M1ED, K 12 Education Credit M1ED, K 12 Education Credit Form

Understanding the M1ED, K 12 Education Credit

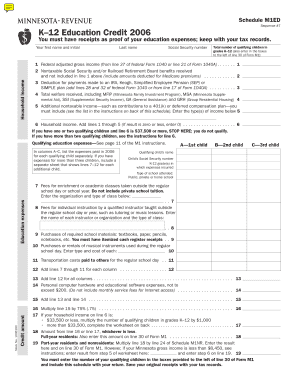

The M1ED, K 12 Education Credit is a tax credit designed to support families with educational expenses for children in kindergarten through grade twelve. This credit aims to alleviate the financial burden associated with education-related costs, such as tuition, textbooks, and other essential supplies. It is important for taxpayers to understand the eligibility criteria and the benefits provided by this credit to maximize their potential savings.

Eligibility Criteria for the M1ED, K 12 Education Credit

To qualify for the M1ED, K 12 Education Credit, taxpayers must meet specific criteria. Generally, the credit is available to parents or guardians of children enrolled in K-12 education. Eligible expenses may include tuition costs, fees for extracurricular activities, and the purchase of educational materials. Income limits may also apply, which can affect the amount of the credit received. It is essential to review the eligibility requirements thoroughly to ensure compliance and maximize benefits.

Steps to Complete the M1ED, K 12 Education Credit

Completing the M1ED, K 12 Education Credit involves several steps. First, gather all necessary documentation, including proof of enrollment and receipts for qualified expenses. Next, fill out the M1ED form accurately, ensuring that all information is complete and correct. After completing the form, review it for accuracy and submit it according to the guidelines provided by the IRS. Keeping copies of all submitted documents is advisable for future reference.

Required Documents for the M1ED, K 12 Education Credit

When applying for the M1ED, K 12 Education Credit, certain documents are necessary to substantiate your claims. These may include:

- Proof of enrollment for each child in K-12 education

- Receipts for eligible educational expenses

- Tax returns from the previous year

- Any additional documentation required by state regulations

Having these documents ready will facilitate a smoother application process and help ensure that you receive the maximum credit available.

How to Use the M1ED, K 12 Education Credit

Using the M1ED, K 12 Education Credit effectively can lead to significant tax savings. Taxpayers should include the credit on their tax return forms, specifically on the lines designated for education credits. It is also beneficial to consult with a tax professional to ensure that all eligible expenses are claimed and that the credit is applied correctly. Understanding how to leverage this credit can enhance financial planning for educational expenses.

IRS Guidelines for the M1ED, K 12 Education Credit

The IRS provides specific guidelines for the M1ED, K 12 Education Credit that outline how to apply, what expenses qualify, and how to report the credit on tax returns. It is important to stay updated with any changes in these guidelines, as they can impact eligibility and the amount of credit received. Taxpayers should refer to the IRS website or consult a tax advisor for the most current information regarding this credit.

Quick guide on how to complete m1ed k 12 education credit m1ed k 12 education credit

Complete [SKS] effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers a perfect eco-conscious substitute to traditional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the tools you require to create, alter, and eSign your documents swiftly without delays. Handle [SKS] on any system using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Employ the tools we offer to complete your form.

- Mark important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tiring form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign [SKS] and ensure clear communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to M1ED, K 12 Education Credit M1ED, K 12 Education Credit

Create this form in 5 minutes!

How to create an eSignature for the m1ed k 12 education credit m1ed k 12 education credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the M1ED, K 12 Education Credit?

The M1ED, K 12 Education Credit is a tax credit designed to support educational expenses for K-12 students. This credit helps families offset costs related to educational materials, making it easier to invest in their children's education. Understanding this credit can signNowly benefit parents looking to maximize their tax savings.

-

How can I apply for the M1ED, K 12 Education Credit?

To apply for the M1ED, K 12 Education Credit, you need to complete the appropriate tax forms during your annual tax filing. Ensure you have all necessary documentation related to educational expenses. Consulting with a tax professional can also help streamline the application process.

-

What are the eligibility requirements for the M1ED, K 12 Education Credit?

Eligibility for the M1ED, K 12 Education Credit typically includes being a parent or guardian of a K-12 student and having incurred qualifying educational expenses. It's important to review the specific criteria set by your state to ensure you meet all requirements. This credit is aimed at making education more affordable for families.

-

What types of expenses qualify for the M1ED, K 12 Education Credit?

Qualifying expenses for the M1ED, K 12 Education Credit may include tuition, textbooks, and other educational materials. Additionally, costs related to extracurricular activities and supplies can also be considered. Keeping detailed records of these expenses is crucial for claiming the credit.

-

How does the M1ED, K 12 Education Credit benefit families?

The M1ED, K 12 Education Credit provides signNow financial relief for families by reducing their overall tax burden. This credit allows parents to allocate more resources towards their children's education, enhancing their learning experience. By utilizing this credit, families can invest in quality educational tools and resources.

-

Is there a limit to the M1ED, K 12 Education Credit?

Yes, there is typically a limit to the amount you can claim under the M1ED, K 12 Education Credit, which varies by state. It's essential to check the specific guidelines to understand the maximum credit available. Staying informed about these limits can help you plan your educational expenses effectively.

-

Can I combine the M1ED, K 12 Education Credit with other education credits?

In many cases, you can combine the M1ED, K 12 Education Credit with other education-related tax credits, but there are specific rules to follow. It's advisable to consult a tax professional to ensure compliance and maximize your benefits. Understanding how these credits interact can lead to greater savings.

Get more for M1ED, K 12 Education Credit M1ED, K 12 Education Credit

- Jdf 1111 sworn financial statementdoc ssareporter spanish form

- Colorado affidavit law marriage form

- Seec form 20 fillable

- Sealing miami dade form

- Petition for violation of injunction orange county clerk of courts form

- 19 request hearing ortrial escambiadoc florida supreme court approved family law form 12902d

- Fl 12902c 2000 form

- Florida supreme court approved family law form 12995a parenting plan 0309 florida supreme court approved family law form 12995a

Find out other M1ED, K 12 Education Credit M1ED, K 12 Education Credit

- eSign Maine Simple confidentiality agreement Easy

- eSign Iowa Standard rental agreement Free

- eSignature Florida Profit Sharing Agreement Template Online

- eSignature Florida Profit Sharing Agreement Template Myself

- eSign Massachusetts Simple rental agreement form Free

- eSign Nebraska Standard residential lease agreement Now

- eSign West Virginia Standard residential lease agreement Mobile

- Can I eSign New Hampshire Tenant lease agreement

- eSign Arkansas Commercial real estate contract Online

- eSign Hawaii Contract Easy

- How Do I eSign Texas Contract

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template