Schedule M1CRN Sequence #17 Credit for Nonresident Partners on Taxes Paid to Home State on the Sale of a Partnership Interest Ta Form

Understanding the Schedule M1CRN Sequence #17 Credit

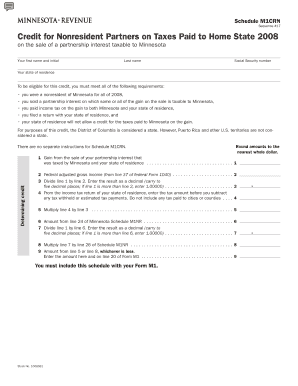

The Schedule M1CRN Sequence #17 Credit is designed for nonresident partners who have paid taxes to their home state on the sale of a partnership interest that is taxable in Minnesota. This credit allows these partners to reduce their Minnesota tax liability by the amount of taxes paid to their home state, ensuring they are not taxed twice on the same income. It is essential for nonresident partners to accurately report this credit to benefit from it and comply with Minnesota tax laws.

Steps to Complete the Schedule M1CRN Sequence #17 Credit

Completing the Schedule M1CRN Sequence #17 requires careful attention to detail. Here are the key steps:

- Gather necessary information, including your full name, Social Security number, and state of residence.

- Calculate the total amount of taxes paid to your home state on the sale of your partnership interest.

- Fill out the Schedule M1CRN form, ensuring all sections are completed accurately.

- Attach any required documentation that supports your claim for the credit.

- Review the completed form for accuracy before submission.

Eligibility Criteria for the Credit

To qualify for the Schedule M1CRN Sequence #17 Credit, you must meet specific criteria:

- You must be a nonresident partner of a partnership that is subject to Minnesota tax.

- You must have paid taxes to your home state on the sale of your partnership interest.

- Your partnership interest must be taxable in Minnesota.

It is important to ensure that you meet these eligibility requirements to avoid issues during the filing process.

Required Documents for Filing

When filing for the Schedule M1CRN Sequence #17 Credit, you will need to provide certain documents:

- A copy of your tax return from your home state showing the taxes paid.

- Documentation of your partnership interest sale, such as a closing statement.

- Any additional forms required by the Minnesota Department of Revenue.

Legal Use of the Schedule M1CRN Sequence #17 Credit

The Schedule M1CRN Sequence #17 Credit is legally recognized under Minnesota tax law. Nonresident partners should utilize this credit to ensure they are not overtaxed. Proper documentation and adherence to filing guidelines are crucial to legally claim this credit. Failure to comply with regulations may result in penalties or denial of the credit.

Filing Methods for the Schedule M1CRN Sequence #17 Credit

You can submit the Schedule M1CRN Sequence #17 Credit through various methods:

- Online submission via the Minnesota Department of Revenue's e-filing system.

- Mailing a paper copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices, if available.

Choosing the right method can affect the processing time of your credit claim.

Quick guide on how to complete schedule m1crn sequence 17 credit for nonresident partners on taxes paid to home state on the sale of a partnership interest 11331809

Effortlessly prepare [SKS] on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Handle [SKS] across any platform with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to modify and eSign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal significance as a traditional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from the device of your choice. Edit and eSign [SKS] and ensure outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule m1crn sequence 17 credit for nonresident partners on taxes paid to home state on the sale of a partnership interest 11331809

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule M1CRN Sequence #17 Credit for Nonresident Partners?

The Schedule M1CRN Sequence #17 Credit For Nonresident Partners On Taxes Paid To Home State On The Sale Of A Partnership Interest Taxable To Minnesota allows nonresident partners to claim a credit for taxes paid to their home state. This credit helps reduce the tax burden for those selling partnership interests that are taxable in Minnesota.

-

How can airSlate SignNow assist with the Schedule M1CRN process?

airSlate SignNow provides an easy-to-use platform for managing documents related to the Schedule M1CRN Sequence #17 Credit For Nonresident Partners On Taxes Paid To Home State On The Sale Of A Partnership Interest Taxable To Minnesota. You can securely eSign and send necessary documents, ensuring compliance and efficiency in your tax filing process.

-

What features does airSlate SignNow offer for tax-related documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for handling tax-related documents like the Schedule M1CRN Sequence #17 Credit For Nonresident Partners. These features streamline the process and enhance accuracy in your submissions.

-

Is there a cost associated with using airSlate SignNow for tax documents?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and provides a cost-effective solution for managing documents related to the Schedule M1CRN Sequence #17 Credit For Nonresident Partners On Taxes Paid To Home State On The Sale Of A Partnership Interest Taxable To Minnesota.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax management software. This integration allows you to efficiently manage the Schedule M1CRN Sequence #17 Credit For Nonresident Partners On Taxes Paid To Home State On The Sale Of A Partnership Interest Taxable To Minnesota alongside your existing tools.

-

What benefits does airSlate SignNow provide for nonresident partners?

For nonresident partners, airSlate SignNow simplifies the process of claiming the Schedule M1CRN Sequence #17 Credit For Nonresident Partners On Taxes Paid To Home State On The Sale Of A Partnership Interest Taxable To Minnesota. The platform enhances document security, reduces processing time, and ensures compliance with tax regulations.

-

How secure is airSlate SignNow for handling sensitive tax information?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive information. When dealing with the Schedule M1CRN Sequence #17 Credit For Nonresident Partners On Taxes Paid To Home State On The Sale Of A Partnership Interest Taxable To Minnesota, you can trust that your data is safe.

Get more for Schedule M1CRN Sequence #17 Credit For Nonresident Partners On Taxes Paid To Home State On The Sale Of A Partnership Interest Ta

Find out other Schedule M1CRN Sequence #17 Credit For Nonresident Partners On Taxes Paid To Home State On The Sale Of A Partnership Interest Ta

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure