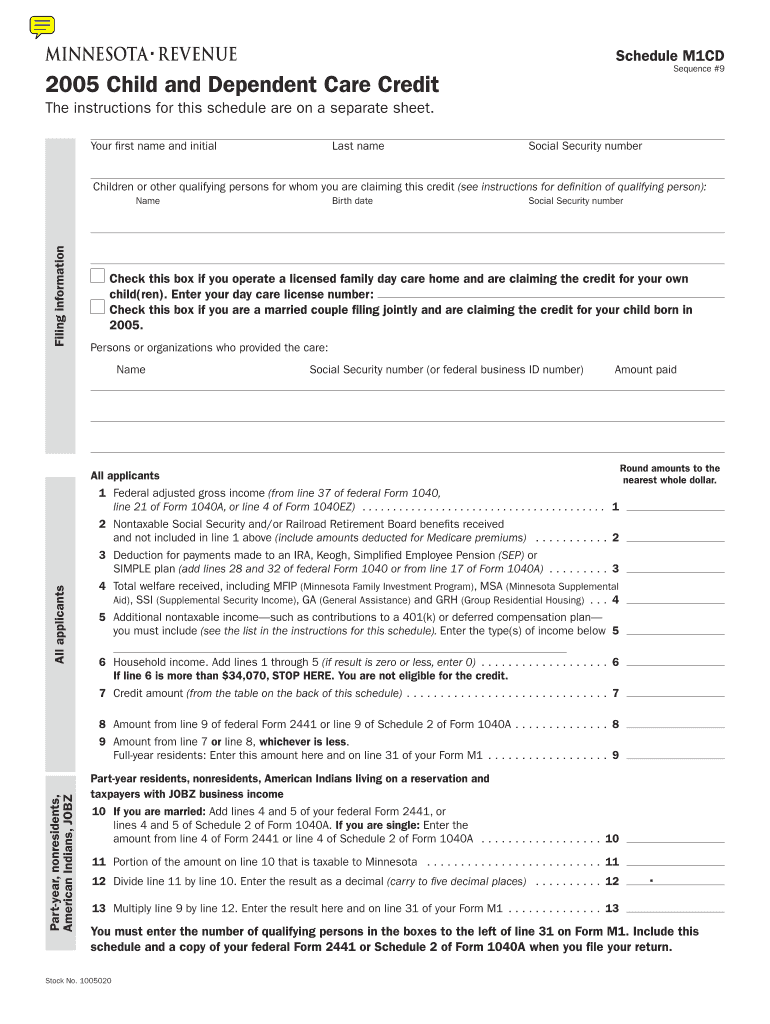

The M1CD, Child And Dependent Care Credit, is a tax credit available to eligible taxpayers in the United States. This credit helps offset the costs of care for children under the age of thirteen or for dependents who are unable to care for themselves. By providing financial relief, the M1CD encourages working families to seek necessary childcare services while they pursue employment or education.

Eligibility Criteria for the M1CD, Child And Dependent Care Credit

To qualify for the M1CD, taxpayers must meet specific eligibility requirements. First, the taxpayer must have earned income during the tax year. Additionally, the care must be provided for a qualifying child or dependent while the taxpayer is working or looking for work. The care provider cannot be a relative of the taxpayer, and the taxpayer must file a federal income tax return to claim the credit.

Steps to Complete the M1CD, Child And Dependent Care Credit

Completing the M1CD requires careful attention to detail. Begin by gathering all necessary documentation, including receipts for childcare expenses and the provider's information. Next, fill out the M1CD form, ensuring that all required fields are completed accurately. Calculate the amount of credit based on your qualifying expenses, and include this information on your tax return. It is essential to review the form for accuracy before submission to avoid delays or penalties.

Required Documents for the M1CD, Child And Dependent Care Credit

When applying for the M1CD, certain documents are necessary to support your claim. These include:

- Receipts or invoices from childcare providers

- The provider's name, address, and taxpayer identification number

- Your Social Security number or Employer Identification Number (EIN) if applicable

- Proof of employment or job search activities

Having these documents ready will streamline the application process and ensure compliance with IRS guidelines.

IRS Guidelines for the M1CD, Child And Dependent Care Credit

The IRS provides specific guidelines regarding the M1CD to ensure that taxpayers understand how to claim the credit correctly. Familiarize yourself with the IRS publications related to the Child And Dependent Care Credit, as they outline eligibility requirements, calculation methods, and documentation needed. Staying informed about any changes to tax laws or guidelines is crucial for accurate filing.

Filing Deadlines for the M1CD, Child And Dependent Care Credit

Timely filing is essential when claiming the M1CD. The typical deadline for submitting your tax return, including the M1CD, is April fifteenth of the following year. If you require additional time, you may file for an extension, but it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties. Keeping track of these dates will help you avoid complications during the tax season.

Quick guide on how to complete m1cd child and dependent care credit

Complete [SKS] seamlessly on any device

Managing documents online has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork since you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

How to edit and eSign [SKS] effortlessly

- Locate [SKS] and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight essential sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which requires mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign [SKS] and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to M1CD, Child And Dependent Care Credit

Create this form in 5 minutes!

How to create an eSignature for the m1cd child and dependent care credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the M1CD, Child And Dependent Care Credit?

The M1CD, Child And Dependent Care Credit is a tax credit designed to help families offset the costs of childcare for children under 13 or dependents who are unable to care for themselves. This credit can signNowly reduce your tax liability, making it easier for parents to manage work and family responsibilities.

-

How can airSlate SignNow help with the M1CD, Child And Dependent Care Credit?

airSlate SignNow provides a streamlined solution for managing and signing documents related to the M1CD, Child And Dependent Care Credit. With our easy-to-use platform, you can quickly prepare and eSign necessary forms, ensuring you meet all deadlines and requirements for claiming the credit.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Our plans are designed to be cost-effective, ensuring that you can access essential features for managing documents related to the M1CD, Child And Dependent Care Credit without breaking the bank.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which are essential for managing tax documents like those related to the M1CD, Child And Dependent Care Credit. These features help ensure that your documents are completed accurately and efficiently.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications, including popular accounting and tax software. This integration allows you to easily manage documents related to the M1CD, Child And Dependent Care Credit alongside your other financial tools, streamlining your workflow.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including those for the M1CD, Child And Dependent Care Credit, offers numerous benefits such as enhanced security, faster processing times, and improved organization. Our platform helps you keep track of all your documents in one place, reducing stress during tax season.

-

Is airSlate SignNow user-friendly for those unfamiliar with eSigning?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate, even if they are unfamiliar with eSigning. Our intuitive interface ensures that you can quickly learn how to manage documents related to the M1CD, Child And Dependent Care Credit without any hassle.

Get more for M1CD, Child And Dependent Care Credit

Find out other M1CD, Child And Dependent Care Credit

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure