Form 14731 Department of the Treasury Internal Revenue 2016

What is the Form 14731 Department Of The Treasury Internal Revenue

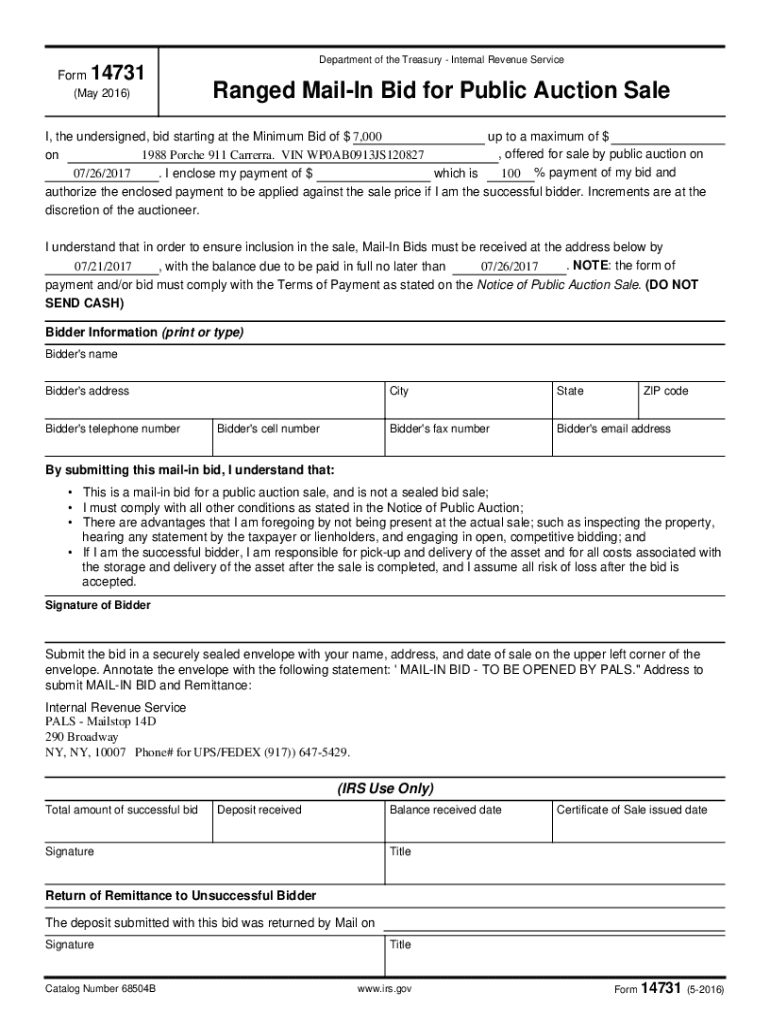

The Form 14731 is a document issued by the Department of the Treasury, specifically for use by the Internal Revenue Service (IRS). This form is primarily utilized for specific tax-related purposes, often involving the reporting of certain financial information. Understanding the purpose of this form is essential for compliance with federal tax regulations.

How to use the Form 14731 Department Of The Treasury Internal Revenue

Using Form 14731 involves several key steps. First, ensure you have the correct version of the form, which can be obtained from the IRS website or other authorized sources. Next, carefully read the instructions provided with the form to understand the required information. Fill out the form accurately, ensuring all necessary details are included. Once completed, the form must be submitted according to the guidelines provided, either electronically or via mail.

Steps to complete the Form 14731 Department Of The Treasury Internal Revenue

Completing Form 14731 requires attention to detail. Follow these steps:

- Gather all necessary documentation, such as financial records and identification numbers.

- Review the form’s instructions to understand the information required.

- Fill out the form, ensuring all fields are completed accurately.

- Double-check your entries for any errors or omissions.

- Submit the form as directed, either electronically or by mail.

Legal use of the Form 14731 Department Of The Treasury Internal Revenue

Form 14731 is legally binding and must be completed in accordance with IRS regulations. Failure to use this form correctly can result in penalties or delays in processing. It is crucial to ensure that the information provided is truthful and accurate, as false statements can lead to legal repercussions.

Filing Deadlines / Important Dates

Timely filing of Form 14731 is essential to avoid penalties. Be aware of the specific deadlines associated with this form, which may vary based on the type of filing and the taxpayer's situation. Typically, forms must be submitted by the designated due date for the tax year in question.

Form Submission Methods (Online / Mail / In-Person)

Form 14731 can be submitted through various methods, depending on the preferences of the filer. Options include:

- Online submission via the IRS e-filing system, if applicable.

- Mailing the completed form to the designated IRS address.

- In-person submission at local IRS offices, where available.

Quick guide on how to complete form 14731 department of the treasury internal revenue

Prepare Form 14731 Department Of The Treasury Internal Revenue seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed papers, allowing you to access the correct form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Form 14731 Department Of The Treasury Internal Revenue on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The easiest method to modify and eSign Form 14731 Department Of The Treasury Internal Revenue effortlessly

- Obtain Form 14731 Department Of The Treasury Internal Revenue and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Leave behind the worries of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign Form 14731 Department Of The Treasury Internal Revenue and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 14731 department of the treasury internal revenue

Create this form in 5 minutes!

How to create an eSignature for the form 14731 department of the treasury internal revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 14731 Department Of The Treasury Internal Revenue?

Form 14731 Department Of The Treasury Internal Revenue is a document used for specific tax-related purposes. It is essential for businesses to understand its requirements to ensure compliance with IRS regulations. airSlate SignNow can help streamline the process of filling out and submitting this form.

-

How can airSlate SignNow assist with Form 14731 Department Of The Treasury Internal Revenue?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending Form 14731 Department Of The Treasury Internal Revenue. Our solution simplifies the document management process, ensuring that you can complete and submit your forms efficiently and securely.

-

What are the pricing options for using airSlate SignNow for Form 14731 Department Of The Treasury Internal Revenue?

airSlate SignNow offers various pricing plans to accommodate different business needs. Whether you are a small business or a large enterprise, you can find a plan that fits your budget while providing the necessary features for managing Form 14731 Department Of The Treasury Internal Revenue.

-

What features does airSlate SignNow offer for managing Form 14731 Department Of The Treasury Internal Revenue?

Our platform includes features such as customizable templates, secure eSigning, and document tracking, all tailored to assist with Form 14731 Department Of The Treasury Internal Revenue. These features enhance efficiency and ensure that your documents are handled with the utmost care and compliance.

-

Is airSlate SignNow compliant with IRS regulations for Form 14731 Department Of The Treasury Internal Revenue?

Yes, airSlate SignNow is designed to comply with IRS regulations, ensuring that your use of Form 14731 Department Of The Treasury Internal Revenue meets all necessary legal requirements. Our platform prioritizes security and compliance, giving you peace of mind when handling sensitive documents.

-

Can I integrate airSlate SignNow with other software for Form 14731 Department Of The Treasury Internal Revenue?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when dealing with Form 14731 Department Of The Treasury Internal Revenue. This flexibility helps you maintain efficiency and organization across your business processes.

-

What are the benefits of using airSlate SignNow for Form 14731 Department Of The Treasury Internal Revenue?

Using airSlate SignNow for Form 14731 Department Of The Treasury Internal Revenue provides numerous benefits, including time savings, enhanced security, and improved accuracy. Our platform simplifies the signing and submission process, allowing you to focus on your core business activities.

Get more for Form 14731 Department Of The Treasury Internal Revenue

Find out other Form 14731 Department Of The Treasury Internal Revenue

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template