Rule 401 Long Form PRINT VERSION NO ZEROES XLS Image 1997

What is the Rule 401 financial statement?

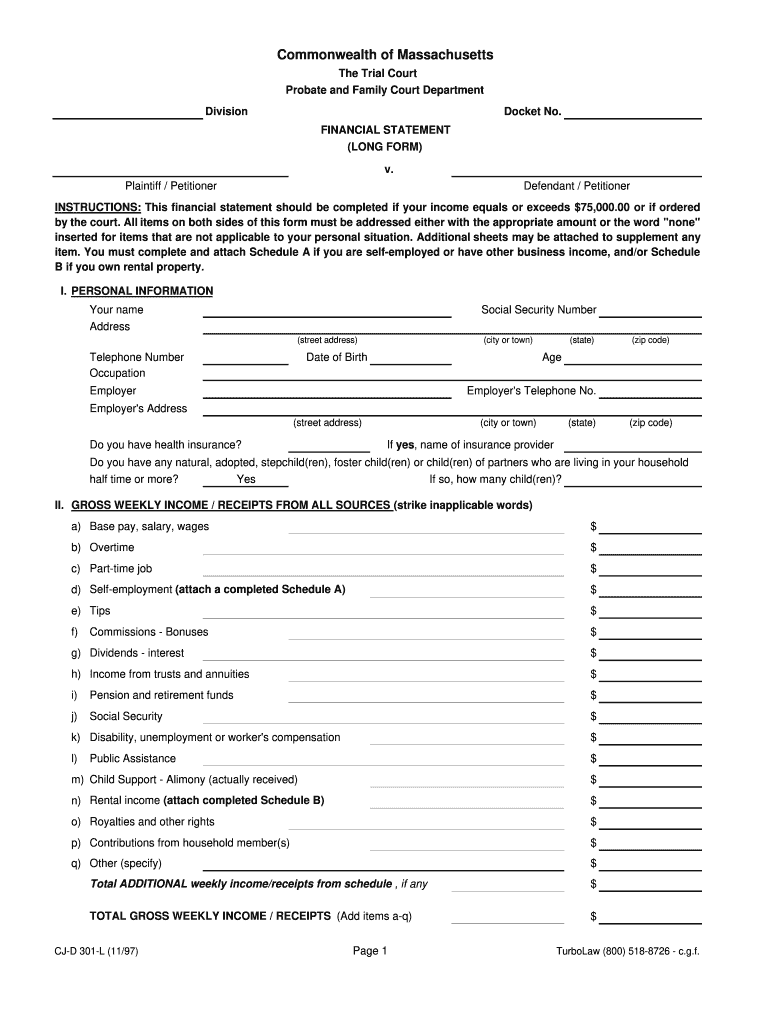

The Rule 401 financial statement is a comprehensive document used primarily in Massachusetts to provide a detailed overview of an individual's or business's financial status. This long-form statement includes various financial data points such as income, expenses, assets, and liabilities. It is often utilized in legal contexts, including divorce proceedings and bankruptcy filings, to ensure transparency and accuracy in financial disclosures. The statement is designed to help courts and other entities assess the financial situation of the individual or entity submitting it.

How to use the Rule 401 financial statement

Using the Rule 401 financial statement involves several steps to ensure that all necessary information is accurately captured. Begin by gathering all relevant financial documents, such as bank statements, tax returns, and pay stubs. Next, fill out the statement with precise figures reflecting your financial situation. It is essential to provide honest and complete information, as inaccuracies can lead to legal consequences. Once completed, the statement can be submitted as part of a legal filing or shared with relevant parties, such as attorneys or courts, depending on the context of its use.

Steps to complete the Rule 401 financial statement

Completing the Rule 401 financial statement requires careful attention to detail. Follow these steps for accuracy:

- Collect all necessary financial documents, including income statements and expense reports.

- Begin filling out the form by entering personal information, such as your name, address, and social security number.

- Document all sources of income, including wages, rental income, and any other earnings.

- List all monthly expenses, including housing costs, utilities, and debts.

- Detail your assets, such as bank accounts, real estate, and investments.

- Include any liabilities, such as loans and credit card debts.

- Review the completed statement for accuracy before submission.

Legal use of the Rule 401 financial statement

The Rule 401 financial statement holds significant legal weight in various proceedings, particularly in family law and bankruptcy cases. Courts require this document to assess an individual's financial capability and obligations. It is crucial that the information provided is truthful and complete, as any discrepancies can lead to legal ramifications, including fines or penalties. The statement must adhere to specific legal standards to be considered valid, and it is often accompanied by a signed declaration affirming its accuracy.

Filing deadlines and important dates

When dealing with the Rule 401 financial statement, it is essential to be aware of filing deadlines, as these can vary based on the specific legal context. For instance, in divorce proceedings, the statement may need to be filed within a certain timeframe after the initial complaint is submitted. Similarly, in bankruptcy cases, timely submission is critical to avoid complications. Always consult with a legal professional to ensure compliance with all relevant deadlines and requirements.

Who issues the Rule 401 financial statement?

The Rule 401 financial statement is typically issued by the Massachusetts court system. It is a standardized form that must be completed by individuals involved in specific legal proceedings, such as divorce or bankruptcy. Legal professionals often assist clients in obtaining and completing this form to ensure that all necessary information is accurately reported. The court provides guidelines on how to fill out the statement and the required documentation that must accompany it.

Quick guide on how to complete rule 401 long form print version no zeroesxls image

Effortlessly Prepare Rule 401 Long Form PRINT VERSION NO ZEROES xls Image on Any Device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents swiftly and without hindrances. Manage Rule 401 Long Form PRINT VERSION NO ZEROES xls Image on any device with airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

How to Edit and eSign Rule 401 Long Form PRINT VERSION NO ZEROES xls Image with Ease

- Find Rule 401 Long Form PRINT VERSION NO ZEROES xls Image and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred method to submit your form: via email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced papers, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and eSign Rule 401 Long Form PRINT VERSION NO ZEROES xls Image to ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct rule 401 long form print version no zeroesxls image

Create this form in 5 minutes!

How to create an eSignature for the rule 401 long form print version no zeroesxls image

The way to make an eSignature for a PDF file in the online mode

The way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your smartphone

The way to make an eSignature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF on Android

People also ask

-

What is the rule 401 financial statement?

The rule 401 financial statement outlines the requirements for financial reporting and provides guidelines on how organizations should present their financial data. Understanding this statement is crucial for compliance and effective decision-making. It ensures transparency and reliability in financial reporting.

-

How does airSlate SignNow assist with rule 401 financial statement compliance?

airSlate SignNow offers features that streamline the process of documenting and signing rule 401 financial statements. Our platform ensures that all necessary documents are easily accessible and securely eSigned, reducing the risk of errors or compliance issues. This functionality is essential for organizations striving to meet regulatory requirements.

-

What pricing options are available for using airSlate SignNow for rule 401 financial statements?

airSlate SignNow provides flexible pricing plans that cater to different business sizes and needs, making it an ideal choice for managing rule 401 financial statements. We offer pay-as-you-go options as well as subscription plans that provide features tailored to financial documentation. You can choose the plan that best fits your organization's requirements.

-

What are the key features of airSlate SignNow relevant to rule 401 financial statements?

Key features of airSlate SignNow include document templates, secure eSigning, and audit trails, which are particularly beneficial for managing rule 401 financial statements. These features not only simplify document handling but also enhance security and compliance. Additionally, our integration capabilities help teams work efficiently within their existing workflows.

-

Can airSlate SignNow help automate the preparation of rule 401 financial statements?

Yes, airSlate SignNow helps automate the preparation of rule 401 financial statements by providing document automation tools. Users can create templates that automatically populate with data, reducing the time and effort spent on manual entries. This automation ensures accuracy and speeds up the document review and approval processes.

-

What benefits does airSlate SignNow offer for teams managing rule 401 financial statements?

Using airSlate SignNow for rule 401 financial statements provides numerous benefits, including improved efficiency, reduced paperwork, and enhanced security. Teams can collaborate in real-time, ensuring that all members have access to the latest versions of documents. Furthermore, eSigning improves turnaround times, allowing for quicker compliance with regulatory deadlines.

-

Is it possible to integrate airSlate SignNow with accounting software for rule 401 financial statements?

Absolutely! airSlate SignNow offers integrations with popular accounting software, which facilitates the seamless management of rule 401 financial statements. This integration helps save time by synchronizing data and enhancing overall accuracy. Users can easily transfer documents between platforms without manual intervention.

Get more for Rule 401 Long Form PRINT VERSION NO ZEROES xls Image

- Invest atlanta business assistance intake form

- Ccw 705 warranty form

- Simple individual to individual construction contract form

- Contractor production report form

- Mulehide heat weld warranty application form

- Medicare private pay contract marcia johnston wood phd form

- Lead generation contract template form

- Clear form print form residential lease agreement statewide multiple listing service inc

Find out other Rule 401 Long Form PRINT VERSION NO ZEROES xls Image

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service

- Electronic signature Tennessee Affidavit of Service Myself

- Electronic signature Indiana Cease and Desist Letter Free

- Electronic signature Arkansas Hold Harmless (Indemnity) Agreement Fast

- Electronic signature Kentucky Hold Harmless (Indemnity) Agreement Online

- How To Electronic signature Arkansas End User License Agreement (EULA)

- Help Me With Electronic signature Connecticut End User License Agreement (EULA)

- Electronic signature Massachusetts Hold Harmless (Indemnity) Agreement Myself

- Electronic signature Oklahoma Hold Harmless (Indemnity) Agreement Free

- Electronic signature Rhode Island Hold Harmless (Indemnity) Agreement Myself

- Electronic signature California Toll Manufacturing Agreement Now

- How Do I Electronic signature Kansas Toll Manufacturing Agreement