Additional Charge for Underpayment of Estimated Tax Minnesota Form

Understanding the Additional Charge for Underpayment of Estimated Tax in Minnesota

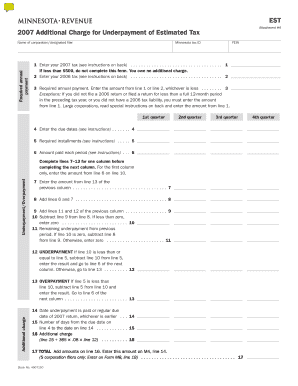

The Additional Charge for Underpayment of Estimated Tax in Minnesota is a penalty imposed on taxpayers who do not pay enough tax throughout the year. This charge is applicable if your estimated tax payments fall short of the required amount, which can lead to additional financial obligations. The state of Minnesota requires taxpayers to make estimated payments if they expect to owe a certain amount in taxes. Understanding this charge is crucial for managing your tax liabilities effectively.

How to Use the Additional Charge for Underpayment of Estimated Tax in Minnesota

To address the Additional Charge for Underpayment of Estimated Tax, taxpayers should first determine if they owe this charge by reviewing their estimated tax payments against their actual tax liability. If underpayment is identified, it is important to calculate the amount owed accurately. You can use the Minnesota Department of Revenue's resources or consult a tax professional for assistance. Keeping records of your estimated payments and tax returns can help in resolving any discrepancies.

Steps to Complete the Additional Charge for Underpayment of Estimated Tax in Minnesota

Completing the process related to the Additional Charge for Underpayment involves several key steps:

- Review your tax liability and estimated payments for the year.

- Calculate any underpayment based on the state's guidelines.

- Determine the applicable penalty rate for the underpayment.

- Prepare the necessary documentation to support your calculations.

- Submit the required payment along with any forms to the Minnesota Department of Revenue.

Key Elements of the Additional Charge for Underpayment of Estimated Tax in Minnesota

Key elements of this charge include the calculation of the underpayment amount, the penalty rate applied, and the timeline for payment. The penalty is typically calculated based on the amount of underpayment and the length of time it remains unpaid. Taxpayers should also be aware of any exemptions or special rules that may apply to their situation, such as those for low-income taxpayers or specific business entities.

Filing Deadlines and Important Dates for Minnesota

Filing deadlines for estimated tax payments in Minnesota are crucial for avoiding the Additional Charge for Underpayment. Generally, estimated payments are due quarterly, with specific deadlines falling on April 15, June 15, September 15, and January 15 of the following year. It is important to be aware of these dates to ensure timely payments and avoid penalties.

Penalties for Non-Compliance with Estimated Tax Payments

Failure to comply with estimated tax payment requirements can lead to significant penalties. The Additional Charge for Underpayment is one of the primary penalties, which can accumulate over time. Additionally, taxpayers may face interest charges on unpaid amounts. Understanding these penalties can motivate timely compliance and reduce potential financial burdens.

Quick guide on how to complete additional charge for underpayment of estimated tax minnesota

Prepare [SKS] effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the features needed to create, modify, and eSign your documents promptly without delays. Manage [SKS] on any platform using airSlate SignNow’s Android or iOS applications and enhance your document-centric processes today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and then click Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Emphasize important parts of your documents or redact sensitive information with tools specifically available through airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the information and then click on the Done button to preserve your changes.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Additional Charge For Underpayment Of Estimated Tax Minnesota

Create this form in 5 minutes!

How to create an eSignature for the additional charge for underpayment of estimated tax minnesota

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Additional Charge For Underpayment Of Estimated Tax Minnesota?

The Additional Charge For Underpayment Of Estimated Tax Minnesota refers to penalties imposed by the state for not paying enough estimated tax throughout the year. This charge can accumulate if you fail to meet the required payment thresholds. It's essential to understand this to avoid unexpected costs during tax season.

-

How can airSlate SignNow help with tax-related documents?

airSlate SignNow provides a streamlined platform for sending and eSigning tax-related documents, ensuring compliance and accuracy. By using our service, you can easily manage documents related to the Additional Charge For Underpayment Of Estimated Tax Minnesota, making the process efficient and secure. This helps you stay organized and reduces the risk of errors.

-

Are there any features in airSlate SignNow that assist with tax compliance?

Yes, airSlate SignNow includes features designed to assist with tax compliance, such as document templates and automated reminders. These tools can help you keep track of important deadlines related to the Additional Charge For Underpayment Of Estimated Tax Minnesota. By utilizing these features, you can ensure timely submissions and avoid penalties.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to fit different business needs, ensuring cost-effectiveness. Each plan provides access to essential features that can help manage documents related to the Additional Charge For Underpayment Of Estimated Tax Minnesota. You can choose a plan that best suits your budget and requirements.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow. This integration can be particularly beneficial for managing documents related to the Additional Charge For Underpayment Of Estimated Tax Minnesota, allowing for a more cohesive approach to tax management.

-

What benefits does airSlate SignNow offer for small businesses?

For small businesses, airSlate SignNow offers a cost-effective solution to manage document signing and compliance. By using our platform, you can efficiently handle documents related to the Additional Charge For Underpayment Of Estimated Tax Minnesota, saving time and reducing administrative burdens. This allows you to focus more on growing your business.

-

Is airSlate SignNow user-friendly for those unfamiliar with eSigning?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible even for those unfamiliar with eSigning. The intuitive interface guides users through the process, ensuring that documents related to the Additional Charge For Underpayment Of Estimated Tax Minnesota can be managed easily. This simplicity helps reduce the learning curve for new users.

Get more for Additional Charge For Underpayment Of Estimated Tax Minnesota

Find out other Additional Charge For Underpayment Of Estimated Tax Minnesota

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now