Unincorporated Nonprofit Association What it Is, the Form

What is the Unincorporated Nonprofit Association?

An unincorporated nonprofit association is a type of organization that operates without formal incorporation under state law. This structure allows groups to come together for a common purpose, typically charitable, educational, or social, without the complexities of forming a corporation. Unlike incorporated entities, unincorporated nonprofit associations do not have a separate legal identity, meaning the members may be personally liable for the organization's debts and obligations. This structure is often simpler and more flexible, making it appealing for small groups or community initiatives.

Key Elements of the Unincorporated Nonprofit Association

Several key elements define an unincorporated nonprofit association:

- Membership: Typically, members join voluntarily and share a common goal or interest.

- Purpose: The association must operate for a nonprofit purpose, such as charitable, educational, or social activities.

- Governance: The group usually has bylaws that outline how it operates, including decision-making processes and member responsibilities.

- Assets: Any assets acquired by the association are typically owned collectively by the members.

Steps to Complete the Unincorporated Nonprofit Association

Completing the necessary documentation for an unincorporated nonprofit association involves several steps:

- Define the Purpose: Clearly outline the mission and objectives of the association.

- Create Bylaws: Draft bylaws that govern the association's operations, including membership criteria and meeting procedures.

- Gather Members: Recruit individuals who share the same goals and are willing to participate actively.

- Hold Initial Meeting: Conduct a meeting to adopt the bylaws and elect officers, if applicable.

- Document Activities: Keep detailed records of meetings, decisions, and financial transactions to ensure transparency and accountability.

Legal Use of the Unincorporated Nonprofit Association

While unincorporated nonprofit associations can operate legally, they must comply with various regulations. These may include:

- State Laws: Each state has different laws governing nonprofit organizations, including registration requirements and reporting obligations.

- Tax Exemption: To qualify for tax-exempt status, the association must meet specific criteria set by the IRS, typically requiring the completion of Form 1023.

- Liability Considerations: Members should be aware of personal liability risks, as the association does not shield them from legal claims.

Examples of Using the Unincorporated Nonprofit Association

Unincorporated nonprofit associations can take many forms, including:

- Community Service Groups: Local organizations that provide assistance and support to community members.

- Advocacy Groups: Collectives that promote specific causes or issues, such as environmental protection or social justice.

- Clubs and Societies: Groups formed around shared interests, such as book clubs, hobby groups, or sports teams.

State-Specific Rules for the Unincorporated Nonprofit Association

Each state has its own regulations regarding unincorporated nonprofit associations. It is essential to research and understand the specific requirements in your state, which may include:

- Registration: Some states may require registration with the state attorney general or a similar agency.

- Reporting: Annual reporting or financial disclosure may be necessary, depending on the state.

- Licensing: Certain activities may require additional licenses or permits at the local or state level.

