Schedule M1CRN Sequence #17 Credit for Nonresident Partners on Taxes Paid to Home State on the Sale of a Partnership Interest Ta Form

Understanding the Schedule M1CRN Sequence #17 Credit

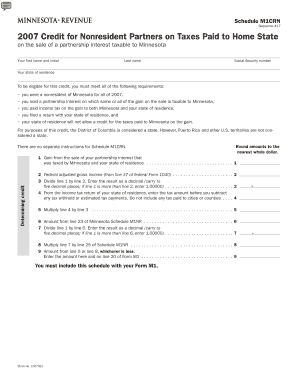

The Schedule M1CRN Sequence #17 Credit is designed for nonresident partners who have paid taxes to their home state on the sale of a partnership interest that is taxable to Minnesota. This credit allows eligible individuals to mitigate the tax burden they face due to their partnership income. It is essential for nonresident partners to accurately report their income and claim this credit to ensure compliance with Minnesota tax laws.

Steps to Complete the Schedule M1CRN Sequence #17 Credit

Completing the Schedule M1CRN Sequence #17 requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including your first name, initial, last name, Social Security number, and state of residence.

- Determine the amount of taxes paid to your home state on the sale of the partnership interest.

- Fill out the Schedule M1CRN form accurately, ensuring all information is complete and correct.

- Attach any required documentation that supports your claim for the credit.

- Review the completed form for accuracy before submission.

Eligibility Criteria for the Schedule M1CRN Sequence #17 Credit

To qualify for the Schedule M1CRN Sequence #17 Credit, individuals must meet specific eligibility criteria:

- You must be a nonresident partner who has sold a partnership interest that is taxable to Minnesota.

- Taxes must have been paid to your home state on the income derived from the sale.

- All information provided must be accurate and verifiable.

Required Documents for the Schedule M1CRN Sequence #17 Credit

When applying for the Schedule M1CRN Sequence #17 Credit, you will need to provide certain documents:

- Proof of taxes paid to your home state, such as tax returns or payment receipts.

- Completed Schedule M1CRN form with all required information.

- Any additional documentation that may support your claim.

Filing Deadlines for the Schedule M1CRN Sequence #17 Credit

It is crucial to be aware of the filing deadlines associated with the Schedule M1CRN Sequence #17 Credit. Typically, the deadline aligns with the state tax filing deadline for Minnesota. Ensure that you submit your application in a timely manner to avoid any penalties.

Legal Use of the Schedule M1CRN Sequence #17 Credit

The Schedule M1CRN Sequence #17 Credit is legally recognized under Minnesota tax law. Nonresident partners must adhere to the guidelines set forth by the Minnesota Department of Revenue when claiming this credit. Proper use of the credit can help reduce overall tax liability, but it is important to ensure compliance with all legal requirements.

Quick guide on how to complete schedule m1crn sequence 17 credit for nonresident partners on taxes paid to home state on the sale of a partnership interest

Complete [SKS] effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to find the appropriate form and securely store it in the cloud. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to modify and electronically sign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional signed signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tiresome form searches, or errors that necessitate printing out new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule M1CRN Sequence #17 Credit For Nonresident Partners On Taxes Paid To Home State On The Sale Of A Partnership Interest Ta

Create this form in 5 minutes!

How to create an eSignature for the schedule m1crn sequence 17 credit for nonresident partners on taxes paid to home state on the sale of a partnership interest

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule M1CRN Sequence #17 Credit for Nonresident Partners?

The Schedule M1CRN Sequence #17 Credit For Nonresident Partners On Taxes Paid To Home State On The Sale Of A Partnership Interest Taxable To Minnesota allows nonresident partners to claim a credit for taxes paid to their home state. This credit helps reduce the tax burden for those who have sold partnership interests and are subject to Minnesota taxes.

-

How can airSlate SignNow assist with the Schedule M1CRN process?

airSlate SignNow provides an efficient platform for managing documents related to the Schedule M1CRN Sequence #17 Credit For Nonresident Partners On Taxes Paid To Home State On The Sale Of A Partnership Interest Taxable To Minnesota. Our eSigning features streamline the process, ensuring that all necessary forms are completed and submitted accurately.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans include features that support the Schedule M1CRN Sequence #17 Credit For Nonresident Partners On Taxes Paid To Home State On The Sale Of A Partnership Interest Taxable To Minnesota, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for tax-related documents?

Our platform includes features such as customizable templates, secure eSigning, and document tracking, all of which are essential for managing tax-related documents like the Schedule M1CRN Sequence #17 Credit For Nonresident Partners On Taxes Paid To Home State On The Sale Of A Partnership Interest Taxable To Minnesota. These tools help ensure compliance and efficiency.

-

Can airSlate SignNow integrate with other software for tax preparation?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax preparation software. This integration is particularly beneficial for managing the Schedule M1CRN Sequence #17 Credit For Nonresident Partners On Taxes Paid To Home State On The Sale Of A Partnership Interest Taxable To Minnesota, allowing for a smooth workflow.

-

What benefits does airSlate SignNow provide for businesses handling tax documents?

By using airSlate SignNow, businesses can enhance their document management processes, reduce turnaround times, and improve accuracy. This is especially important for handling the Schedule M1CRN Sequence #17 Credit For Nonresident Partners On Taxes Paid To Home State On The Sale Of A Partnership Interest Taxable To Minnesota, ensuring timely submissions.

-

Is airSlate SignNow secure for handling sensitive tax information?

Absolutely. airSlate SignNow employs advanced security measures to protect sensitive information, including Social Security numbers and tax details. This is crucial when dealing with the Schedule M1CRN Sequence #17 Credit For Nonresident Partners On Taxes Paid To Home State On The Sale Of A Partnership Interest Taxable To Minnesota.

Get more for Schedule M1CRN Sequence #17 Credit For Nonresident Partners On Taxes Paid To Home State On The Sale Of A Partnership Interest Ta

Find out other Schedule M1CRN Sequence #17 Credit For Nonresident Partners On Taxes Paid To Home State On The Sale Of A Partnership Interest Ta

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document