Can Life Insurance Help Your Estate Plan? Fidelity Form

What is the Can Life Insurance Help Your Estate Plan? Fidelity

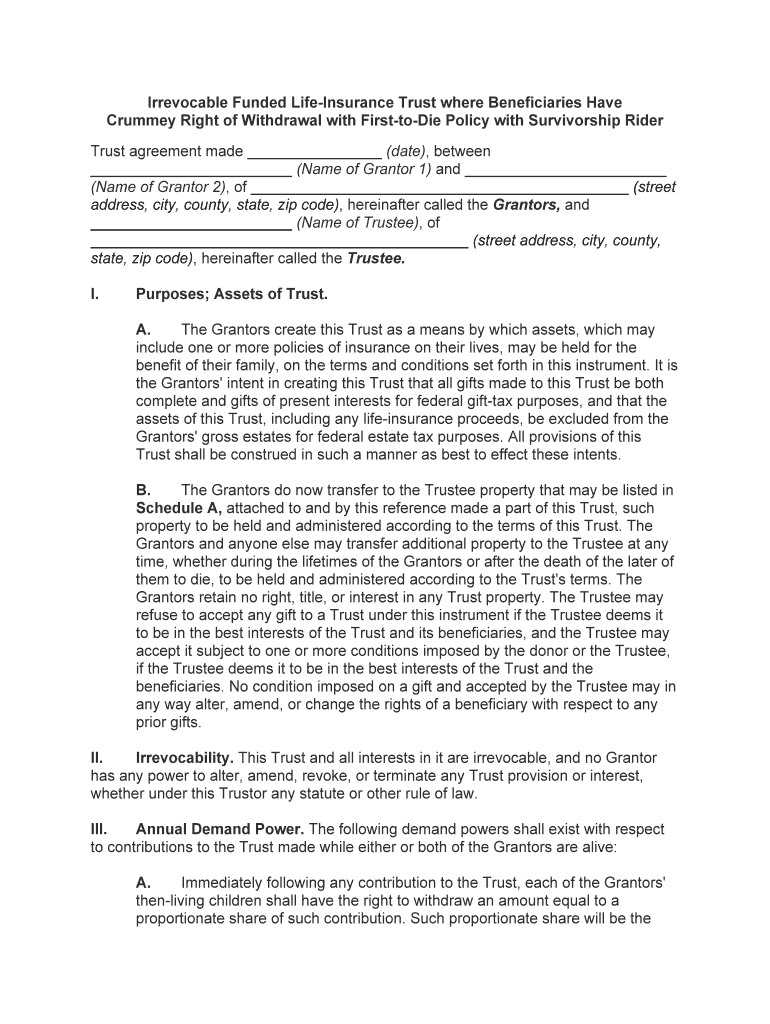

The "Can Life Insurance Help Your Estate Plan? Fidelity" form is designed to assist individuals in understanding how life insurance can play a crucial role in their estate planning. This form outlines the benefits of incorporating life insurance into an estate plan, such as providing liquidity to cover estate taxes, ensuring that heirs receive a financial benefit, and helping to avoid probate complications. By filling out this form, individuals can clarify their intentions regarding life insurance and its implications for their estate.

Steps to complete the Can Life Insurance Help Your Estate Plan? Fidelity

Completing the "Can Life Insurance Help Your Estate Plan? Fidelity" form involves several key steps:

- Gather necessary personal information, including your full name, contact details, and details about your current life insurance policies.

- Review your estate planning goals to determine how life insurance can help meet these objectives.

- Fill out the form accurately, ensuring all information is current and truthful.

- Consult with a financial advisor or estate planning attorney if needed to ensure your choices align with your overall estate strategy.

- Sign and date the form, ensuring compliance with any specific requirements outlined in the document.

Legal use of the Can Life Insurance Help Your Estate Plan? Fidelity

The legal use of the "Can Life Insurance Help Your Estate Plan? Fidelity" form is grounded in its ability to facilitate the proper documentation of life insurance policies in relation to estate planning. This form serves as a formal declaration of intent, which can be referenced in legal proceedings or estate settlements. It is important to ensure that the form is filled out in accordance with state laws regarding estate planning and life insurance, as these can vary significantly across the United States.

Key elements of the Can Life Insurance Help Your Estate Plan? Fidelity

Several key elements are essential when completing the "Can Life Insurance Help Your Estate Plan? Fidelity" form:

- Beneficiary Designation: Clearly outline who will receive the life insurance benefits upon your passing.

- Policy Details: Include information about the type of life insurance policy, coverage amounts, and any riders attached to the policy.

- Financial Considerations: Assess how the life insurance proceeds will impact your overall estate, including tax implications and liquidity needs.

- Intentions: Specify your intentions regarding the use of life insurance in your estate plan, ensuring clarity for your beneficiaries.

How to use the Can Life Insurance Help Your Estate Plan? Fidelity

Using the "Can Life Insurance Help Your Estate Plan? Fidelity" form effectively involves understanding its purpose and implications. Begin by assessing your current financial situation and estate planning needs. Use the form to document how life insurance fits into your estate plan, including any specific instructions for beneficiaries. It can also serve as a discussion point with your financial advisor or attorney, ensuring that all aspects of your estate plan are cohesive and well-structured.

Examples of using the Can Life Insurance Help Your Estate Plan? Fidelity

There are various scenarios in which the "Can Life Insurance Help Your Estate Plan? Fidelity" form can be beneficial:

- A parent wanting to ensure their children's education is funded after their passing may use life insurance to provide necessary funds.

- An individual with significant assets may use life insurance to cover potential estate taxes, ensuring that heirs receive their intended inheritance.

- Business owners can utilize life insurance to facilitate a smooth transition of business ownership, providing liquidity for buy-sell agreements.

Quick guide on how to complete can life insurance help your estate plan fidelity

Prepare Can Life Insurance Help Your Estate Plan? Fidelity effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly option to conventional printed and signed paperwork, as you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents rapidly without delays. Handle Can Life Insurance Help Your Estate Plan? Fidelity on any platform using airSlate SignNow Android or iOS applications and elevate any document-centric process today.

The easiest way to modify and eSign Can Life Insurance Help Your Estate Plan? Fidelity without hassle

- Locate Can Life Insurance Help Your Estate Plan? Fidelity and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to store your changes.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Can Life Insurance Help Your Estate Plan? Fidelity and ensure outstanding communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

Can life insurance play a role in my estate planning?

Yes, life insurance can signNowly impact your estate plan. It provides liquidity to cover taxes and expenses associated with your estate after your passing, ensuring your beneficiaries receive their intended inheritance. Understanding how 'Can Life Insurance Help Your Estate Plan? Fidelity.' can be crucial in facilitating a smooth transition.

-

What are the benefits of including life insurance in an estate plan?

Incorporating life insurance into your estate plan can provide immediate cash flow to your heirs, helping them manage debts or expenses. It also secures financial support for dependents, ensuring they maintain their lifestyle. Asking 'Can Life Insurance Help Your Estate Plan? Fidelity.' is essential to safeguard your family's future.

-

How does life insurance help cover estate taxes?

Life insurance can be a strategic tool to cover potential estate taxes upon your death. By having a policy in place, your beneficiaries can access the funds needed to pay these taxes, avoiding the forced sale of your assets. Thus, it answers the question: 'Can Life Insurance Help Your Estate Plan? Fidelity.' with a positive affirmation.

-

What types of life insurance are best for estate planning?

Permanent life insurance, such as whole life or universal life, is often considered best for estate planning as it provides lifelong coverage and cash value accumulation. However, term life insurance can also be beneficial depending on your financial strategy. Understanding 'Can Life Insurance Help Your Estate Plan? Fidelity.' will guide you in selecting the right type.

-

How much life insurance do I need for effective estate planning?

The amount of life insurance needed can vary based on your estate's size, your outstanding debts, and your beneficiaries' needs. A common approach is calculating the total liabilities and anticipated tax obligations. Evaluating 'Can Life Insurance Help Your Estate Plan? Fidelity.' can assist in determining the appropriate coverage.

-

Are there any integration options available with life insurance in estate planning?

Many estate planning strategies can integrate life insurance seamlessly. Financial advisors often create holistic plans that include investment and retirement accounts along with your life policy. Thus, considering 'Can Life Insurance Help Your Estate Plan? Fidelity.' is wise to ensure all aspects of your estate are covered.

-

What should I consider when choosing a life insurance provider for estate planning?

When selecting a life insurance provider, evaluate their financial strength, policy options, and customer service reputation. It's essential to choose a provider that understands the complexities of estate planning. This ensures that your question, 'Can Life Insurance Help Your Estate Plan? Fidelity.', is answered with suitable products.

Get more for Can Life Insurance Help Your Estate Plan? Fidelity

Find out other Can Life Insurance Help Your Estate Plan? Fidelity

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online