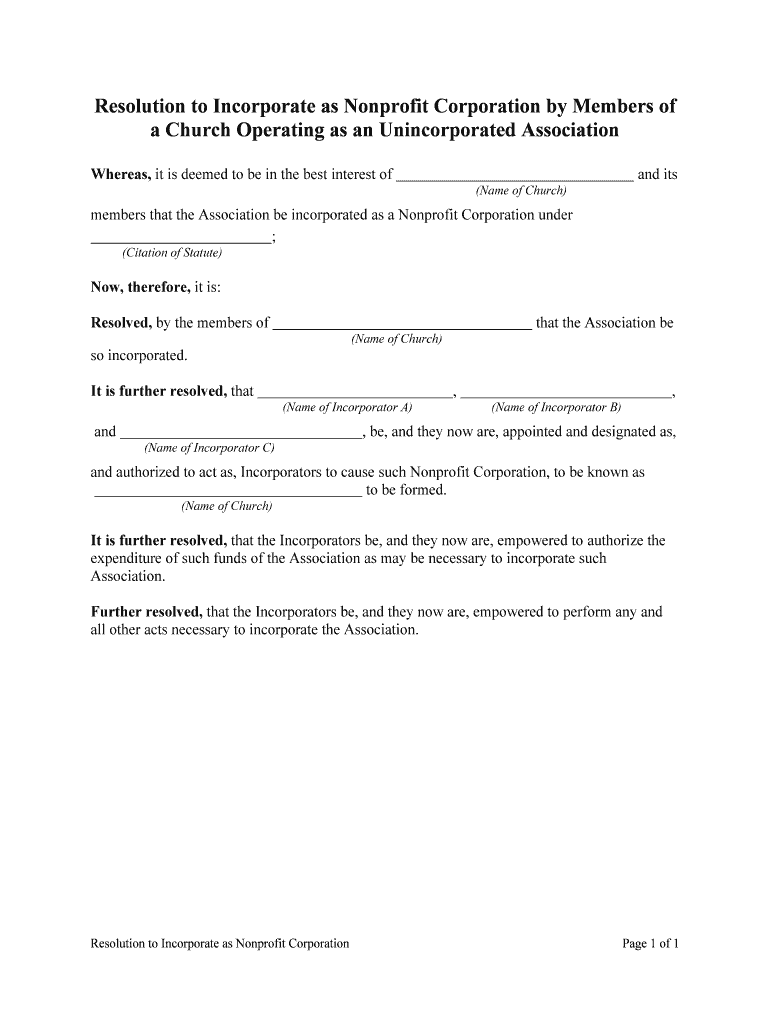

Quick guide on how to complete unincorporated nonprofit association what it is the

Complete Unincorporated Nonprofit Association What It Is, The effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to locate the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents rapidly without delays. Manage Unincorporated Nonprofit Association What It Is, The on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to alter and electronically sign Unincorporated Nonprofit Association What It Is, The effortlessly

- Locate Unincorporated Nonprofit Association What It Is, The and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries exactly the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you prefer to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that necessitate printing out new document copies. airSlate SignNow caters to all your requirements in document management in just a few clicks from any device of your choice. Alter and electronically sign Unincorporated Nonprofit Association What It Is, The and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Unincorporated Nonprofit Association?

An Unincorporated Nonprofit Association is a type of organization that operates for a charitable purpose without formal incorporation. Understanding 'Unincorporated Nonprofit Association What It Is, The' can help you grasp its unique characteristics, such as the lack of formal structure or incorporation requirements. This setup offers flexibility, allowing groups to come together for a common purpose without the complexities of incorporation.

-

What are the benefits of creating an Unincorporated Nonprofit Association?

The benefits of an Unincorporated Nonprofit Association include ease of formation and flexibility in operations. By knowing 'Unincorporated Nonprofit Association What It Is, The,' you can appreciate how it allows members to collaborate without a formal setup, reducing administrative burden while fulfilling their mission. Additionally, they can still operate under many of the protections granted to nonprofits.

-

How do I form an Unincorporated Nonprofit Association?

To form an Unincorporated Nonprofit Association, gather a group of individuals who share a common goal and create a mutual agreement outlining the purpose and structure. This is crucial for understanding 'Unincorporated Nonprofit Association What It Is, The,' as it emphasizes the collective intent rather than legal formalities. Keeping detailed records and guidelines will ensure smooth operations and clarify roles within the association.

-

Are there any legal requirements for an Unincorporated Nonprofit Association?

While there are fewer legal requirements for an Unincorporated Nonprofit Association, it’s essential to adhere to any relevant local, state, and federal laws governing nonprofit activities. Learning about 'Unincorporated Nonprofit Association What It Is, The' highlights that while formal incorporation is not necessary, compliance with regulations concerning fundraising and tax exemptions is still crucial. Consulting a legal expert can provide clarity on compliance.

-

What features does airSlate SignNow offer for Unincorporated Nonprofit Associations?

airSlate SignNow offers features tailored for Unincorporated Nonprofit Associations, such as secure e-signatures and document management. Understanding 'Unincorporated Nonprofit Association What It Is, The' is vital as these features streamline the process of collecting signatures, making it easier to manage agreements and contracts necessary for your nonprofit. This user-friendly platform enhances efficiency and supports the mission of your organization.

-

Is airSlate SignNow affordable for nonprofits?

Yes, airSlate SignNow is designed to be cost-effective, making it an excellent choice for Unincorporated Nonprofit Associations. When addressing 'Unincorporated Nonprofit Association What It Is, The,' you can see that implementing an affordable e-signature solution helps nonprofits save money while ensuring compliance. Competitive pricing plans make it accessible for nonprofits to adopt technology efficiently without overspending.

-

Can I integrate airSlate SignNow with other tools for my Unincorporated Nonprofit Association?

Absolutely! airSlate SignNow provides numerous integrations that can enhance the capabilities of your Unincorporated Nonprofit Association. By understanding 'Unincorporated Nonprofit Association What It Is, The,' you realize that connecting with tools like Google Workspace or Salesforce can streamline your workflow, enabling better collaboration and data management. This ensures that all your processes run smoothly and efficiently.

Get more for Unincorporated Nonprofit Association What It Is, The

Find out other Unincorporated Nonprofit Association What It Is, The

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple