KF, Beneficiary's Share of Minnesota Taxable Income Revenue State Mn Form

What is the KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn

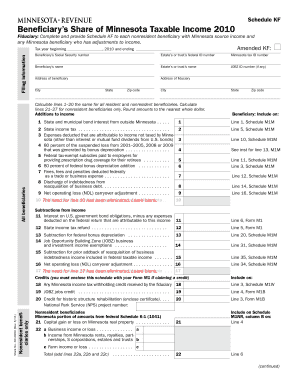

The KF, Beneficiary's Share Of Minnesota Taxable Income form is a tax document used to report the income allocated to beneficiaries from various entities such as estates or trusts. This form is essential for beneficiaries who need to declare their share of taxable income for state tax purposes in Minnesota. It ensures that the income is accurately reported to the Minnesota Department of Revenue, reflecting the beneficiaries' financial interests in the estate or trust.

How to use the KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn

To effectively use the KF form, beneficiaries should first gather all relevant financial information regarding the income received from the estate or trust. This includes any distributions made during the tax year. Once the necessary details are compiled, the beneficiary can complete the form by entering their share of the taxable income as provided by the estate or trust. It is important to review the instructions carefully to ensure all information is accurately reported.

Steps to complete the KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn

Completing the KF form involves several key steps:

- Collect all necessary documents, including the trust or estate's financial statements.

- Identify the amount of income allocated to you as a beneficiary.

- Fill out the KF form with your personal information and the reported income.

- Review the completed form for accuracy.

- Submit the form to the Minnesota Department of Revenue by the specified deadline.

Key elements of the KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn

Several key elements are crucial for understanding the KF form:

- Beneficiary Information: Includes the name, address, and Social Security number of the beneficiary.

- Income Amount: The total taxable income allocated to the beneficiary from the estate or trust.

- Signature: The beneficiary must sign the form to validate the information provided.

- Filing Status: Indicates whether the beneficiary is filing as an individual or in a different capacity.

State-specific rules for the KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn

In Minnesota, specific rules govern the completion and submission of the KF form. Beneficiaries must be aware of the state’s tax laws, including any deductions or exemptions that may apply to their situation. Additionally, the state may have particular deadlines for filing the KF form that differ from federal tax deadlines. Understanding these rules helps ensure compliance and avoids potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for the KF form typically align with the state tax return deadlines. Beneficiaries should ensure they submit the form by the due date to avoid late fees or penalties. It is advisable to check the Minnesota Department of Revenue’s official website for the most current deadlines, as they can vary each tax year.

Quick guide on how to complete kf beneficiarys share of minnesota taxable income revenue state mn 11331947

Complete [SKS] effortlessly on any device

Online document organization has gained popularity among businesses and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely preserve it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to edit and eSign [SKS] without hassle

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the kf beneficiarys share of minnesota taxable income revenue state mn 11331947

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn?

KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn refers to the portion of taxable income that beneficiaries must report for Minnesota tax purposes. Understanding this concept is crucial for beneficiaries to ensure compliance with state tax regulations and to accurately report their income.

-

How can airSlate SignNow help with KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn documentation?

airSlate SignNow provides a streamlined platform for creating, sending, and eSigning documents related to KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn. This ensures that all necessary forms are completed accurately and efficiently, reducing the risk of errors in tax reporting.

-

What features does airSlate SignNow offer for managing tax-related documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax-related documents like those involving KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn. These features enhance efficiency and ensure that all parties are kept informed throughout the process.

-

Is airSlate SignNow cost-effective for small businesses dealing with KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses managing KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn. With flexible pricing plans, users can choose a plan that fits their budget while still accessing essential features.

-

Can airSlate SignNow integrate with other software for tax management?

Absolutely! airSlate SignNow offers integrations with various accounting and tax management software, making it easier to handle KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn documentation. This seamless integration helps streamline workflows and ensures that all data is synchronized across platforms.

-

What are the benefits of using airSlate SignNow for KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn?

Using airSlate SignNow for KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn provides numerous benefits, including improved accuracy in document handling, faster turnaround times for eSigning, and enhanced security for sensitive information. These advantages help businesses maintain compliance and reduce the stress associated with tax documentation.

-

How secure is airSlate SignNow for handling sensitive tax documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive tax documents, including those related to KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn. Users can trust that their information is safe and secure throughout the document management process.

Get more for KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn

Find out other KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document