FPI Rental Application Tax Credit ForRent Com 2007

What is the FPI Rental Application Tax Credit ForRent com

The FPI Rental Application Tax Credit ForRent com is a financial incentive designed to assist renters in the United States. This tax credit allows eligible individuals to reduce their tax liability based on specific rental expenses incurred during the tax year. It is particularly beneficial for low-income households seeking affordable housing options. Understanding this credit can help renters maximize their financial resources and improve their overall financial stability.

How to use the FPI Rental Application Tax Credit ForRent com

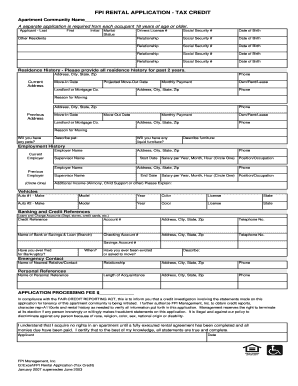

Using the FPI Rental Application Tax Credit ForRent com involves several straightforward steps. First, renters must determine their eligibility based on income and rental agreements. Next, they need to gather necessary documentation, such as proof of income and rental payments. Once eligibility is confirmed, individuals can complete the application form, ensuring all required fields are filled accurately. After submission, keeping track of the application status is essential to ensure timely processing.

Steps to complete the FPI Rental Application Tax Credit ForRent com

Completing the FPI Rental Application Tax Credit ForRent com requires careful attention to detail. Begin by collecting all relevant financial documents, including income statements and rental agreements. Next, fill out the application form with accurate information, ensuring that all required sections are completed. Review the form for any errors before submission. Finally, submit the application according to the specified guidelines, whether online or by mail, and retain copies for your records.

Eligibility Criteria

Eligibility for the FPI Rental Application Tax Credit ForRent com is primarily based on income level and rental status. Renters must demonstrate that their income falls within the limits set by federal or state guidelines. Additionally, the rental property must meet specific criteria, such as being a qualified low-income housing unit. It is essential for applicants to review these criteria thoroughly to ensure they meet the necessary qualifications before applying.

Required Documents

To successfully apply for the FPI Rental Application Tax Credit ForRent com, several documents are required. Applicants must provide proof of income, which may include pay stubs, tax returns, or bank statements. Additionally, a copy of the rental agreement or lease is necessary to verify the rental expenses claimed. Any other supporting documentation that demonstrates eligibility, such as identification or proof of residency, should also be included to facilitate the application process.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the FPI Rental Application Tax Credit ForRent com. These guidelines outline the eligibility requirements, application process, and documentation needed for claiming the credit. Renters should familiarize themselves with these guidelines to ensure compliance and maximize their potential benefits. Adhering to IRS regulations is crucial for a successful application and to avoid any penalties or issues during tax filing.

Application Process & Approval Time

The application process for the FPI Rental Application Tax Credit ForRent com typically involves submitting the completed application form along with the required documentation. After submission, the approval time can vary based on the processing workload of the relevant tax authority. Generally, applicants can expect to receive confirmation of their application status within a few weeks. Staying informed about the application timeline can help renters plan accordingly and manage their financial expectations.

Quick guide on how to complete fpi rental application tax credit forrentcom

The simplest method to obtain and endorse FPI Rental Application Tax Credit ForRent com

At the level of your whole organization, ineffective procedures related to paper approvals can consume a signNow amount of productive time. Endorsing documents like FPI Rental Application Tax Credit ForRent com is an inherent aspect of operations in any organization, which is why the effectiveness of each agreement’s lifecycle impacts the overall productivity of the company so greatly. With airSlate SignNow, endorsing your FPI Rental Application Tax Credit ForRent com is as straightforward and swift as possible. You’ll discover with this platform the latest version of virtually any form. What's even better, you can endorse it immediately without needing to install external applications on your computer or printing anything as physical copies.

How to obtain and endorse your FPI Rental Application Tax Credit ForRent com

- Explore our collection by category or utilize the search option to locate the document you require.

- View the form preview by clicking Learn more to confirm it is the correct one.

- Press Get form to commence editing right away.

- Fill out your form and insert any necessary details using the toolbar.

- Once completed, click the Sign feature to endorse your FPI Rental Application Tax Credit ForRent com.

- Select the signature method that is most suitable for you: Draw, Create initials, or upload a photo of your handwritten signature.

- Click Done to finish editing and proceed to document-sharing options as needed.

With airSlate SignNow, you have everything you need to handle your documents effectively. You can find, complete, modify, and even distribute your FPI Rental Application Tax Credit ForRent com in one tab with no complications. Enhance your workflows with a single, intelligent eSignature solution.

Create this form in 5 minutes or less

Find and fill out the correct fpi rental application tax credit forrentcom

FAQs

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

I am trying to get my first credit card but no company will accept my application. How can I fill out the application differently to get accepted?

Look no farther than AmazonIf you are a frequent Amazon customer, as I was, you will have seen many prompts trying to get you to sign up for their rewards card. I didn’t really have a need for a credit card but I figured I might as well get the $70 or so as well as the cash back for signing up for a rewards card.I’m only 18 so I figured there was a high chance of being denied. I entered my information and was promptly denied. For some reason the prompts kept being displayed on my checkout pages, so after a month or so I applied again. Denied.Oh well… I thought.But one day I saw a new rewards card pop up. Rather than being through Synchrony Financial, this one was through Chase. Since I have no credit, it was reasonable that I was getting rejected. However, I currently have a Chase College Student Checking account and have had a Business and Savings account with them in the past. Because I was a current account holder I figured I would have a better chance.I applied one last time only to get waitlisted…? (I read too many college application questions)Waitlisted in this setting meant they needed to further review my application. I wasn’t very optimistic about the outcome but a few days later I found out I had been approved!My very first credit card: An Amazon Rewards Visa..How times have changed.Note: This only works with Chase, at least to my knowledge. You also do not need a cosigner for this method.

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

Create this form in 5 minutes!

How to create an eSignature for the fpi rental application tax credit forrentcom

How to generate an eSignature for your Fpi Rental Application Tax Credit Forrentcom in the online mode

How to make an electronic signature for your Fpi Rental Application Tax Credit Forrentcom in Chrome

How to generate an electronic signature for signing the Fpi Rental Application Tax Credit Forrentcom in Gmail

How to make an electronic signature for the Fpi Rental Application Tax Credit Forrentcom straight from your smartphone

How to make an electronic signature for the Fpi Rental Application Tax Credit Forrentcom on iOS devices

How to generate an eSignature for the Fpi Rental Application Tax Credit Forrentcom on Android

People also ask

-

What is the FPI Rental Application Tax Credit on ForRent com?

The FPI Rental Application Tax Credit on ForRent com is a financial incentive designed to help potential tenants afford their rent by providing tax relief. This program aims to increase access to rental housing for individuals and families. Understanding the specifics of this tax credit can help you make informed decisions about your rental applications.

-

How can I apply for the FPI Rental Application Tax Credit on ForRent com?

Applying for the FPI Rental Application Tax Credit on ForRent com is simple. You will need to complete the necessary application forms and provide relevant documentation to verify your eligibility. It's advisable to gather all required information before starting your application to streamline the process.

-

What documents are required for the FPI Rental Application Tax Credit on ForRent com?

To qualify for the FPI Rental Application Tax Credit on ForRent com, you typically need to submit identification, proof of income, and any other assets. Specific documents may vary based on your state or region. It’s best to check the latest requirements directly on ForRent com before applying.

-

Is there a fee associated with the FPI Rental Application Tax Credit on ForRent com?

Generally, there is no fee to apply for the FPI Rental Application Tax Credit on ForRent com. However, some related services or application processes might incur nominal costs. Always review the terms and conditions on ForRent com to be fully informed about any potential fees.

-

What are the benefits of using the FPI Rental Application Tax Credit on ForRent com?

The FPI Rental Application Tax Credit on ForRent com offers signNow benefits, including reduced rental costs for eligible applicants. Additionally, this program can assist in improving housing stability for families and individuals. By taking advantage of this tax credit, renters can enhance their financial well-being.

-

How does the FPI Rental Application Tax Credit on ForRent com integrate with other rental assist programs?

The FPI Rental Application Tax Credit on ForRent com often works in conjunction with other rental assistance programs. This integration helps provide a more comprehensive support system for tenants seeking affordable housing. Check with local housing authorities and ForRent com for more information on available services.

-

Can I track the status of my application for the FPI Rental Application Tax Credit on ForRent com?

Yes, applicants can typically track the status of their FPI Rental Application Tax Credit on ForRent com. The website provides an online portal where you can check updates regarding your application. Make sure to log in with your credentials for real-time information.

Get more for FPI Rental Application Tax Credit ForRent com

- Download the award request form air mauritius

- Work and income forms

- Marie curie sponsor form

- Intake and output record in form

- Transportation security administration tsa claims management form

- Submit online e mail or fax form

- Mmac use only below this line form

- Pharmacy prior authorization form anthem providers

Find out other FPI Rental Application Tax Credit ForRent com

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement