Schedule M1LS Sequence #10 Tax on Lump Sum Distribution Your First Name and Initial Last Name You Must Complete Federal Form 497

Understanding Schedule M1LS Sequence #10 Tax on Lump Sum Distribution

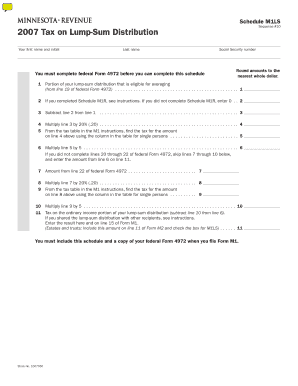

The Schedule M1LS Sequence #10 is a specific tax form used to report the tax implications of a lump sum distribution from a retirement plan or similar account. This form is essential for individuals who have received a one-time payment from their retirement savings, as it helps determine the correct amount of tax owed on that distribution. Before completing this schedule, it is necessary to fill out Federal Form 4972, which calculates the tax owed on the lump sum distribution. This ensures accurate reporting and compliance with IRS guidelines.

Steps to Complete Schedule M1LS Sequence #10

Completing the Schedule M1LS Sequence #10 involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your Social Security number and details from Federal Form 4972. Next, round all amounts to the nearest whole dollar to simplify calculations. Follow the form instructions closely, entering your first name and initial last name as required. Double-check your entries for accuracy before submitting the form to avoid potential delays or issues with your tax return.

Required Documents for Schedule M1LS Sequence #10

To successfully complete the Schedule M1LS Sequence #10, you will need several documents. These include your Social Security number, the completed Federal Form 4972, and any documentation related to the lump sum distribution you received. This may encompass statements from your retirement plan provider or any other relevant financial records. Having these documents on hand will facilitate a smoother filing process and help ensure that all information is accurate and complete.

IRS Guidelines for Schedule M1LS Sequence #10

The IRS provides specific guidelines for completing the Schedule M1LS Sequence #10. These guidelines outline the eligibility criteria for using this form, the necessary calculations for determining tax owed, and the deadlines for submission. It is important to review these guidelines carefully to ensure compliance. Failure to adhere to IRS regulations can result in penalties or delays in processing your tax return.

Filing Deadlines for Schedule M1LS Sequence #10

Filing deadlines for the Schedule M1LS Sequence #10 align with the general tax filing deadlines set by the IRS. Typically, individual tax returns are due by April fifteenth of each year. If you are unable to meet this deadline, consider filing for an extension, which can provide additional time to complete your tax forms accurately. However, it is crucial to pay any taxes owed by the original deadline to avoid interest and penalties.

Examples of Using Schedule M1LS Sequence #10

Understanding practical examples of how to use the Schedule M1LS Sequence #10 can clarify its application. For instance, if an individual receives a lump sum distribution from a pension plan, they would first complete Federal Form 4972 to calculate the tax owed. Once this is done, they would transfer the relevant information to the Schedule M1LS Sequence #10, ensuring all amounts are rounded to the nearest whole dollar. This process illustrates the importance of accurate reporting and compliance with IRS requirements.

Quick guide on how to complete schedule m1ls sequence 10 tax on lump sum distribution your first name and initial last name you must complete federal form

Complete [SKS] effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, as you can easily locate the right form and securely keep it online. airSlate SignNow provides all the resources necessary to create, modify, and eSign your documents swiftly without delays. Handle [SKS] on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign [SKS] without hassle

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet-ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or save it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management requirements in just a few clicks from a device of your choice. Modify and eSign [SKS] and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule M1LS Sequence #10 Tax On Lump Sum Distribution Your First Name And Initial Last Name You Must Complete Federal Form 497

Create this form in 5 minutes!

How to create an eSignature for the schedule m1ls sequence 10 tax on lump sum distribution your first name and initial last name you must complete federal form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule M1LS Sequence #10 Tax On Lump Sum Distribution?

Schedule M1LS Sequence #10 Tax On Lump Sum Distribution is a tax form that helps individuals report taxes on lump sum distributions from retirement plans. To complete this schedule, you must first fill out Federal Form 4972. This ensures that you accurately report your income and comply with tax regulations.

-

How do I complete Federal Form 4972?

To complete Federal Form 4972, you need to gather your Social Security Number and details about your lump sum distribution. Make sure to round amounts to the nearest whole dollar. Once you have this information, you can fill out the form to determine the tax owed on your distribution.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents streamlines the process of sending and eSigning important forms like Schedule M1LS Sequence #10 Tax On Lump Sum Distribution. Our platform is user-friendly and cost-effective, making it easy to manage your tax paperwork efficiently.

-

Is there a cost associated with using airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our plans are designed to be cost-effective while providing essential features for managing documents, including those related to Schedule M1LS Sequence #10 Tax On Lump Sum Distribution.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow. This means you can easily manage documents related to Schedule M1LS Sequence #10 Tax On Lump Sum Distribution alongside your other business tools.

-

How secure is my information with airSlate SignNow?

Your security is our priority at airSlate SignNow. We implement robust security measures to protect your information, including data encryption and secure access protocols. This ensures that your details related to Schedule M1LS Sequence #10 Tax On Lump Sum Distribution are safe.

-

What types of documents can I send using airSlate SignNow?

You can send a wide range of documents using airSlate SignNow, including tax forms like Schedule M1LS Sequence #10 Tax On Lump Sum Distribution. Our platform supports various file formats, making it versatile for all your document needs.

Get more for Schedule M1LS Sequence #10 Tax On Lump Sum Distribution Your First Name And Initial Last Name You Must Complete Federal Form 497

- Reliacard dispute transaction online form

- Day and ross bol 448566890 form

- Jamaica hospital doctors note form

- 4 team consolation tournament form

- Evaluation form oral presentation university of unlv

- Iifl forms

- Dtc eligibility questionnaire form

- Com grammar worksheet comparatives and superlatives name date write the missing comparatives and superlatives in the chart below form

Find out other Schedule M1LS Sequence #10 Tax On Lump Sum Distribution Your First Name And Initial Last Name You Must Complete Federal Form 497

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer