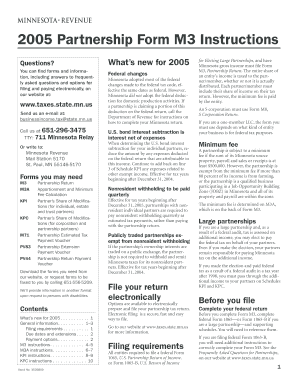

Partnership Form M3 Instructions Questions Revenue State Mn

What is the Partnership Form M3?

The Partnership Form M3 is a tax form used by partnerships in the state of Minnesota to report income, deductions, and credits. This form is essential for partnerships to comply with state tax regulations and ensure accurate reporting of their financial activities. It collects information about the partnership's income, expenses, and distributions to partners, which is crucial for the state’s revenue assessment.

Steps to Complete the Partnership Form M3

Filling out the Partnership Form M3 involves several key steps:

- Gather necessary documentation, including financial statements and partner information.

- Begin with the identification section, providing the partnership's name, address, and federal employer identification number (FEIN).

- Report total income and deductions in the appropriate sections, ensuring accuracy in calculations.

- Detail distributions made to each partner, including any special allocations.

- Review the completed form for any errors or omissions before submission.

Legal Use of the Partnership Form M3

The Partnership Form M3 is legally required for partnerships operating in Minnesota. Failing to file this form can lead to penalties and interest on unpaid taxes. It is important for partnerships to understand their legal obligations regarding this form, as it ensures compliance with state tax laws and contributes to accurate financial reporting.

Filing Deadlines for the Partnership Form M3

Partnerships must file the Partnership Form M3 by the due date, which is typically the 15th day of the fourth month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the form is due by April 15. Extensions may be available, but it is crucial to file any necessary requests on time to avoid penalties.

Required Documents for the Partnership Form M3

To complete the Partnership Form M3, partnerships should prepare several documents:

- Financial statements, including income statements and balance sheets.

- Records of all income and expenses incurred during the tax year.

- Partner information, including names, addresses, and ownership percentages.

- Any prior year tax returns that may be relevant for comparison.

Form Submission Methods for the Partnership Form M3

Partnerships can submit the Partnership Form M3 through various methods, including:

- Online submission through the Minnesota Department of Revenue's e-Services portal.

- Mailing a paper copy of the completed form to the designated address provided by the state.

- In-person submission at local Department of Revenue offices, if preferred.

State-Specific Rules for the Partnership Form M3

Partnerships in Minnesota must adhere to specific state rules when completing the Partnership Form M3. These rules include guidelines on how to report income, the treatment of certain deductions, and the requirements for partner distributions. It is essential for partnerships to familiarize themselves with these regulations to ensure compliance and avoid potential issues with tax authorities.

Quick guide on how to complete partnership form m3 instructions questions revenue state mn

Effortlessly Prepare [SKS] on Any Device

Online document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents swiftly without interruptions. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

Steps to Edit and Electronically Sign [SKS] with Ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive details with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes only a few seconds and has the same legal validity as a traditional wet ink signature.

- Review all information and click the Done button to save your changes.

- Choose how you want to send your form—via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, and mistakes that necessitate printing new document copies. airSlate SignNow manages all your document organization needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] to ensure seamless communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the partnership form m3 instructions questions revenue state mn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Partnership Form M3 and why is it important for Revenue State Mn?

The Partnership Form M3 is a crucial document for partnerships operating in Minnesota, as it provides essential information for tax purposes. Understanding the Partnership Form M3 Instructions Questions Revenue State Mn can help ensure compliance and avoid penalties. Properly completing this form is vital for accurate reporting of partnership income and deductions.

-

How can airSlate SignNow assist with completing the Partnership Form M3?

airSlate SignNow offers an intuitive platform that simplifies the process of completing the Partnership Form M3. With our eSigning capabilities, you can easily fill out and sign the form electronically, ensuring accuracy and efficiency. This streamlines the submission process for the Partnership Form M3 Instructions Questions Revenue State Mn.

-

What features does airSlate SignNow provide for managing Partnership Form M3?

Our platform includes features such as document templates, real-time collaboration, and secure cloud storage, all tailored to assist with the Partnership Form M3. These features enhance productivity and ensure that all necessary information is captured accurately. Utilizing airSlate SignNow for Partnership Form M3 Instructions Questions Revenue State Mn can signNowly reduce the time spent on paperwork.

-

Is there a cost associated with using airSlate SignNow for Partnership Form M3?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions provide excellent value, especially for those frequently dealing with the Partnership Form M3 Instructions Questions Revenue State Mn. You can choose a plan that best fits your budget and requirements.

-

Can I integrate airSlate SignNow with other software for Partnership Form M3?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow for the Partnership Form M3. This integration allows for easy data transfer and management, making it easier to handle Partnership Form M3 Instructions Questions Revenue State Mn alongside your existing tools.

-

What are the benefits of using airSlate SignNow for eSigning the Partnership Form M3?

Using airSlate SignNow for eSigning the Partnership Form M3 offers numerous benefits, including increased efficiency and reduced turnaround time. Our platform ensures that all signatures are legally binding and securely stored. This is particularly beneficial for addressing Partnership Form M3 Instructions Questions Revenue State Mn quickly and effectively.

-

How secure is airSlate SignNow when handling Partnership Form M3?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your documents, including the Partnership Form M3. You can trust that your sensitive information related to Partnership Form M3 Instructions Questions Revenue State Mn is safe with us.

Get more for Partnership Form M3 Instructions Questions Revenue State Mn

Find out other Partnership Form M3 Instructions Questions Revenue State Mn

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement

- How To eSign Illinois Profit and Loss Statement

- How To eSign New York Profit and Loss Statement

- How To eSign Ohio Profit and Loss Statement

- How Do I eSign Ohio Non-Compete Agreement

- eSign Utah Non-Compete Agreement Online

- eSign Tennessee General Partnership Agreement Mobile

- eSign Alaska LLC Operating Agreement Fast

- How Can I eSign Hawaii LLC Operating Agreement

- eSign Indiana LLC Operating Agreement Fast

- eSign Michigan LLC Operating Agreement Fast

- eSign North Dakota LLC Operating Agreement Computer

- How To eSignature Louisiana Quitclaim Deed

- eSignature Maine Quitclaim Deed Now

- eSignature Maine Quitclaim Deed Myself

- eSignature Maine Quitclaim Deed Free

- eSignature Maine Quitclaim Deed Easy

- How Do I eSign South Carolina LLC Operating Agreement

- Can I eSign South Carolina LLC Operating Agreement