ETP Employer Transit Pass Credit for C Corporations, S Corporations, Partnerships, Sole Proprietors, Fiduciaries and Tax Exempt Form

Understanding the ETP Employer Transit Pass Credit

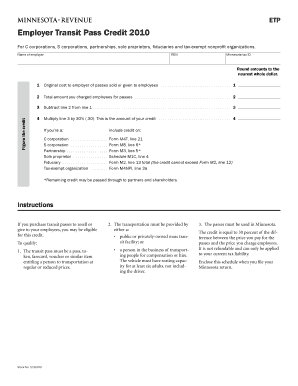

The ETP Employer Transit Pass Credit is a tax incentive designed for various business entities, including C Corporations, S Corporations, Partnerships, Sole Proprietors, Fiduciaries, and tax-exempt nonprofit organizations. This credit allows eligible employers to receive a tax benefit for providing transit passes to their employees. By encouraging public transportation use, the credit aims to reduce traffic congestion and promote environmentally friendly commuting options. The amount of the credit can vary based on the total value of transit passes provided to employees, making it a valuable financial incentive for businesses focused on employee benefits and sustainability.

Eligibility Criteria for the ETP Employer Transit Pass Credit

To qualify for the ETP Employer Transit Pass Credit, businesses must meet specific eligibility requirements. These include being classified as a C Corporation, S Corporation, Partnership, Sole Proprietor, Fiduciary, or a tax-exempt nonprofit organization. Additionally, the employer must provide transit passes directly to employees for commuting purposes. The credit is available for various forms of public transportation, including buses, subways, and commuter trains. Employers should also ensure that the transit passes meet the necessary criteria set forth by the IRS to maximize their benefits.

Steps to Claim the ETP Employer Transit Pass Credit

Claiming the ETP Employer Transit Pass Credit involves several straightforward steps. First, employers should gather documentation that verifies the purchase of transit passes for employees. This includes receipts and records of the amounts spent on the passes. Next, businesses need to complete the appropriate tax forms, detailing the total value of the transit passes provided. Finally, employers must submit these forms along with their annual tax return to claim the credit. It is crucial to adhere to IRS guidelines to ensure a smooth filing process and avoid potential issues.

Required Documents for the ETP Employer Transit Pass Credit

When claiming the ETP Employer Transit Pass Credit, employers must prepare specific documents to support their claim. Key documents include:

- Receipts for the purchase of transit passes.

- Records of employee distribution of these passes.

- Completed tax forms that detail the credit claim.

Maintaining organized records is essential for substantiating the credit during audits or inquiries from tax authorities.

IRS Guidelines for the ETP Employer Transit Pass Credit

The IRS provides clear guidelines regarding the ETP Employer Transit Pass Credit. Employers should familiarize themselves with the relevant tax codes and instructions to ensure compliance. Key points include:

- The credit applies only to transit passes provided directly to employees.

- Employers must keep accurate records of all transactions related to the transit passes.

- Changes in tax laws may affect eligibility and credit amounts, so staying updated is crucial.

Consulting a tax professional can help businesses navigate these guidelines effectively.

Examples of the ETP Employer Transit Pass Credit in Action

To illustrate the benefits of the ETP Employer Transit Pass Credit, consider the following scenarios:

- A C Corporation provides monthly subway passes to its employees, resulting in a significant tax credit based on the total value of the passes issued.

- An S Corporation implements a commuter benefits program, offering bus passes to employees, which not only enhances employee satisfaction but also reduces the company's taxable income.

These examples demonstrate how various business entities can leverage the credit to support their workforce while benefiting financially.

Quick guide on how to complete etp employer transit pass credit for c corporations s corporations partnerships sole proprietors fiduciaries and tax exempt 11331940

Prepare [SKS] easily on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and streamline your document-related processes today.

The simplest way to modify and electronically sign [SKS] without hassle

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the forms or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all details and then click on the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Edit and electronically sign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the etp employer transit pass credit for c corporations s corporations partnerships sole proprietors fiduciaries and tax exempt 11331940

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ETP Employer Transit Pass Credit?

The ETP Employer Transit Pass Credit For C Corporations, S Corporations, Partnerships, Sole Proprietors, Fiduciaries And Tax exempt Nonprofit Organizations is a tax incentive designed to encourage employers to provide transit passes to their employees. This credit helps businesses reduce their tax liability while promoting public transportation use among their workforce.

-

Who is eligible for the ETP Employer Transit Pass Credit?

Eligibility for the ETP Employer Transit Pass Credit For C Corporations, S Corporations, Partnerships, Sole Proprietors, Fiduciaries And Tax exempt Nonprofit Organizations includes a wide range of business structures. Whether you operate as a corporation, partnership, or nonprofit, you can benefit from this credit if you provide transit passes to your employees.

-

How can businesses apply for the ETP Employer Transit Pass Credit?

To apply for the ETP Employer Transit Pass Credit For C Corporations, S Corporations, Partnerships, Sole Proprietors, Fiduciaries And Tax exempt Nonprofit Organizations, businesses must complete the necessary tax forms and provide documentation of the transit passes issued. Consulting with a tax professional can streamline the application process and ensure compliance with IRS regulations.

-

What are the financial benefits of the ETP Employer Transit Pass Credit?

The ETP Employer Transit Pass Credit For C Corporations, S Corporations, Partnerships, Sole Proprietors, Fiduciaries And Tax exempt Nonprofit Organizations can signNowly reduce your tax burden. By taking advantage of this credit, businesses can lower their taxable income, leading to potential savings that can be reinvested into the company or used to enhance employee benefits.

-

Are there any limitations on the ETP Employer Transit Pass Credit?

Yes, the ETP Employer Transit Pass Credit For C Corporations, S Corporations, Partnerships, Sole Proprietors, Fiduciaries And Tax exempt Nonprofit Organizations has specific limitations. Businesses should be aware of the maximum credit amount allowed and ensure that the transit passes provided meet the IRS criteria to qualify for the credit.

-

How does the ETP Employer Transit Pass Credit impact employee satisfaction?

Offering the ETP Employer Transit Pass Credit For C Corporations, S Corporations, Partnerships, Sole Proprietors, Fiduciaries And Tax exempt Nonprofit Organizations can enhance employee satisfaction by providing a valuable benefit. Employees appreciate the support for their commuting costs, which can lead to increased morale and productivity in the workplace.

-

Can the ETP Employer Transit Pass Credit be combined with other tax credits?

Yes, businesses can often combine the ETP Employer Transit Pass Credit For C Corporations, S Corporations, Partnerships, Sole Proprietors, Fiduciaries And Tax exempt Nonprofit Organizations with other tax incentives. However, it is essential to consult with a tax advisor to understand the implications and ensure compliance with all applicable tax laws.

Get more for ETP Employer Transit Pass Credit For C Corporations, S Corporations, Partnerships, Sole Proprietors, Fiduciaries And Tax exempt

Find out other ETP Employer Transit Pass Credit For C Corporations, S Corporations, Partnerships, Sole Proprietors, Fiduciaries And Tax exempt

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF