M11T, Township Mutual Premium Tax Return Form M19, Insurance Estimated Premium Tax Payment Revenue State Mn

What is the M11T, Township Mutual Premium Tax Return Form M19, Insurance Estimated Premium Tax Payment Revenue State Mn

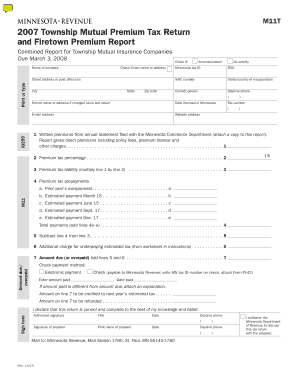

The M11T, Township Mutual Premium Tax Return Form M19, is a specific document used by insurance companies in Minnesota to report premium taxes. This form is essential for ensuring compliance with state tax regulations concerning insurance premiums collected. The form captures various financial details related to the estimated premium tax payments that insurance providers must remit to the state. Understanding this form is crucial for accurate tax reporting and maintaining good standing with state authorities.

Steps to complete the M11T, Township Mutual Premium Tax Return Form M19, Insurance Estimated Premium Tax Payment Revenue State Mn

Completing the M11T form involves several important steps. First, gather all necessary financial records, including premium income and previous tax payments. Next, accurately fill in the required fields on the form, ensuring that all calculations reflect the most current data. After completing the form, review it for accuracy before submission. It is advisable to keep a copy for your records. Finally, submit the form by the designated deadline to avoid penalties.

Key elements of the M11T, Township Mutual Premium Tax Return Form M19, Insurance Estimated Premium Tax Payment Revenue State Mn

The M11T form includes several key elements that must be accurately reported. These elements typically encompass the total premiums collected, any deductions applicable, and the calculated tax amount owed. Additionally, the form may require information about the insurance company’s operations and compliance history. Each section must be filled out thoroughly to ensure proper processing by state tax authorities.

Legal use of the M11T, Township Mutual Premium Tax Return Form M19, Insurance Estimated Premium Tax Payment Revenue State Mn

The M11T form is legally mandated for insurance companies operating in Minnesota. It serves as a formal declaration of premium tax obligations and must be submitted according to state law. Failure to file this form correctly can result in legal consequences, including fines or penalties. Understanding the legal requirements surrounding this form is essential for compliance and to avoid potential disputes with tax authorities.

Filing Deadlines / Important Dates

Timely filing of the M11T form is crucial to avoid penalties. The state of Minnesota typically sets specific deadlines for submission, often aligning with the end of the fiscal year or specific tax periods. It is important for insurance companies to be aware of these dates and plan accordingly to ensure that all required documentation is submitted on time. Keeping a calendar of important tax dates can help in maintaining compliance.

Form Submission Methods (Online / Mail / In-Person)

The M11T form can be submitted through various methods, depending on the preferences of the insurance company. Options usually include online submission through the state’s tax portal, mailing a physical copy of the form, or delivering it in person to the appropriate tax office. Each method has its own processing times and requirements, so it is advisable to choose the one that best suits the company’s operational needs.

Quick guide on how to complete m11t township mutual premium tax return form m19 insurance estimated premium tax payment revenue state mn

Effortlessly Complete [SKS] on Any Device

Managing documents online has become increasingly popular among companies and individuals alike. It offers an excellent eco-friendly option to conventional printed and signed paperwork, allowing you to easily obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly without delays. Handle [SKS] on any device with the airSlate SignNow apps for Android or iOS and enhance any document-focused process today.

Easily Modify and eSign [SKS] Without Any Hassle

- Find [SKS] and click Get Form to begin.

- Utilize the tools provided to fill in your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional signature with ink.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form—via email, text message (SMS), invite link, or download it to your computer.

Forget about missing or lost documents, frustrating form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and eSign [SKS] and ensure excellent communication at every step of the document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the m11t township mutual premium tax return form m19 insurance estimated premium tax payment revenue state mn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the M11T, Township Mutual Premium Tax Return Form M19?

The M11T, Township Mutual Premium Tax Return Form M19 is a specific form used for reporting insurance premium taxes in Minnesota. It is essential for insurance companies to accurately report their estimated premium tax payments to comply with state regulations.

-

How can airSlate SignNow help with the M11T, Township Mutual Premium Tax Return Form M19?

airSlate SignNow provides an efficient platform for businesses to prepare, send, and eSign the M11T, Township Mutual Premium Tax Return Form M19. Our user-friendly interface simplifies the process, ensuring that your documents are completed accurately and submitted on time.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various businesses. Whether you are a small business or a large enterprise, you can choose a plan that fits your budget while ensuring you can efficiently manage forms like the M11T, Township Mutual Premium Tax Return Form M19.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking of document status. These features enhance the management of important forms like the M11T, Township Mutual Premium Tax Return Form M19, making the process seamless and efficient.

-

Is airSlate SignNow compliant with state regulations for tax forms?

Yes, airSlate SignNow is designed to comply with state regulations, including those related to the M11T, Township Mutual Premium Tax Return Form M19. Our platform ensures that your documents meet all necessary legal requirements, providing peace of mind for your business.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow offers integrations with various accounting and tax management software. This allows you to streamline your workflow when handling the M11T, Township Mutual Premium Tax Return Form M19 and other related documents.

-

What are the benefits of using airSlate SignNow for insurance premium tax forms?

Using airSlate SignNow for insurance premium tax forms like the M11T, Township Mutual Premium Tax Return Form M19 provides numerous benefits, including increased efficiency, reduced errors, and enhanced security. Our platform helps you save time and resources while ensuring compliance with state tax regulations.

Get more for M11T, Township Mutual Premium Tax Return Form M19, Insurance Estimated Premium Tax Payment Revenue State Mn

- Ky need deposition form

- Lusersa_mgmt sharedconnieformsrepossession form 2

- Voluntary transfer of custody louisiana form

- Affidavit of residency state of louisiana form

- Vehicle massachusetts form

- Rule 401 long form print version no zeroesxls image

- State of michigan petition for hospitalization pcm 201 form

- Form ccfc179 parenting plan part a custody

Find out other M11T, Township Mutual Premium Tax Return Form M19, Insurance Estimated Premium Tax Payment Revenue State Mn

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter